Will $97K support hold amid long-term holder selling?

- Lengthy-term holders have been promoting as Bitcoin consolidated on the charts

- Bitcoin derivatives quantity surged by 74%, signaling cautious optimism

Bitcoin’s current rally previous $109,000 has slowed down these days, with the cryptocurrency now consolidating simply above $100,000. The truth is, Bitcoin (BTC) was buying and selling at $104,982 at press time, gaining by 2.18% within the final 24 hours and by 3.58% over the previous week.

Its 24-hour buying and selling quantity was $104.8 billion, whereas the market cap stood at $2.08 trillion, in response to Coingecko data.

Lengthy-term holders see promoting exercise

Lengthy-term Bitcoin holders have began promoting after months of holding by way of the correction interval from March 2024, in response to the SOPR (Spent Output Revenue Ratio) information. Throughout this era, these holders shunned promoting and accrued Bitcoin.

Nonetheless, as the worth surged previous $100,000, long-term holders resumed promoting —A conduct beforehand seen in the course of the 2021 bull market.

Supply: CryptoQuant

Supply: CryptoQuant

Quick-term holders, alternatively, proceed to take earnings extra ceaselessly. SOPR information for short-term holders revealed a number of situations the place the ratio exceeded 1.02 – An indication of worthwhile promoting.

Nonetheless, SOPR values above 1.06, typically seen throughout market cycle peaks, haven’t but appeared. Which means there should still be room for added worth development earlier than short-term earnings peak.

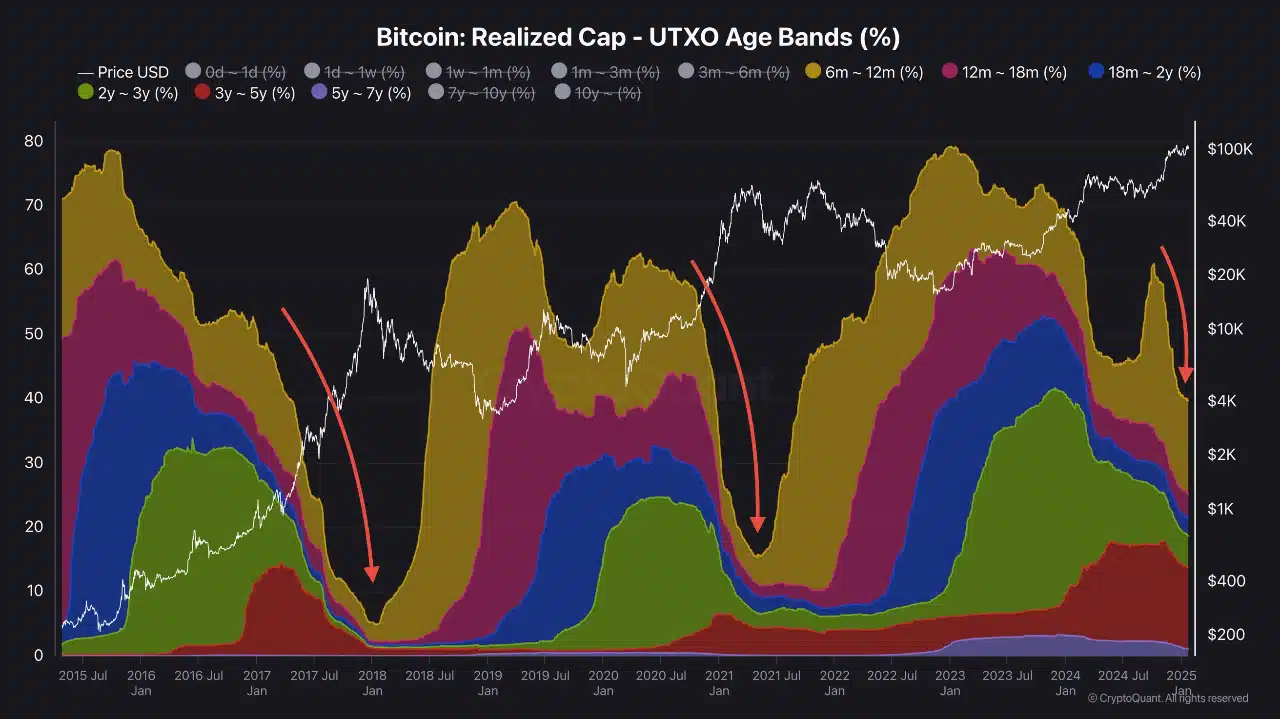

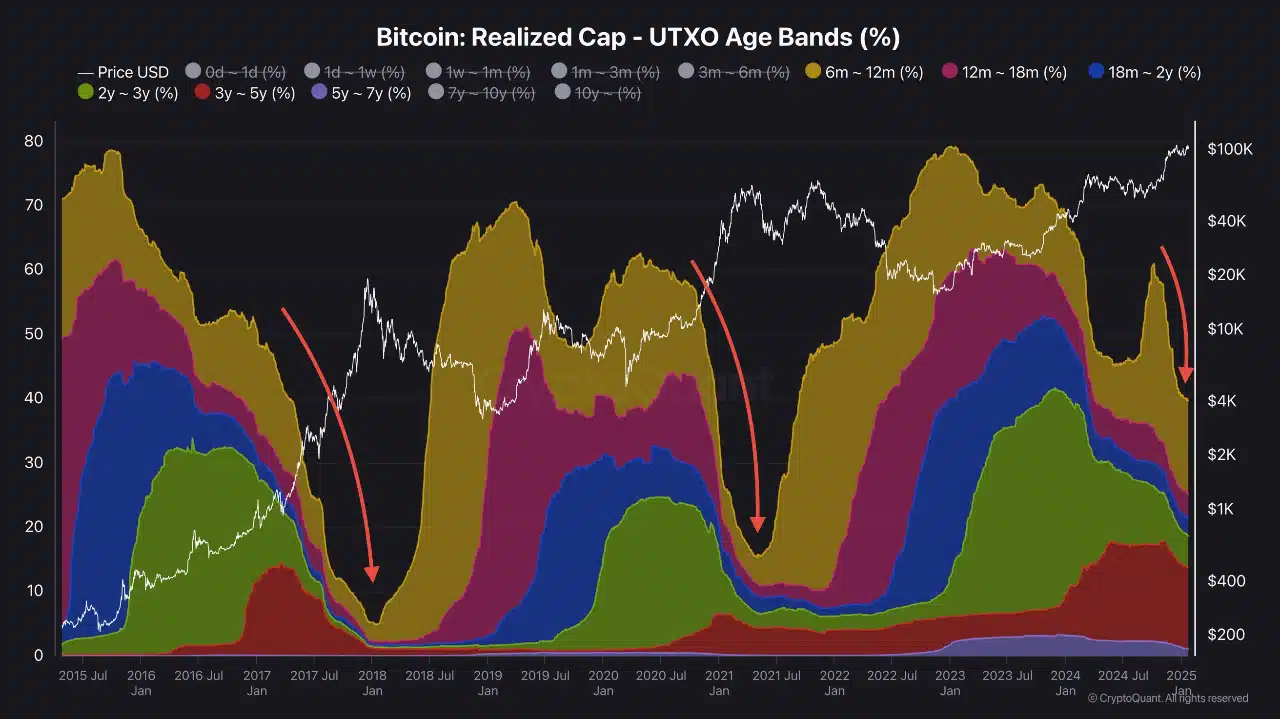

Regardless of the promoting exercise, UTXO information highlighted that long-term holders nonetheless retain substantial holdings. This appeared to assist the notion that the continued cycle has not ended but.

Supply: CryptoQuant

Supply: CryptoQuant

$97,530 recognized as essential assist stage

In line with standard crypto analyst Ali’s newest tweet,

“The important thing assist stage to observe for Bitcoin is $97,530. Holding above this stage is essential to sustaining the present bullish momentum.”

Latest information from Glassnode confirmed that this worth level aligns with excessive exercise ranges, making it a pivotal zone for worth stability. Ought to Bitcoin lose the $97,530-level, it might retrace to $93,856 or $90,000. Particularly since these are areas of sturdy historic exercise.

On the upside, resistance is anticipated close to $100,967–$105,118, as many holders could start to take earnings on this vary.

Buying and selling and derivatives exercise reveals market warning

In line with Coinglass, Bitcoin’s buying and selling quantity surged by 73.27% to $172.56 billion, with Open Curiosity climbing by 1.19% to $68.52 billion. Choices buying and selling additionally noticed higher exercise, with a 74.28% hike in quantity to $6.61 billion and Open Curiosity growing by 3.95% to $40.62 billion.

In the meantime, funding charges have steadily declined, with the OI-weighted funding charge at 0.0038% on 24 January, 2025.

This hinted at lowered leverage within the derivatives market, reflecting cautious sentiment amongst merchants.

Hashrate reveals sustained energy

Lastly, Bitcoin’s hashrate was at 746.7 EH/s at press time, reflecting constant development in community safety and miner exercise.

Whereas not at its all-time excessive, this elevated stage demonstrated sturdy miner confidence and sustained funding in mining infrastructure, aligning with Bitcoin’s press time worth of $104,994.

Supply: CryptoQuant

As Bitcoin consolidates, merchants and traders ought to intently watch key ranges to find out the following transfer within the ongoing market cycle.