Why the Next Solana Moves Demand Attention

Solana (SOL) has been navigating a difficult correction section for about two months, throughout which its fortunes have ebbed and flowed. The newest dip, occurring on Aug. 15, was a direct response to a sudden decline within the value of Bitcoin, sending shockwaves all through the crypto market. Nevertheless, a better examination of Solana’s value chart reveals an rising inverse head and shoulders sample.

For these unfamiliar with the inverse head and shoulders sample, it’s a technical chart formation that indicators a possible development reversal. It consists of three key elements: a decrease low (the pinnacle) with two larger lows on both facet (the shoulders), forming an inverted “T” form. This sample usually signifies a shift from a bearish development to a bullish one, making it an attractive prospect for buyers.

Solana seems to be sketching out this intriguing configuration, hinting at the opportunity of a major upswing in its value. Nevertheless, the conclusion of this bullish state of affairs hinges considerably on SOL’s ability to breach a vital resistance level often called the neckline.

Solana’s Potential Trajectory

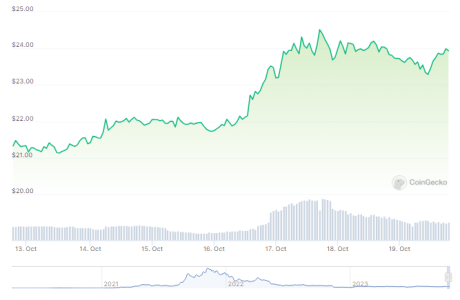

As of the most recent information out there on CoinGecko, Solana (SOL) is at present buying and selling at $23.79. Over the previous 24 hours, the cryptocurrency skilled a slight dip of 0.6%, whereas it boasted a seven-day rally of 9.9%. These fluctuations mirror the continued battle between patrons and sellers, every vying for management of SOL’s value trajectory.

SOL seven-day value motion. Supply: Coingecko

SOL: From Help To Vulnerability

Solana has come a good distance from its help stage at $22.38, providing sellers a possibility to exert stress on the cryptocurrency. If the promoting stress persists, price predictions point out that SOL might drop one other 12%, probably reaching a value of $18.8. The market’s vulnerability underscores the necessity for a cautious method, each for current buyers and potential patrons.

A more in-depth examination of the each day timeframe chart reveals a definite downward development characterizing the continued correction section of the cryptocurrency. Sellers are more likely to proceed exploiting any resistance factors throughout bullish bounces, making it important for buyers to train warning.

As of at this time, the market cap of cryptocurrencies stood at $1.06 trillion. Chart: TradingView.com

Because the market continues on its downward trajectory, potential patrons are suggested to train persistence. One of the best technique is likely to be to attend till the neckline resistance is breached, signaling a change in development. Timing stays paramount, and buyers must be ready to behave when the circumstances are proper.

Solana’s journey by the correction section has been a rollercoaster trip for buyers. Within the midst of ongoing market fluctuations, staying knowledgeable and cautious is crucial for each current and potential buyers in SOL.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. If you make investments, your capital is topic to threat).

Featured picture from PYMNTS