Will Bitcoin catch investors off-guard in the short term?

- BTC was up by greater than 2.5% within the final 24 hours, together with a hike in quantity.

- Market sentiment turned bearish on BTC, as did a couple of metrics.

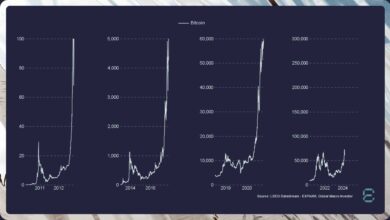

Bitcoin [BTC] has shocked traders over the past month, due to its newest bull rally. As we entered the second month of the final quarter, a key indicator turned bullish.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

The market’s confidence in Bitcoin is low

Over the past seven days, the king of cryptos’ value has rallied by over 3%. Although the momentum had dropped, its value chart nonetheless remained within the inexperienced. In accordance with CoinMarketCap, BTC’s worth rose by over 2.5% in simply the final 24 hours.

On the time of writing, it was buying and selling at $35,379.27 with a market capitalization of greater than $690 billion.

The higher information was that its 24-hour buying and selling quantity additionally surged by greater than 90%, suggesting that traders had been actively buying and selling the coin.

Whereas the coin’s value went up, market sentiment turned within the sellers’ favor. This was evident from the information AMBCrypto analyzed by way of LunarCrush, which showcased that bullish sentiment across the token had dropped.

Not solely that, however Social Engagements additionally plummeted final week, which means that Bitcoin’s reputation had considerably declined.

Supply: LunarCrush

Will Bitcoin shock traders once more?

Although market sentiment seemed bearish on the king of cryptos, CryptoCon, a preferred X (previously Twitter) account highlighted a key bullish metric. As per the tweet, one of the vital essential Bitcoin indicator breakout for the cycle has simply occurred for a uncommon second time this cycle.

Not solely does this sometimes spell good issues to return within the quick time period, nevertheless it additionally marks the beginnings of all the biggest historic strikes.

Crucial #Bitcoin indicator breakout for the cycle has simply occurred for a uncommon 2nd time this cycle.

Not solely does this sometimes spell good issues to return within the shorter time period, nevertheless it additionally marks the beginnings of the entire largest historic strikes:

– The bull run in… pic.twitter.com/WWlKPEy4u7

— CryptoCon (@CryptoCon_) November 1, 2023

Subsequently, a more in-depth take a look at the blockchain’s stats sheds mild on what to anticipate from it. As per further information analyzed by AMBCrypto by way of CryptoQuant, promoting stress on BTC was excessive at press time. This was evident from the truth that its trade reserve was rising.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Its aSORP was additionally within the crimson, which means that extra traders had been promoting the token at a revenue, which may point out a doable market prime.

Nonetheless, BTC’s derivatives metrics like Funding Charge and Taker Purchase Promote Ratio had been inexperienced, indicating that traders within the futures market had been shopping for BTC at its increased value on the time of publication.

Supply: CryptoQuant