Will Ethereum crash again? The surprising April price prediction

- Ethereum introduced a bearish risk on the value charts for April and Could.

- The probabilities of an ETF approval for Ethereum had been bleak, at finest.

“Promote in Could, stroll away” was a preferred saying in crypto. It’s not Could but, however Ethereum [ETH] holders are already starting to stroll away.

Crypto analyst Daan Crypto took to X to focus on some scenarios that might play out concerning the Ethereum ETF hypothesis.

Eric Balchunas, senior ETF analyst at Bloomberg, revealed that their odds of an ETH ETF approval had been at 25%. With the deadline in Could, a detrimental end result might trigger costs to slip additional south.

AMBCrypto analyzed the value motion and related metrics to know the market scenario, and if (or when) traders ought to flip bullish on the altcoin king.

The bearish pennant was taking part in out

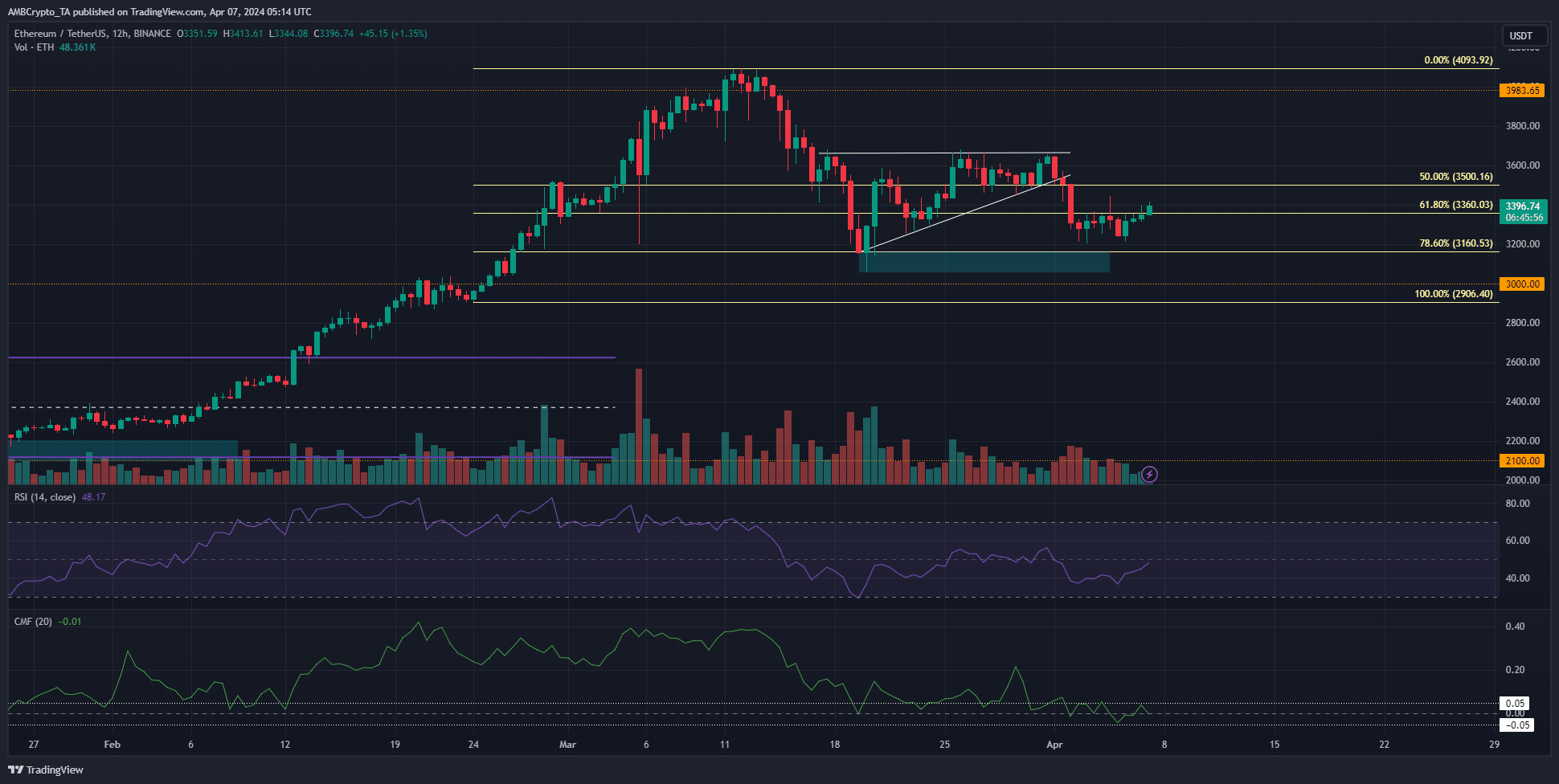

Supply: ETH/USDT on TradingView

The 12-hour market construction was nonetheless bullish. ETH set the next low at $3056 on the twentieth of March. A latest AMBCrypto report confirmed {that a} bearish chart sample had developed and will see costs fall to $2800.

This bearish outlook has not but modified. A transfer beneath $3056 would imply that swing merchants ought to shift their bias towards promoting. The technical indicators had been additionally rising more and more bearish.

The RSI confirmed a studying of 44 and has been beneath impartial 50 for almost all of the time because the fifteenth of March. The CMF was additionally trending downward to point out capital outflow was rising.

Nevertheless, neither the momentum nor the capital circulate had been considerably bearish on the 12-hour chart.

The bulls nonetheless have some hope that the bearish chart sample wouldn’t transfer towards its completion – which is a drop to the $2.6k-$2.8k area.

The on-chain metrics confirmed volatility forward

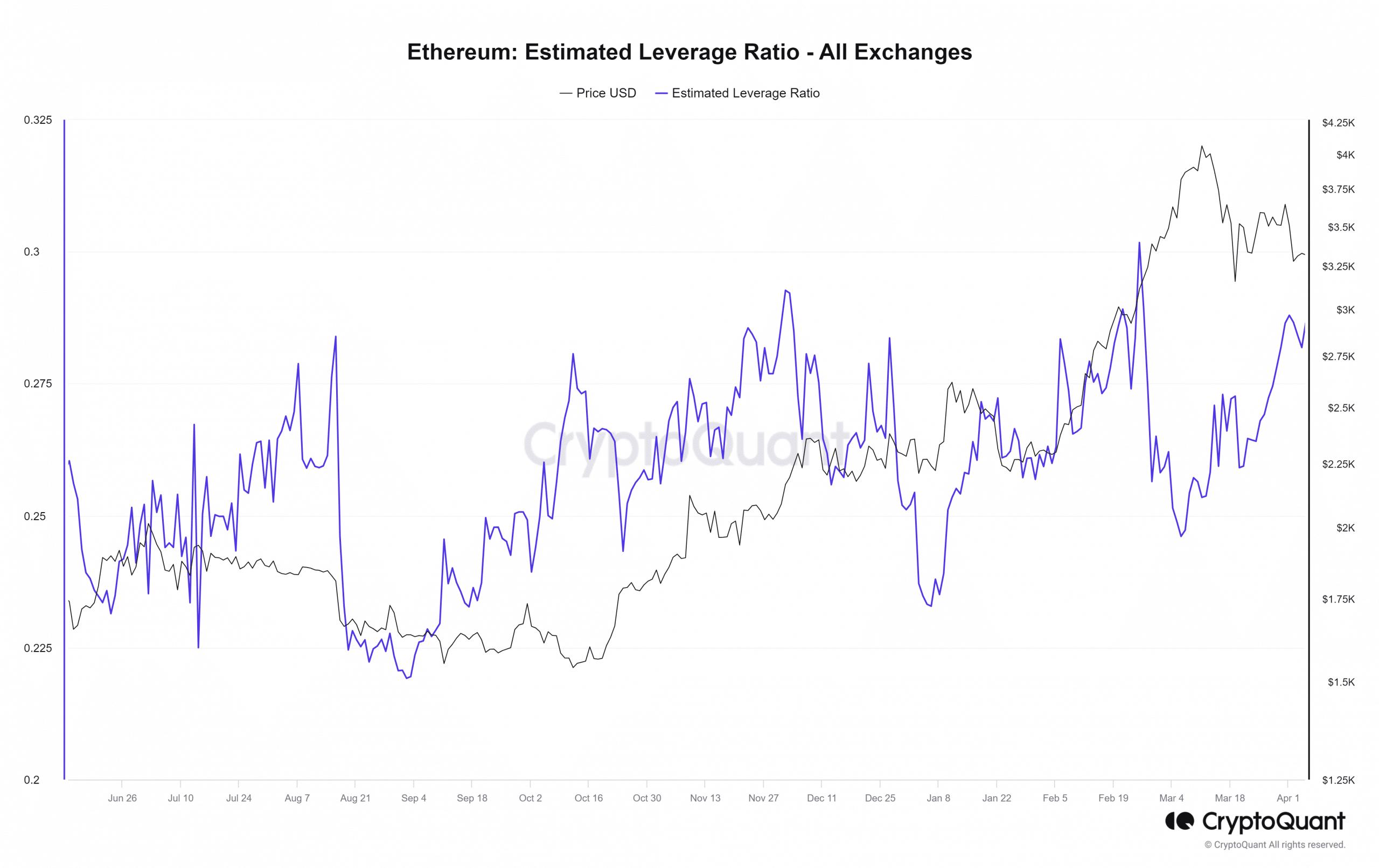

Supply: CryptoQuant

In March, Ethereum confronted a rejection at $4.1k. Per week earlier than this pullback, the estimated leverage ratio (ELR) started to fall. After the pullback, the ELR started to development increased.

The ratio is outlined as Open Curiosity/alternate reserve (of Ethereum).

Therefore, a rising ELR means the OI is rising, or that the reserve is trending downward. A rising Open Curiosity was not in proof based mostly on Coinglass data for the previous two weeks.

The latest ETH losses noticed the ratio decline barely. It confirmed speculators had been starting to unwind their leverage positions within the face of market adversity.

Do long-term holders anticipate volatility, too?

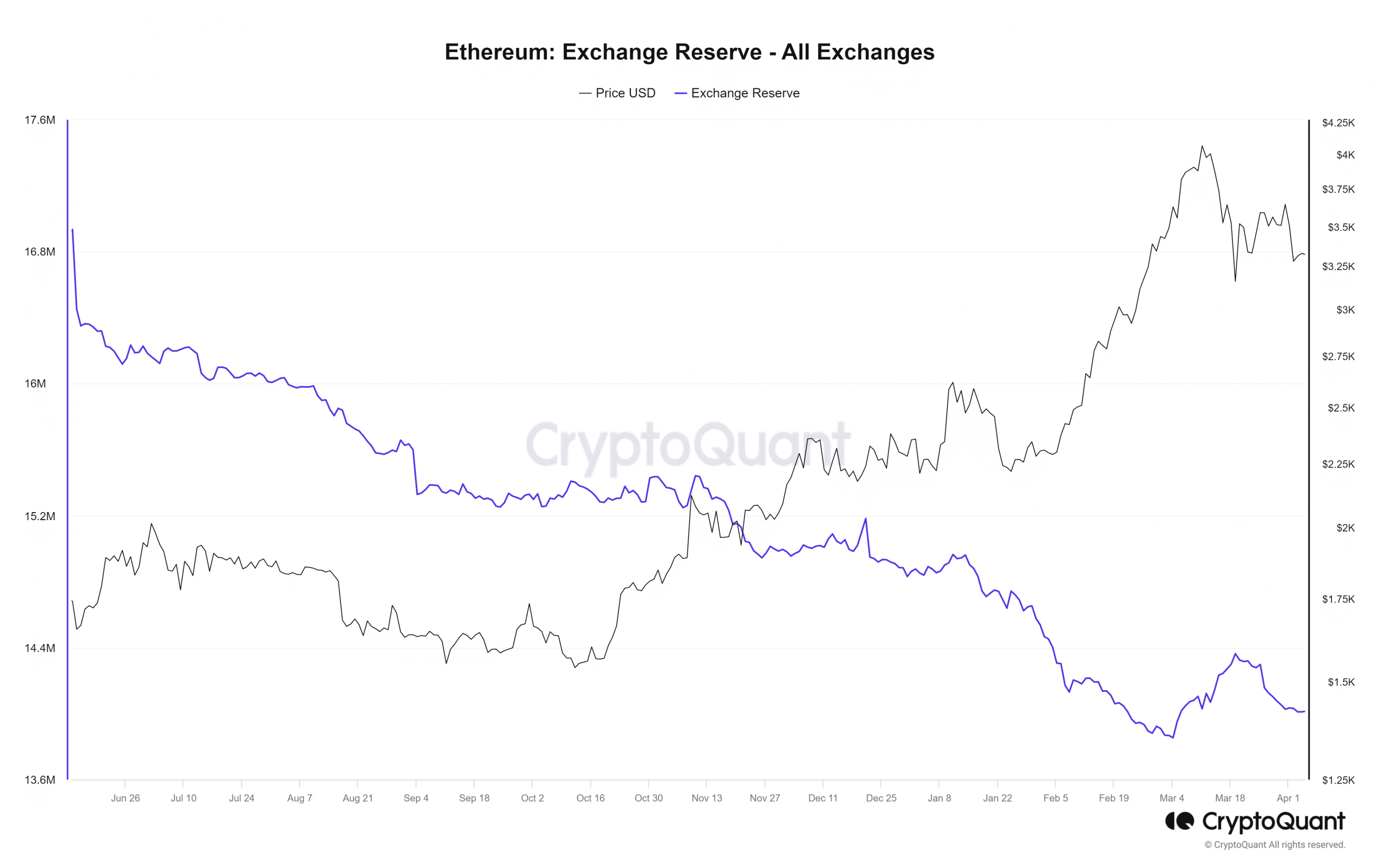

Supply: CryptoQuant

Evaluation of the Ethereum alternate reserve confirmed a downtrend since mid-March, after a two-week spike in early March. This confirmed that holders had doubtless taken income and the wave of promoting has begun to lighten.

Falling alternate reserves point out rising accumulation, and had been a constructive take-away for ETH traders.

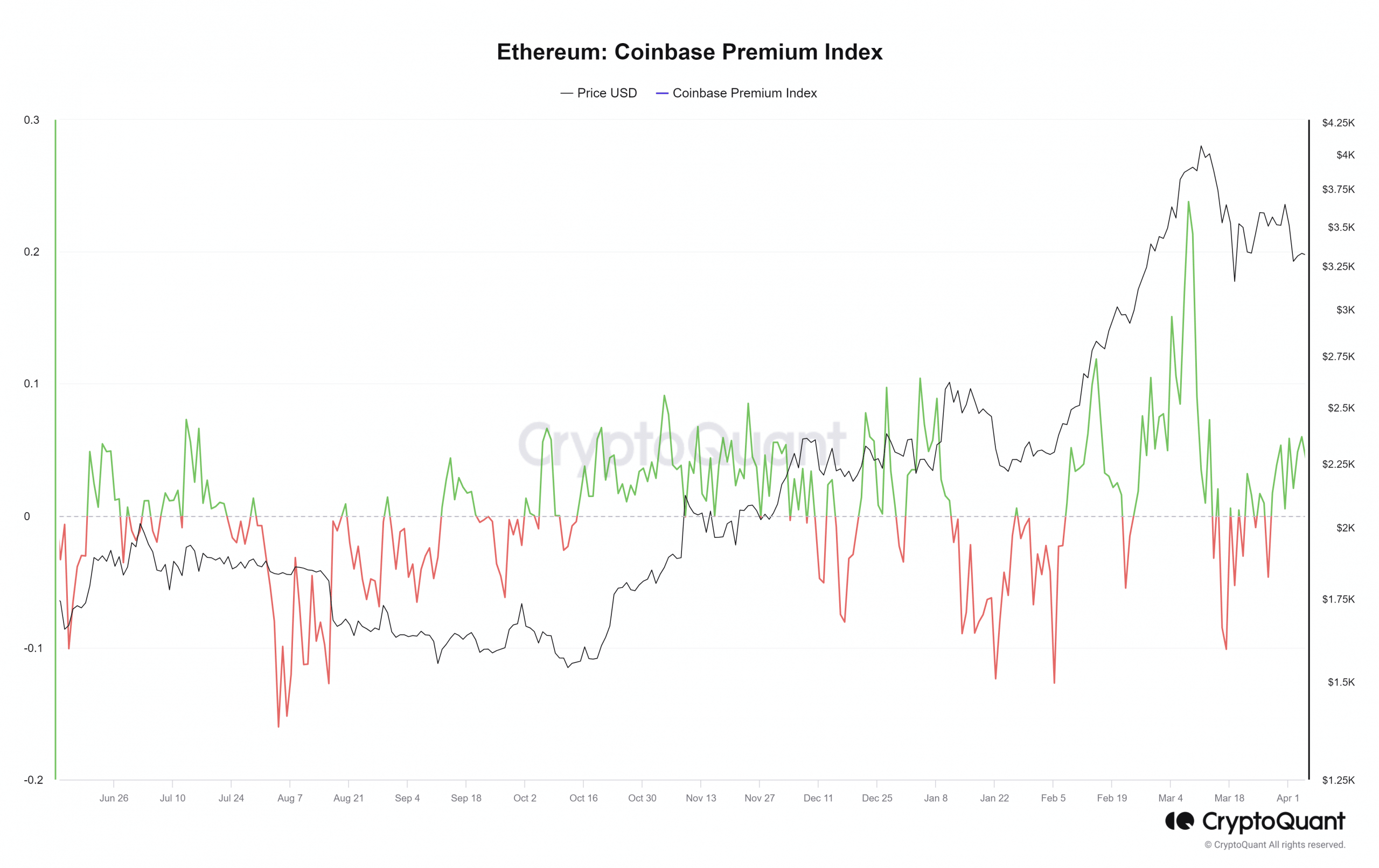

Supply: CryptoQuant

The Coinbase Premium Index displays the proportion distinction between Ethereum costs on Binance and Coinbase on the USDT (Tether) pair. The previous two weeks noticed the Premium Index development increased.

Whereas it didn’t attain the highs from earlier in March, it nonetheless hinted at bullish U.S. traders.

The technical evaluation confirmed a bearish efficiency was doubtless in April. The leverage ratio revealed that speculators had been additionally starting to maneuver towards the sidelines for worry of volatility.

In the meantime, different on-chain metrics confirmed bullish traders regardless of the losses.

Learn Ethereum [ETH] Value Prediction 2024-25

General, the affect of the Ethereum ETF, or its denial, could be a pivotal occasion in Could. As issues stand, the U.S. SEC favored denial, and Balchunas states,

“There have been no constructive indicators.”

The Bitcoin [BTC] efficiency within the weeks following the halving might result in extra draw back. Therefore, Ethereum traders have a cause to be cautious for the following 6–8 weeks.