Polkadot drops 10% in 24 hours: Start of a bigger decline?

- Market sentiment round Polkadot turned bearish.

- Metrics revealed that promoting stress was rising on DOT.

The crypto market turned bearish within the final 24 hours as most cryptos suffered value corrections, and Polkadot [DOT] was not an exception.

The truth is, DOT was most severely hit among the many prime 20 cryptos by way of market capitalization. Subsequently, AMBCrypto investigated additional to see whether or not DOT can get well from this anytime quickly.

Polkadot’s newest value correction

Whereas a number of cryptos witnessed slight pullbacks, Polkadot’s worth dipped by practically 10% within the final 24 hours alone.

On the time of writing, the token was trading at $9.49 with a market cap of over $14.44 billion, making it the fifteenth largest crypto.

The unhealthy information was that DOT’s buying and selling quantity elevated by 15% within the final 24 hours, which acted as a basis of this value decline.

This declining value development additionally had a unfavorable affect on the token’s social metrics. Santiment’s knowledge revealed that DOT’s social dominance plummeted sharply—an indication of the dropping recognition of the token.

On prime of that, Polkadot’s Weighted Sentiment entered the unfavorable zone. This indicated that bearish sentiment across the token was rising available in the market.

Supply: Santiment

Can DOT get well quickly?

AMBCrypto then checked different knowledge units to search out out whether or not they present indicators of a restoration from this bearish development within the close to time period. We discovered that whereas DOT’s value began to drop, buyers selected to promote their holdings.

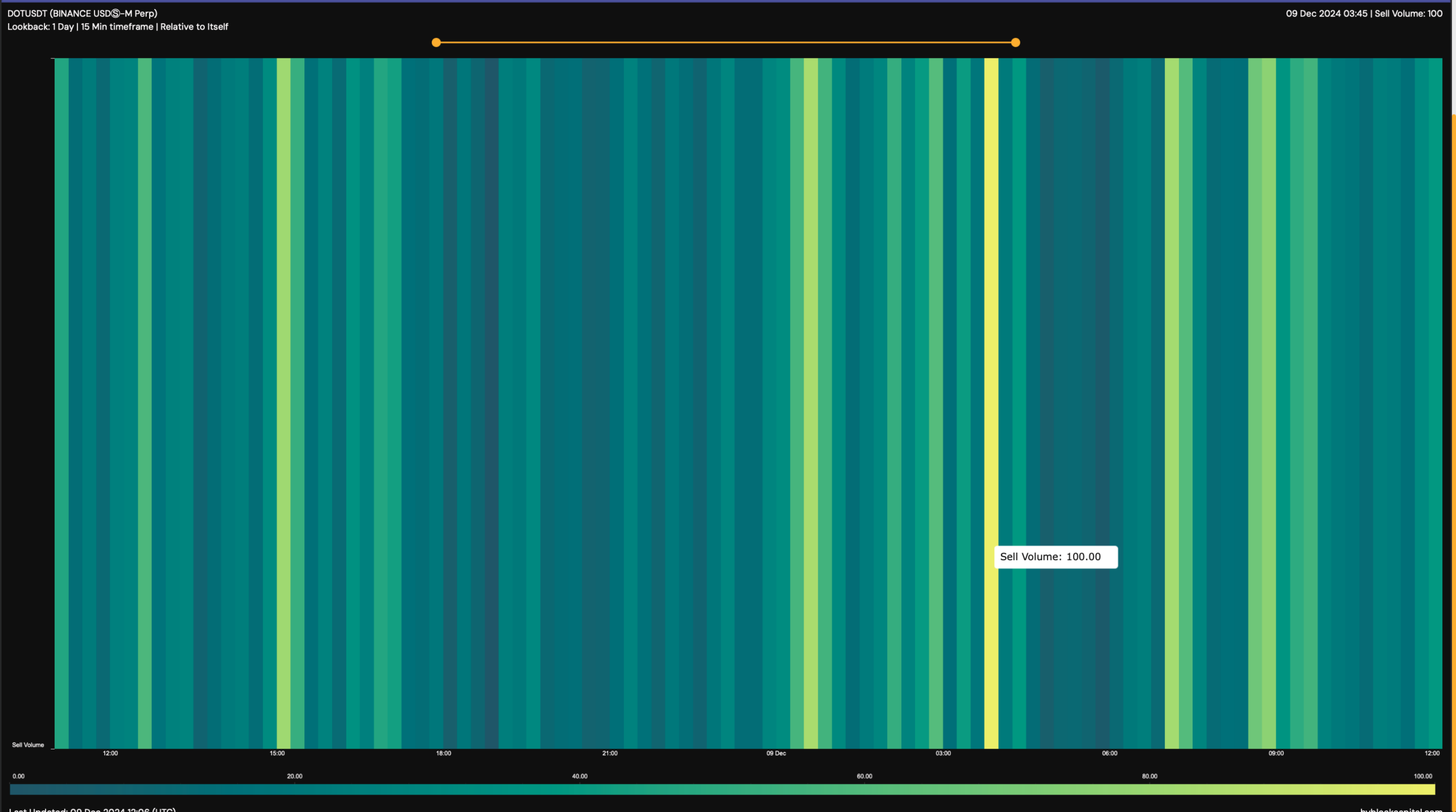

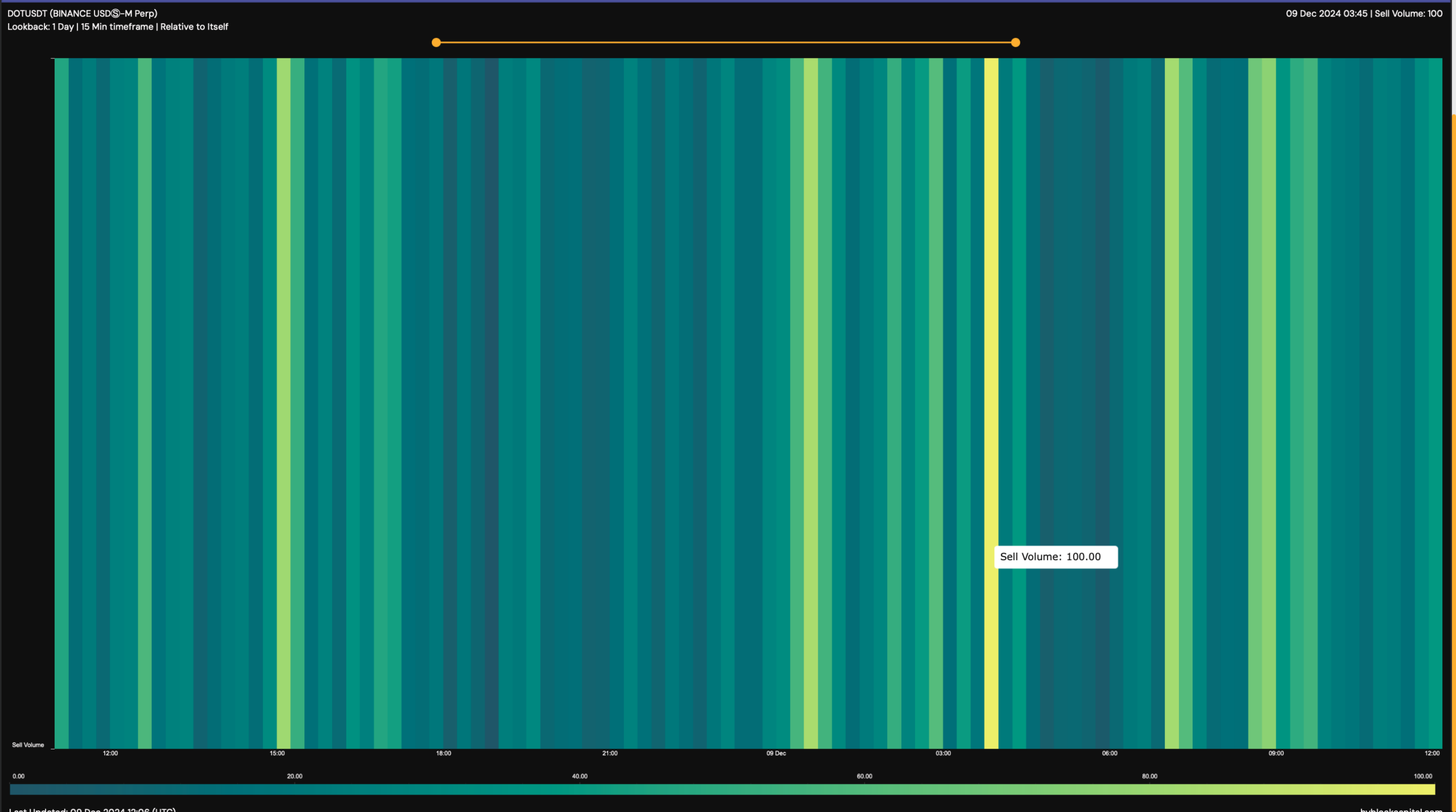

Hyblock Capital’s knowledge identified that DOT’s promote quantity spiked a number of instances up to now 24 hours, and even surged to 100 on one occasion.

For starters, a quantity nearer to 100 mirrored excessive promoting exercise occurring available in the market for a specific token.

Supply: Hyblock Capital

Aside from that, Polkadot’s Funding Price additionally declined barely, as per Coinglass’ data. A decline in Funding Charges in cryptocurrencies signifies that quick positions have gotten extra dominant.

This could be a signal of a bearish sentiment available in the market.

Just like the promote quantity indicator, the Relative Power Index (RSI) additionally painted an analogous image. The indicator registered a pointy decline-an indication of rising promoting stress.

In case of a continued downtrend, DOT would possibly first drop to its 20-day SMA assist, as prompt by the Bollinger Bands. At that degree, DOT would possibly get an opportunity to kickstart a bull rally and get well.

Supply: TradingView

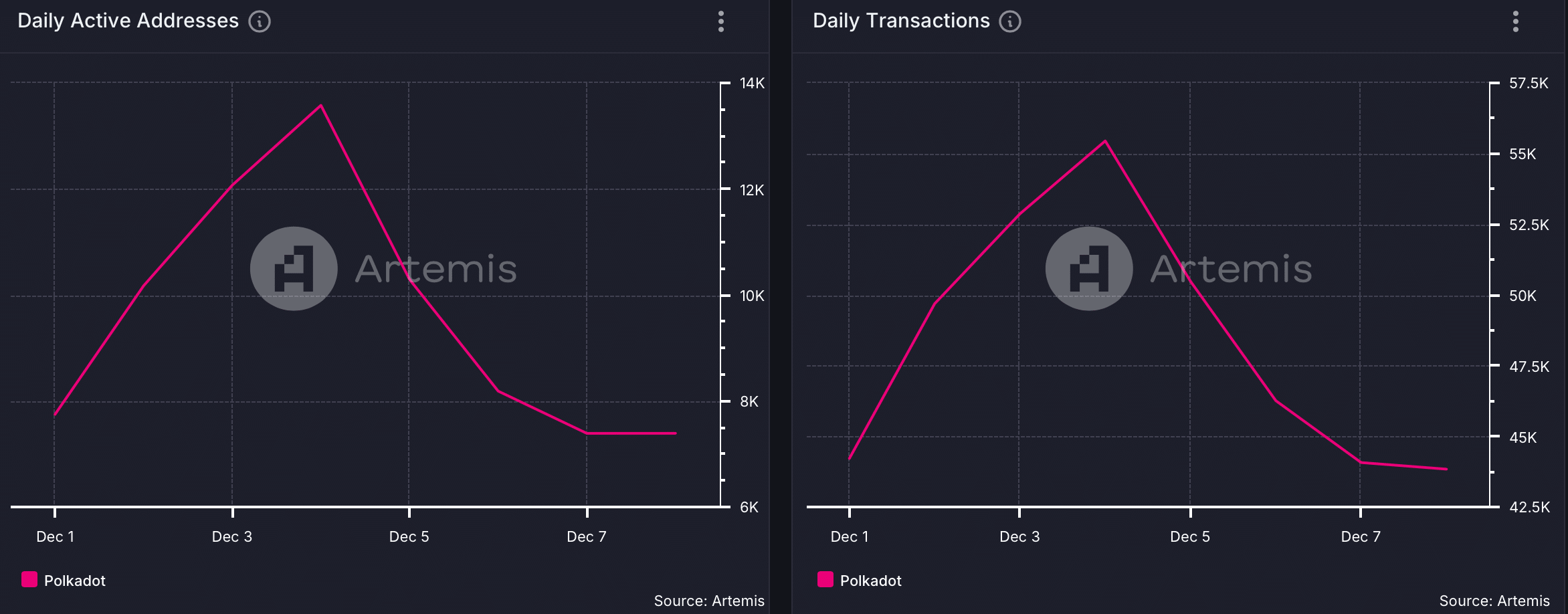

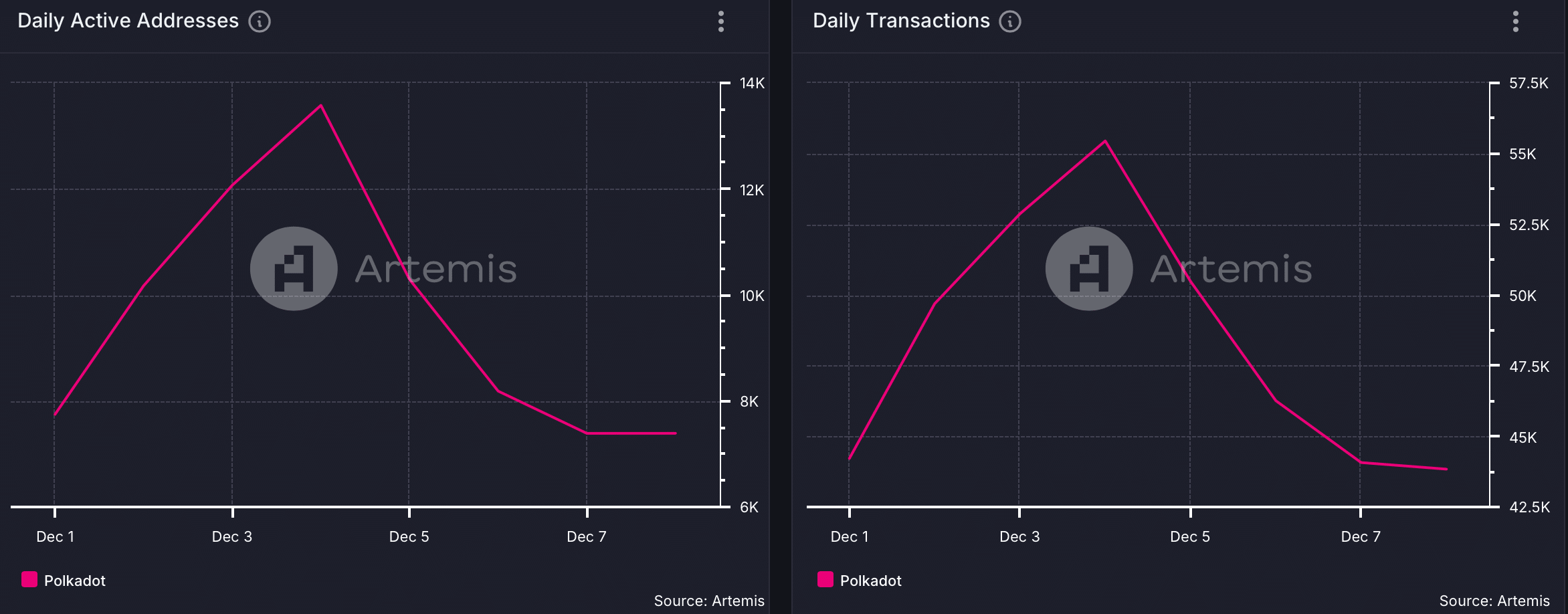

Notably, not solely did Polkadot’s value drop, its community exercise additionally adopted an analogous development.

Learn Polkadot’s [DOT] Worth Prediction 2024-25

AMBCrypto’s have a look at Artemis’ knowledge identified that each DOT’s every day energetic addresses and transactions dipped sharply over the previous few days.

This meant that customers weren’t actively using the blockchain, which might trigger additional bother for DOT.

Supply: Artemis