Will BTC Price Dip Below $90K This Week?

Over the previous few days, the value of Bitcoin has been falling as a result of it hasn’t attracted sufficient patrons across the $98,000 mark. Consequently, sellers have been consolidating the value round $95,000. Nonetheless, the just lately launched sizzling Client Worth Index (CPI) report might change issues, as many analysts assume that the higher-than-expected inflation may plunge Bitcoin’s value towards $90K this week.

Greater-Than-Anticipated CPI Report Triggers Lengthy Liquidations

Bitcoin value was surging towards $96K forward of the CPI report because the market anticipated a softer inflation knowledge for January. Nonetheless, the consumer-price index elevated by 3% in comparison with final 12 months, choosing up pace from December’s 2.9% charge and exceeding economists’ predictions.

Additionally learn: U.S. CPI Knowledge Launched: What’s the Affect on Crypto Market?

January’s CPI usually reveals important value modifications that companies implement in the beginning of the 12 months. Due to this fact, right this moment’s report is an important indicator of how properly the Federal Reserve is doing in its efforts to regulate inflation.

The index went up by 0.5% from final month, which is a bit quicker than the 0.4% enhance in December and better than the 0.3% enhance economists had predicted.

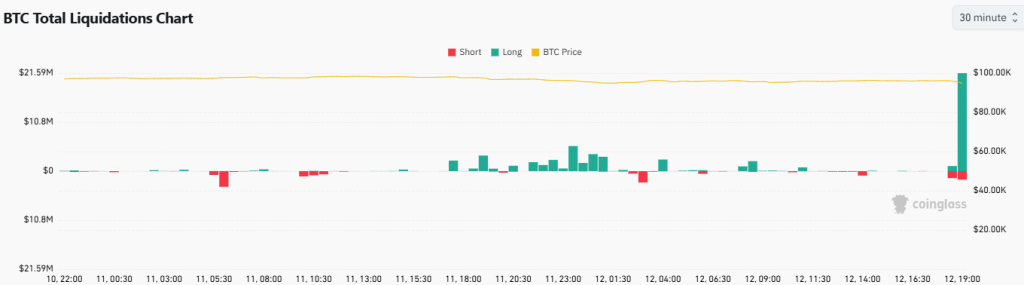

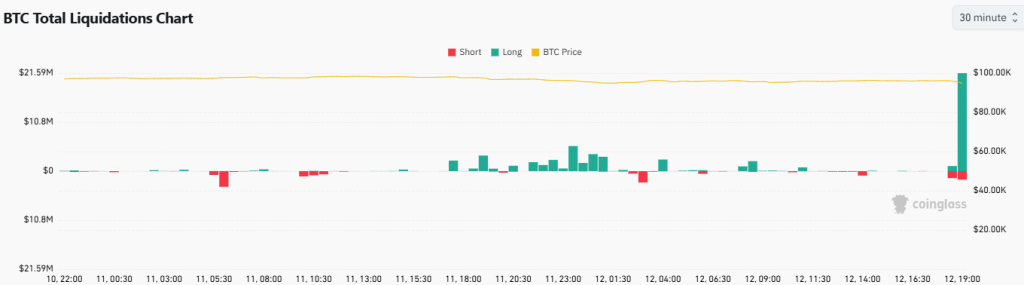

Following the current CPI report, Bitcoin’s value has taken a pointy downturn. Inside just some minutes, it fell from a excessive of $96,000 to about $94,000. Based on Coinglass, there have been almost $25 million in whole Bitcoin liquidations, with patrons rapidly closing out $22 million in lengthy positions.

If the CPI is larger than anticipated, it means inflation isn’t reducing as hoped. This typically causes the Federal Reserve to maintain rates of interest excessive and even increase them to handle inflation.

Excessive rates of interest normally make the greenback stronger and Treasury bonds extra interesting as a result of they provide larger returns. This could lead buyers to desire these safer investments over extra unstable ones like cryptocurrencies. Consequently, demand for cryptocurrencies like Bitcoin could drop, resulting in decrease costs.

Analysts are actually predicting that this surge in inflation may decelerate the current restoration within the crypto market that began after the crash on February third. It’s anticipated that Bitcoin’s value might drop to check the $90,000 degree this weekend, which might plunge the chance of it reaching $100,000 quickly.