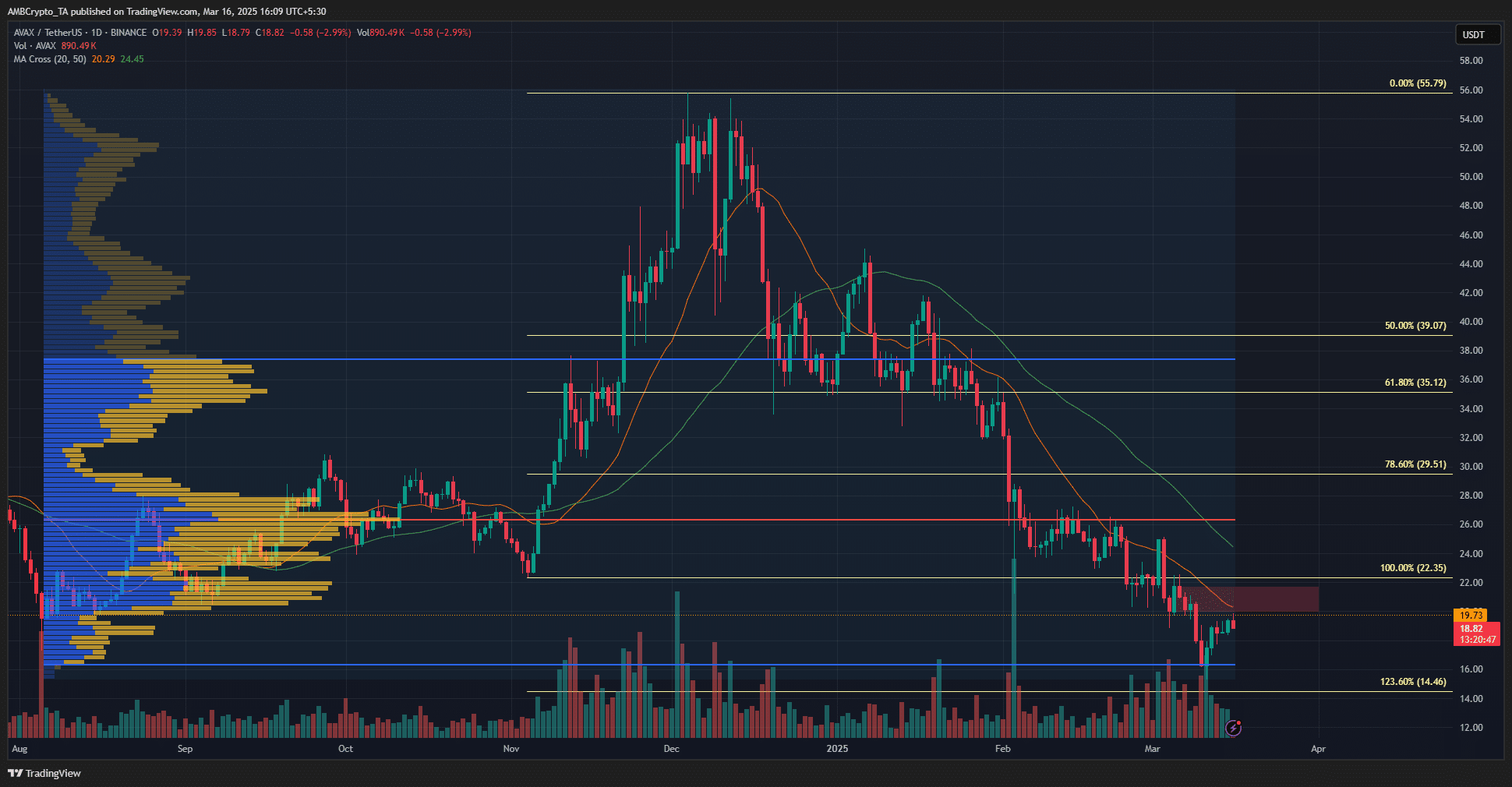

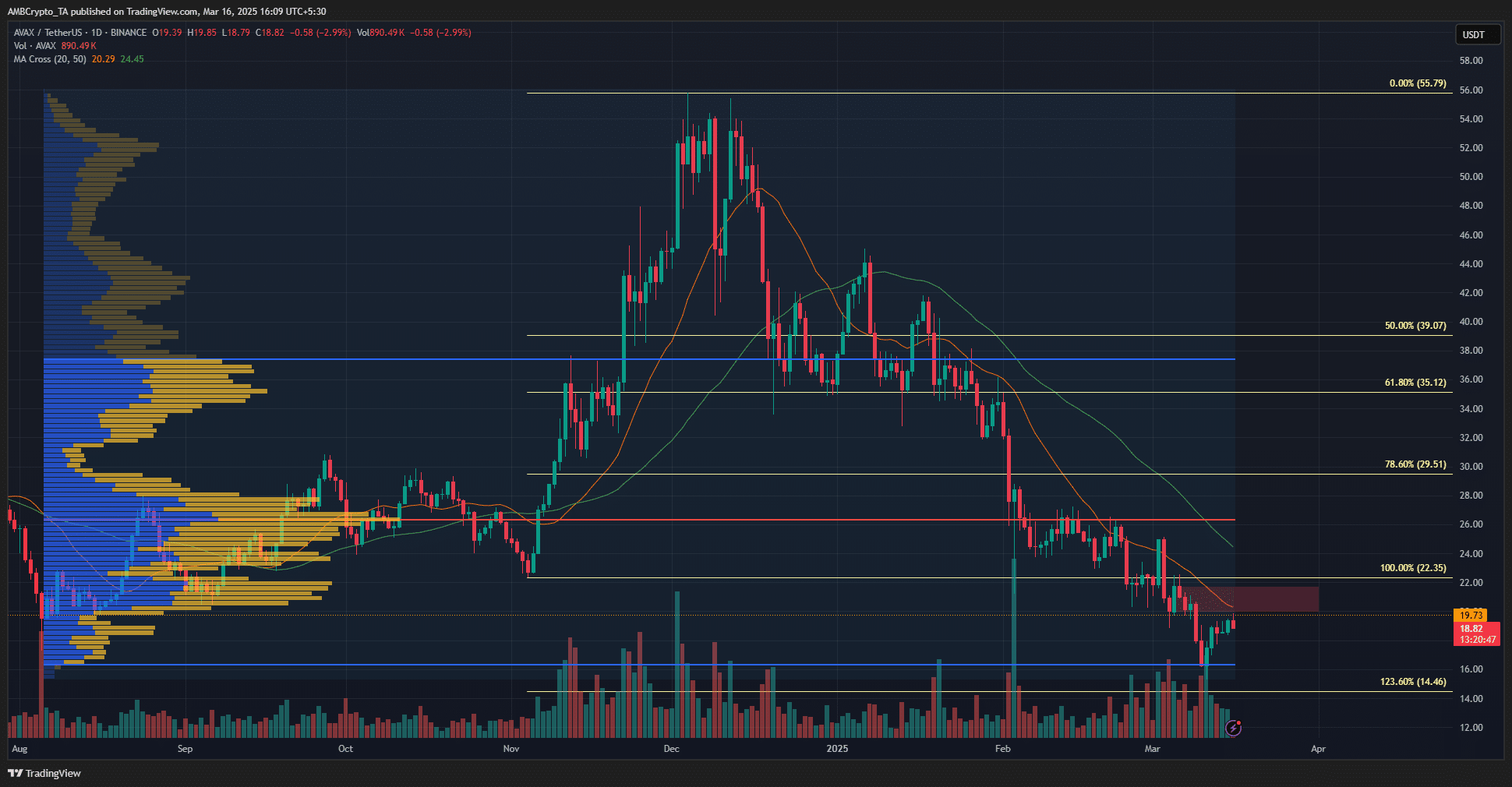

Will Avalanche [AVAX] crash deeper? Why $14.5 support is bears’ new target

- Technical evaluation confirmed a number of the reason why the $20 space was a formidable resistance zone for AVAX bulls.

- A minor value bounce was doable, however a bearish transfer was more likely to begin quickly.

In early March, Avalanche [AVAX] was forecast to see a ten% value bounce, however the downtrend was anticipated to proceed, and this had come to go.

Later, a value drop to $14 was anticipated in an evaluation, and AVAX fell to $15.2 every week later.

The bearish outlook remained in place. The demand was not robust sufficient to coax Avalanche out of its downtrend, and agency resistance zones have been overhead.

Swing merchants may wish to search for brief entries or stay sidelined for the approaching days.

Avalanche set to keep up bearish trajectory

Supply: AVAX/USDT on TradingView

The November rally was wholly retraced by the twenty fourth of February. Since then, Avalanche has shed one other 14% on the value chart.

The buying and selling quantity has additionally been comparatively excessive throughout the drop, highlighting intense promoting stress.

The 20 and 50-period transferring averages confirmed regular downward momentum. The 20 DMA acted as dynamic resistance to the value up to now two weeks as effectively. At press time, the 20 DMA was at $20.29.

The $20-$21.7 area shaped a resistance zone, because it was a bearish order block. Any AVAX value bounce would doubtless be checked by the sellers.

Furthermore, the Mounted Vary Quantity Profile instrument confirmed that the $20.5-$22.1 space was a high-volume node, reinforcing the energy of the resistance.

The instrument was plotted from the August lows to press time and marked the Level of Management at $26.36.

The each day market construction was bearish, and the latest decrease excessive was set at $24.95. A each day session shut above this degree is required to shift the construction bullishly. At press time, such a transfer appeared unlikely.

The Fibonacci retracement and extension ranges confirmed that the 23.6% extension degree at $14.46 was the subsequent goal.

Swing merchants can look to promote a short-term value bounce towards $21 and goal this degree as a take-profit. The bearish thought could be invalidated if the value might climb above $22.15.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion