Will Ethereum continue to see green as self custody rises and whales sell?

- Many Ethereum addresses withdrew their holdings on a substantial scale

- General curiosity from new addresses in ETH declined

Ethereum [ETH] recorded a serious correction in value on the charts, regardless of the anticipation related to spot ETH ETFs and their impending launch.

Ethereum self-custody on the rise

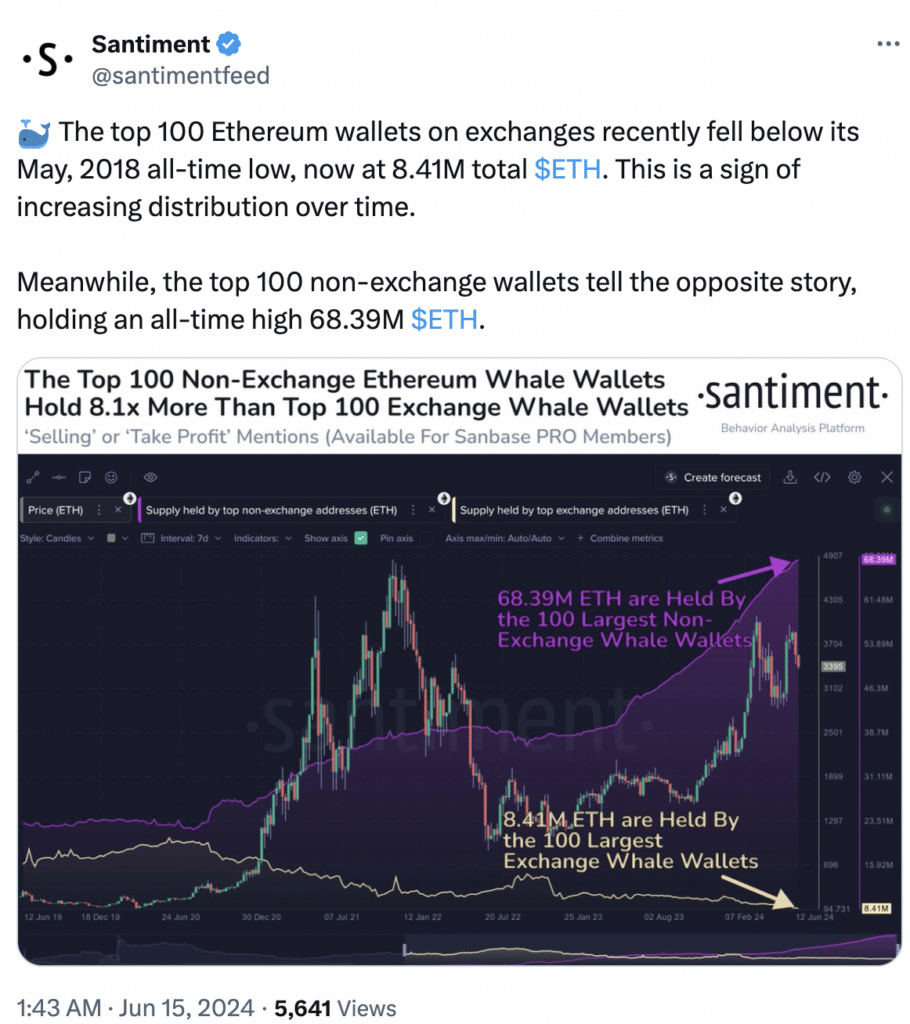

In reality, Santiment’s knowledge revealed a shift within the distribution of Ethereum holdings. There’s a development of customers shifting their ETH away from exchanges.

On the one hand, the highest 100 alternate wallets not too long ago dipped beneath their Might 2018 all-time low. They’re now at present holding solely 8.41 million ETH – Implying a fall within the focus of Ethereum on exchanges.

Alternatively, the highest 100 non-exchange wallets had been at an all-time excessive of 68.39 million ETH, signifying an increase in self-custody. Which means that extra customers at the moment are taking management of their very own holdings by storing them in wallets they management immediately, fairly than preserving them on exchanges.

If this development continues, it might assist Ethereum’s declare to decentralization. A extra distributed community, with much less reliance on centralized exchanges, aligns with the core rules of blockchain know-how.

Nonetheless, diminished liquidity on exchanges, brought on by a decline in ETH holdings, might result in increased value volatility for Ethereum. With fewer cash available for purchasing and promoting, value swings might turn into extra important in response to market adjustments.

Supply: Santiment

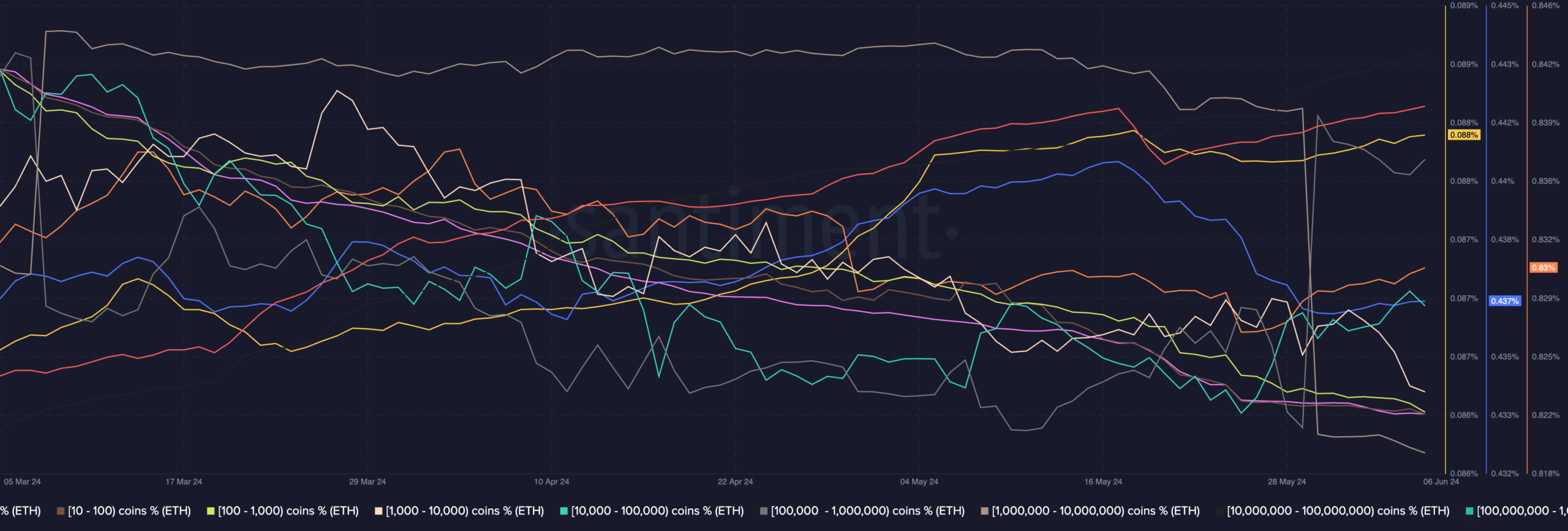

Despite the fact that increased self-custody might be seen as a constructive growth, there are different regarding elements for ETH too. As an example, some massive addresses have been promoting a big quantity of their holdings, with out accumulating.

This might influence ETH’s value negatively sooner or later.

It’s price noting, nevertheless, that retail buyers proceed to indicate curiosity in ETH, regardless of the dip in value.

Supply: Santiment

Retail curiosity declines

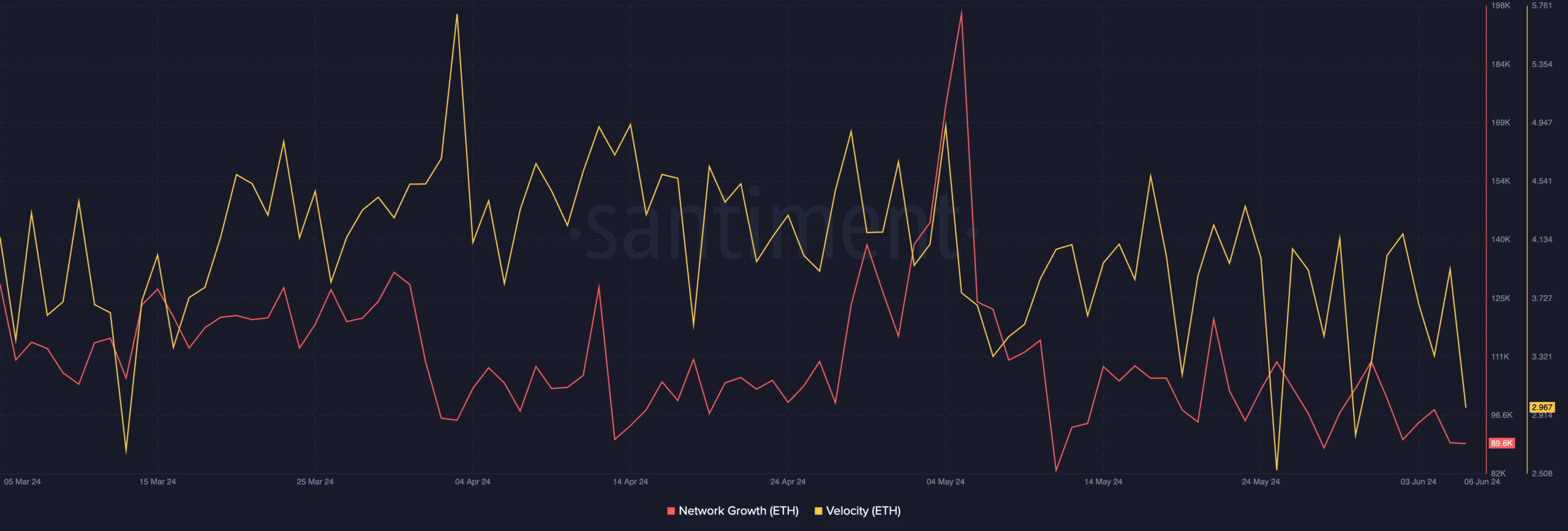

And but, regardless that retail buyers have been displaying curiosity in ETH, it hasn’t been important sufficient to maneuver ETH’s value. Moreover, the community progress for ETH additionally declined over the previous month.

This meant that the variety of new addresses displaying curiosity in ETH diminished. A declining community progress additionally signifies that the buildup of ETH was being achieved by pre-existing holders.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Moreover, the rate at which ETH was buying and selling additionally fell over the previous couple of days. Merely put, it implies that the frequency with which ETH was being traded declined considerably.

Supply: Santiment