Why MKR drops against ETH every time MakerDAO sells

- MKR’s value decoupled from ETH as MakerDAO offered some tokens.

- On-chain and technical evaluation recommended a bounce to $3,545 when the promoting stress halts.

For the previous two weeks, a sure multisign pockets, linked to MakerDAO, has moved $14.4 million price of MKR to completely different exchanges.

In response to Spot On Chain, some platforms the tokens landed on have been Binance [BNB], Coinbase, and Kraken.

A multisign pockets is a brief kind for a multi-signature pockets that acts as a storage choice for organizations. To unlock property from this sort of pockets, two or extra non-public keys should be administered.

Again to MakerDAO’s activity. One factor AMBCrypto observed was that MKR’s value fell each time that the challenge made a sale.

MKR can’t match ETH

At press time, MKR modified fingers at $2,952, representing a 3.84% decline within the final 24 hours.

Apparently, the token had a distinct motion from Ethereum [ETH], which it appeared to have a robust correlation with.

As of this writing, ETH’s value was $3,216— a 1.48% enhance inside the identical interval MKR dropped.

Findings from our finish confirmed that the multisign pockets nonetheless holds 21,928 MKR tokens, which means that extra change deposits may happen going ahead.

If this occurs, ETH may proceed to decouple from MKR, and the worth of the latter may drop beneath $2,800. However an additional drop may very well be an excellent factor for the token’s worth.

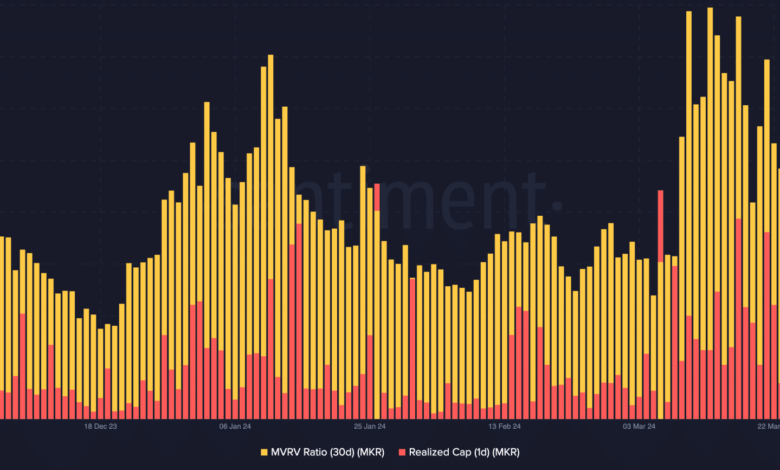

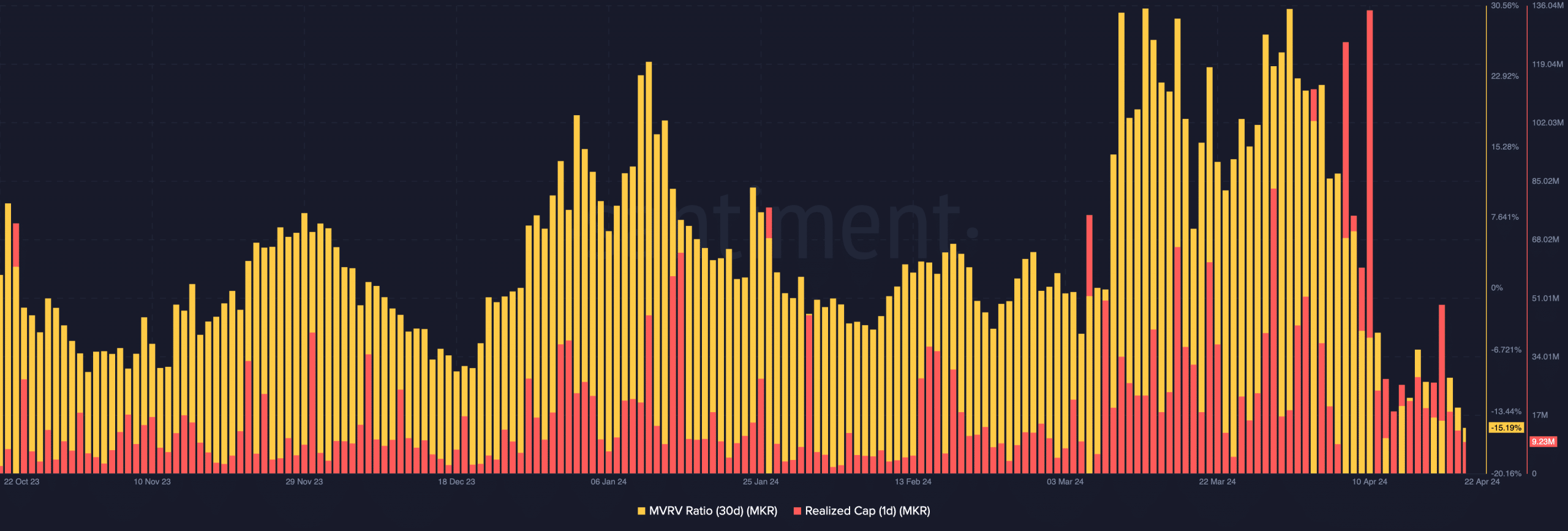

This was due to the signal proven by the Market Worth to Realized Worth Ratio (MVRV). This metric tracks profitability and the perceived valuation of a token.

Information from Santiment confirmed that the 30-day MVRV ratio was -15.19%. Traditionally, when the metric hits a studying like this, the worth bounces.

Ought to this occur once more, the worth of MKR might rise to $3,545 inside a couple of weeks. Moreover, the one-day Realized Cap shared this sentiment.

Supply: Santiment

If promoting stops, the worth will rebound

At press time, the Realized Cap was all the way down to 9.23 million. This decline was proof that previous tokens have been realizing earnings.

Nevertheless, the decline additionally signifies MKR was undervalued, relative to its historic transaction worth.

As well as, this indicators a possible backside for the worth. Due to this fact, MKR won’t must rely upon ETH within the quick time period to seek out its course.

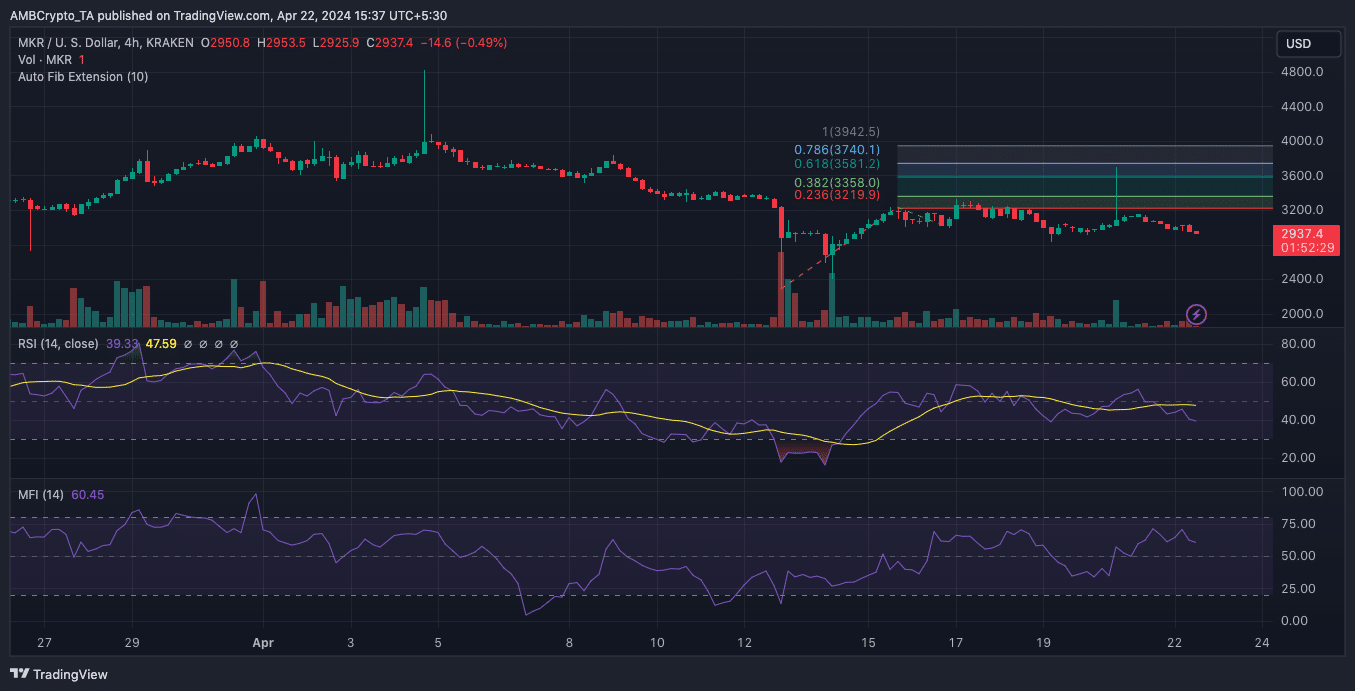

From a technical perspective, the Relative Energy Index (RSI) had dropped beneath the zero midpoint. This recommended a bearish momentum for the token. As such, an additional value decline may very well be on the playing cards.

Life like or not, right here’s MKR’s market cap in ETH phrases

But when the RSI faucets 30.00, MKR could be deemed oversold, and a rebound may very well be subsequent. Ought to this be the case, the 0.786 Fibonacci indicator confirmed that the worth may climb to $3,740 within the quick to midterm.

Supply: TradingView

Nevertheless, earlier than the projected, hike, MKR’s worth may fall because the Cash Circulate Index (MFI) revealed that capital was flowing out of the cryptocurrency.