Why Mt. Gox’s third Bitcoin transfer of $1B raises fresh liquidation fears

- Mt. Gox strikes 11,501 BTC, fueling hypothesis about its asset administration technique.

- Bitcoin drops 3% amid Mt. Gox transfers and weak U.S. inventory market Futures.

Bankrupt crypto change Mt. Gox has made one more huge Bitcoin [BTC] switch, marking its third important transaction in lower than a month.

On the twenty fifth of March, blockchain analytics agency Arkham Intelligence flagged the motion of 11,501 BTC, with 893 BTC—valued at roughly $78 million—redirected to the Mt. Gox chilly pockets.

The remaining 10,608 BTC—value round $929 million—was despatched to the change’s change pockets.

This follows two earlier transfers of 12,000 BTC on the sixth of March and 11,833 BTC on the eleventh of March, fueling hypothesis concerning the change’s ongoing asset administration technique as collectors await repayments.

Broader technique at play?

Moreover, blockchain analytics platform Spot On Chain revealed in an X (previously Twitter) put up that considered one of Mt. Gox’s earlier Bitcoin transfers this month was finally directed to the crypto change Bitstamp.

This has raised hypothesis that the most recent motion of 893 BTC to a heat pockets could quickly observe the same path.

Analysts counsel that these transactions may very well be a part of a broader liquidation technique because the change works towards creditor repayments.

In the meantime, Arkham Intelligence knowledge signifies that Mt. Gox nonetheless holds roughly 35,000 BTC—valued at round $3.1 billion—unfold throughout wallets underneath its management, leaving the market carefully anticipating additional actions.

Affect on Bitcoin

On the twenty fourth of March, Bitcoin hit an intraday excessive of $88,772 on the Bitstamp change, however by the twenty fifth of March, it had dipped by roughly 3%, signaling a pullback in value.

The numerous drop in Bitcoin’s worth is believed to be partly linked to the huge Mt. Gox switch, which can have added downward stress available on the market.

Moreover, the broader monetary panorama appears to be influencing cryptocurrency actions, as U.S. inventory market Futures additionally confirmed indicators of weak spot forward of essential financial knowledge, additional contributing to Bitcoin’s subdued efficiency.

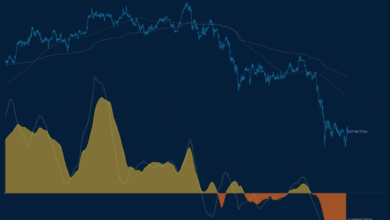

Bitcoin’s present value motion

Bitcoin was buying and selling at $86,624.27 at press time, reflecting a slight 0.43% decline prior to now 24 hours, in line with CoinMarketCap.

Whereas technical indicators current combined alerts, the MACD stays above the sign line with inexperienced histograms, indicating that bullish momentum continues to be in play.

Nevertheless, the RSI hovering round 50 and trending downward suggests that purchasing stress might weaken, probably giving bears a chance to regain management.

Supply: Buying and selling View

Thus, as market sentiment stays unsure, merchants are carefully watching these indicators for indicators of Bitcoin’s subsequent main transfer.