Why SushiSwap is seeing growth despite bear market

- SushiSwap’s TVL rose considerably over the past week.

- Exercise on the protocol continued to say no, as costs witnessed a correction.

The DeFi sector has skilled a downturn in current months. With Uniswap’s dominance within the DEX sector, there was restricted house for different DEX platforms to broaden. Nonetheless, current information indicated that SushiSwap [SUSHI] has been making progress and demonstrating development regardless of the prevailing market downturn.

Is your portfolio inexperienced? Take a look at the SUSHI Revenue Calculator

Rising regardless of all odds

In accordance with information offered by digital asset agency ASXN, SushiSwap’s TVL grew by 32.94% over the past week, reaching $21.3 million at press time.

Notable modifications in TVL and charges earned over the previous week:@eigenlayer TVL grew 182.33%. They re-opened LSTs deposits for restaking yesterday.@GMX_IO TVL grew 63.02%, and reached $34.7M.@sushiswap TVL grew by 32.94%, reaching $21.3M. pic.twitter.com/rsDAGtwSma

— ASXN (@asxn_r) August 23, 2023

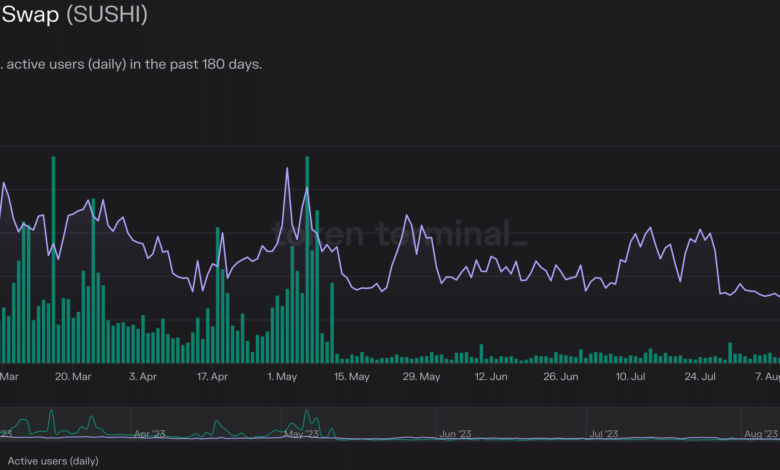

Regardless of the surging TVL, the income collected on the protocol continued to say no. Token Terminal’s information indicated that over the past month, the income collected by SushiSwap fell by 7.4%. One purpose for the decline in income could be the falling exercise on the SushiSwap community.

Within the final month, the exercise on SushiSwap dropped by 60%. This sharp decline in exercise may hinder the expansion potential of SushiSwap sooner or later.

Supply: token terminal

What’s happening when it comes to governance?

Regardless of the ups and downs of the protocol’s efficiency, the governance took an energetic position in making makes an attempt to enhance the state of the protocol.

A proposal was just lately handed by the Sushi governance, associated to including liquidity to one in all its swimming pools. DWF Labs, a worldwide digital asset market maker, proposed a collaboration to boost V3 liquidity and SUSHI token buying and selling depth.

The partnership concerned offering a minimum of $1.6 million extra liquidity to pairs like WETH/USDT, WETH/USDC, LDO/WETH, and extra. DWF Labs dedicated to reaching an growing market share: 3% in three months, 6% in six months, and 10% in 9 months.

SUSHI assist on exchanges like Binance and OKX with market-making depth was additionally a part of the plan. SUSHI additionally deliberate to lend 2 million tokens for twenty-four months, with a 5% annualized yield paid to Sushi Treasury.

DWF Labs has a European Name Choice with strike costs primarily based on SUSHI’s spot value improve. The proposal handed with over 99.85% votes.

Supply: Snapshot

Lifelike or not, right here’s SUSHI’s market cap in BTC’s phrases

Whales get an urge for food for SUSHI

Despite the fact that there was numerous progress made by the SushiSwap protocol on the governance entrance, the value of SUSHI continued to say no. At press time, SUSHI was buying and selling at $0.5901.

Regardless of the decline in value, whale curiosity in SUSHI continued to rise. Rising optimism from massive buyers may present some impetus to SUSHI holders in the long term.

Supply: Santiment