Why Solana nodes are ’10x higher than Ethereum’ – founder Anatoly Yakovenko

- Solana’s founder proposed a mechanism to decrease entry limitations to node operations.

- The manager mulled methods of coping with voting charges to deal with the difficulty.

Solana [SOL] and Ethereum [ETH] leaders have debated numerous points within the house for some time.

Most just lately, the Solana Basis’s clampdown on validators utilizing MEV (Most Extractable Worth) sandwich assaults caught main consideration.

The Basis withdrew monetary assist to some validators to cut back the assaults.

It emerged that working a Solana validator node may be very costly, about $65K per 12 months, which requires the Solana Basis to supply monetary assist in some circumstances.

Quite the opposite, an Ethereum validator prices 32 ETH as a one-off fee, and excludes {hardware} and different assets.

Why Solana nodes are 10x costlier

Solana founder Anatoly Yakovenko clarified the price distinction on ‘Ethereum’s higher funding’ in its consensus system.

‘Financial barrier for trustworthy nodes take part in consensus on Solana is 10x increased than ethereum atm. Largely because of the funding Ethereum has made into BLS aggregation for consensus messages.”

The BLS refers to Boneh-Lynn-Shacham, an environment friendly signature scheme leveraged by Ethereum. Notably, the scheme can comprise a number of independently verified messages by validators.

This permits a number of messages to be aggregated successfully, reducing general prices.

As Yakovenko famous, Solana’s present mechanism doesn’t match Ethereum’s method. Nevertheless, the founder added that Solana would finally implement such a system.

‘Possibly that’s one thing that Solana will implement finally, possibly it will likely be voting subcommittees, possibly nothing. As {hardware} improves, the decrease certain charge to ship a message to your entire cluster will drop, so the price per vote will drop, and the financial barrier will drop as effectively’

Nevertheless, one person famous that many of the value was inflated by voting charges and requested how Solana would remedy that. In his response, Yakovenko said,

‘Voting subcommittees would permit reducing the vote charge, and rotating the containers in/out of the committee, which would scale back the vote load and ends in decrease vote prices’

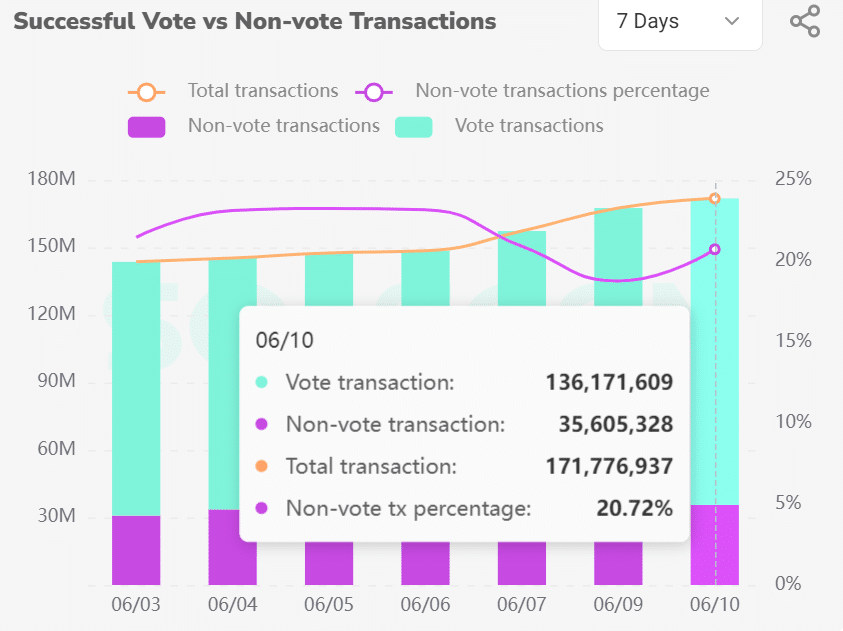

Prior to now seven days, 80% of whole Solana transactions have been associated to votes, underscoring their dominance on block transactions.

Supply: Solscan

For the reason that vote transactions additionally appeal to charges like the remainder, validators bear the price. Their increased dominance means that voting charges are the primary contributor and maybe barrier to entry into the house.

It stays to be seen whether or not Solana will implement the answer as floated by the founder.

Within the meantime, SOL shed 6% as crypto traders de-risked forward of the FOMC (Federal Open Assembly Committee) assembly.

SOL hit a low of $145 on the eleventh of June, the extent final hit in mid-Could, because the market rout prolonged liquidations throughout the markets.