Will Ethereum create a clear coast for DeFi, GameFi?

- High DeFi and GameFi tokens correlated with ETH on most events, however the altcoin king continues to outperform them.

- Curiosity in DeFi tokens has not been reignited.

The Decentralized finance (DeFi) and Gaming Finance (GameFi) sectors working on the Ethereum [ETH] blockchain have been rising in reputation, in line with Glassnode. Nevertheless, the identical knowledge talked about that the expansion of those sectors has not been capable of match the hype. It was the identical with tokens related to the tasks.

The rising #Ethereum sectors of DeFi, GameFi, and Staking are gaining momentum, contributing to the worth progress of each the sectors themselves and Ethereum as a complete.

However, their present illustration inside the broader Ethereum ecosystem stays comparatively modest.… pic.twitter.com/QqAFduW3pp

— glassnode (@glassnode) June 3, 2023

Because the main sensible contract platform, Ethereum supplies the infrastructure and ecosystem for these revolutionary functions to thrive.

Whereas Ethereum has confronted challenges corresponding to excessive fuel charges and scalability points, contributions by tasks beneath the aforementioned sectors have been comparatively scanty. As anticipated, the DeFi sector accounted for the most important share at 3.04%.

However regardless of Lido Finance’s [LDO] progress in adoption, the liquid staking protocol facet took a gentle 1.6% share. The GameFi sector, backed by Polygon [MATIC] strides grabbed 1.2%.

The blue chips aren’t any match for ETH

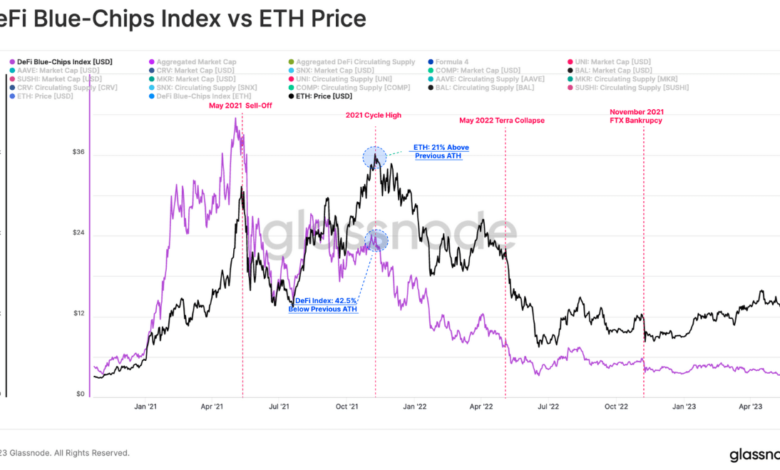

On 31 Could, the on-chain analytic platform analyzed ETH’s correlation with the tasks utilizing the DeFI blue-chip index. The blue-chip index tracks the real-time market efficiency of the most important DeFi tasks.

In accordance with the report, ETH’s motion alongside the tokens beneath the group was comparable. Nevertheless, there have been instances when the correlation decoupled.

As an example, when ETH reached its All-Time Excessive (ATH) in 2021, the combination value efficiency of the tokens decreased by 43%.

Supply: Glassnode

Regardless of the similarities in pattern, ETH continued to outperform the tokens. In backing this declare, Glassnode talked about,

“Within the wake of the 2022 bear market, DeFi tokens have fallen -92.1% under the Could 2021 ATH, whereas ETH is down simply 45%”

Moreover, it appeared that buyers had not walked the discuss of the FTX collapse aftermath. Throughout that interval, there have been numerous conversations in regards to the full adoption of DeFi tasks.

Nevertheless, that has not been the case. In accordance with Glassnode, the Ethereum Mainnet buying and selling quantity nonetheless surpassed the entire DEXes linked to the sector.

All discuss, no motion

In actual fact, centralized exchanges together with OKX and Binance had far more liquidity than DEXes like Uniswap [UNI] and swimming pools like Curve Finance [CRV].

As an alternative of leading to elevated demand, new tackle creation has been unimpressive. A rise in new addresses suggests the attraction of latest buyers.

Nevertheless, when the metric falls to a day by day progress of 600 prefer it was with DeFi blue chips, it implies that adoption momentum has decreased.

Supply: Glassnode

Real looking or not, right here’s MATIC’s market cap in ETH phrases

As well as, the vast majority of the DeFi tokens principally functioned beneath their particular person ecosystem. UNI, which has a variety of functions, was the standout token. This was as a result of it operates past its residence floor.

In abstract, ETH performs a serious position within the progress or decline of those tokens. However with new fashions rising on account of new proposals on Uniswap and MakerDAO [MKR], a resurgence in curiosity could possibly be troublesome to attain.