Will Curve’s new stablecoin prove as its mettle in the days to come

- crvUSD will get deployed on Curve protocols UI. TVL on Curve begins to lower.

- CRV’s value falls, nevertheless, holders proceed to indicate religion within the token.

Because the DeFi area continues to get extra aggressive with protocols, akin to Uniswap and SushiSwap dominating the sector, protocols akin to Curve are having a tough time competing.

Lifelike or not, right here’s CRV’s market cap in BTC’s phrases

Nonetheless, Curve just lately introduced that they are going to be launching a brand new stablecoin on their protocol referred to as crvUSD, which may assist the protocol compete within the area.

Curve enters a brand new enjoying area

On 4 Might, the sensible contracts for these stablecoins have been deployed on the protocol. Nonetheless, the stablecoin swimming pools’ integration into the Curve Finance protocol occurred on 18 Might.

These swimming pools are common swimming pools, not metapools, which suggests they don’t mix a number of stablecoins. The aim of getting separate swimming pools is to distribute belief throughout varied stablecoins, particularly for the PegKeeper contracts.

For context, PegKeeper contracts seek advice from sensible contracts designed to keep up the steadiness of a stablecoin’s worth, retaining it pegged or carefully aligned with a particular reference asset, sometimes a fiat foreign money just like the US greenback. These contracts monitor and handle the availability and demand dynamics of the stablecoin, making changes as vital to make sure its value stays steady

Stablecoin swimming pools with crvUSD are actually seen in UI.

The usually are not metapools however plain swimming pools with a purpose to break up belief between a number of stablecoins for PegKeeper contracts pic.twitter.com/TPJOv60rR3

— Curve Finance (@CurveFinance) May 17, 2023

Within the $crvUSD system, the holder’s collateral is transformed to $crvUSD if its worth declines, and repurchased if its worth will increase. This ensures a gradual and steady course of with out abrupt liquidations.

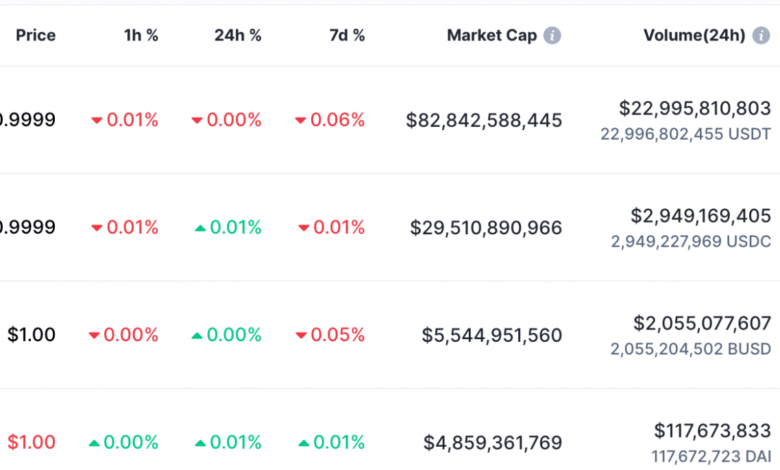

Regardless of the advantages of the crvUSD, the stablecoin may have a tough time making its mark. The market is crowded and very aggressive at press time. Stablecoins akin to USDT, USDC, and DAI have captured a big a part of the marketshare with USDT main the best way.

Supply: CoinMarketCap

Although crvUSD might have a tricky time breaking into the stablecoin market, the introduction of crvUSD may assist the protocol in different areas akin to TVL and treasury holdings.

At press time, the whole worth locked on the protocol was $4.2 billion. It had declined by 6.3% during the last month.

As a consequence of Curve’s poor efficiency, the general earnings generated by the protocol additionally declined by 20.6% during the last month in keeping with the token terminal’s information.

Supply: token terminal

State of CRV

Coming to the CRV token, the variety of holders of the token remained the identical during the last month. Regardless of this, the worth of CRV fell throughout this era.

Learn Curve’s Worth Prediction 2023-2024

Solely time will inform whether or not the introduction of crvUSD may have a optimistic affect on CRV going ahead.

Supply: Santiment