Bitcoin Whale Breaks Silence with $26 Million Transfer — What’s Going On?

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

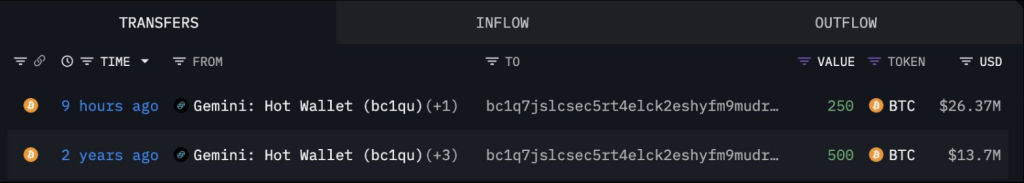

Based mostly on reviews, a long-dormant Bitcoin whale made a shock transfer this week, snapping up 250 BTC for about $26.37 million. It’s the primary time this pockets has proven exercise in two years.

Associated Studying

The acquisition has stirred discuss amongst merchants and on-chain analysts alike. Some see it as an indication that huge gamers are preparing for extra motion within the weeks forward.

Whale Returns After Two Years

In response to Lookonchain information, the identical whale pulled 500 BTC out of Gemini again in 2022 when Bitcoin was buying and selling close to $27,400, a transfer price almost $14 million on the time. Now, with BTC hovering round $105,000, the whale’s holdings sit on an unrealized achieve of over $39 million.

That form of revenue margin grabs consideration. Different giant holders usually watch these strikes carefully. They marvel if that is the beginning of a wider development or only one pockets’s play.

A whale that had been dormant for two years purchased one other 250 $BTC($26.37M) 9 hours in the past.

2 years in the past, this whale withdrew 500 $BTC($13.7M) from Gemini at $27,401, now sitting on an unrealized revenue of $39M.https://t.co/c0U92isSfc pic.twitter.com/vcb4V3M0Uz

— Lookonchain (@lookonchain) June 8, 2025

Massive Beneficial properties On Early Wager

Early adopters have seen huge upside in Bitcoin through the years. This whale’s 2022 withdrawal got here simply earlier than a multi-year worth increase. Since then, Bitcoin has climbed almost 300%.

Not everybody could make strikes like that. Small traders usually really feel left behind when a pockets this measurement shifts cash. Nonetheless, some merchants say it may possibly create a ripple of optimism. When huge holders purchase, retail merchants typically pile in, chasing the identical positive aspects.

Technical Indicators Present Blended Indicators

On the charts, BTC appears to be shaping an inverse cup-and-handle sample with a major neckline at $100,800 serving as main assist. The value has fallen into the deal with stage, and a dip beneath $100,800 might propel Bitcoin to $91,000, which coincides with its 200-day exponential shifting common (EMA).

Bitcoin’s relative power index (RSI) is 52, indicating the bullish momentum is fading. A fall beneath 50 might introduce extra promoting stress. For the bulls to regain management, BTC should recapture the 20-day EMA resistance, which is simply above $105,000.

Associated Studying

Market Volatility And Liquidations

There have been some wild worth actions final week fueled partly by social media battles between US President Donald Trump and billionaire Elon Musk. The value of bitcoin fell beneath $101,000 for a second, inflicting near $1 billion in liquidations throughout futures markets, earlier than recovering to above $105,000 inside hours.

The miner capitulation sign was additionally detected by CryptoQuant’s Hash Ribbons indicator, pointing to near-term ache for worse-off miners, however some potential rallies forward as soon as they pulled by.

Featured picture from Unsplash, chart from TradingView