Will Ethereum fall below $2500 in May? Taking a closer look

- ETH briefly broke assist and traded at a low of $2852 on the first of Might.

- Its Futures Open Curiosity declined significantly because the tenth of April.

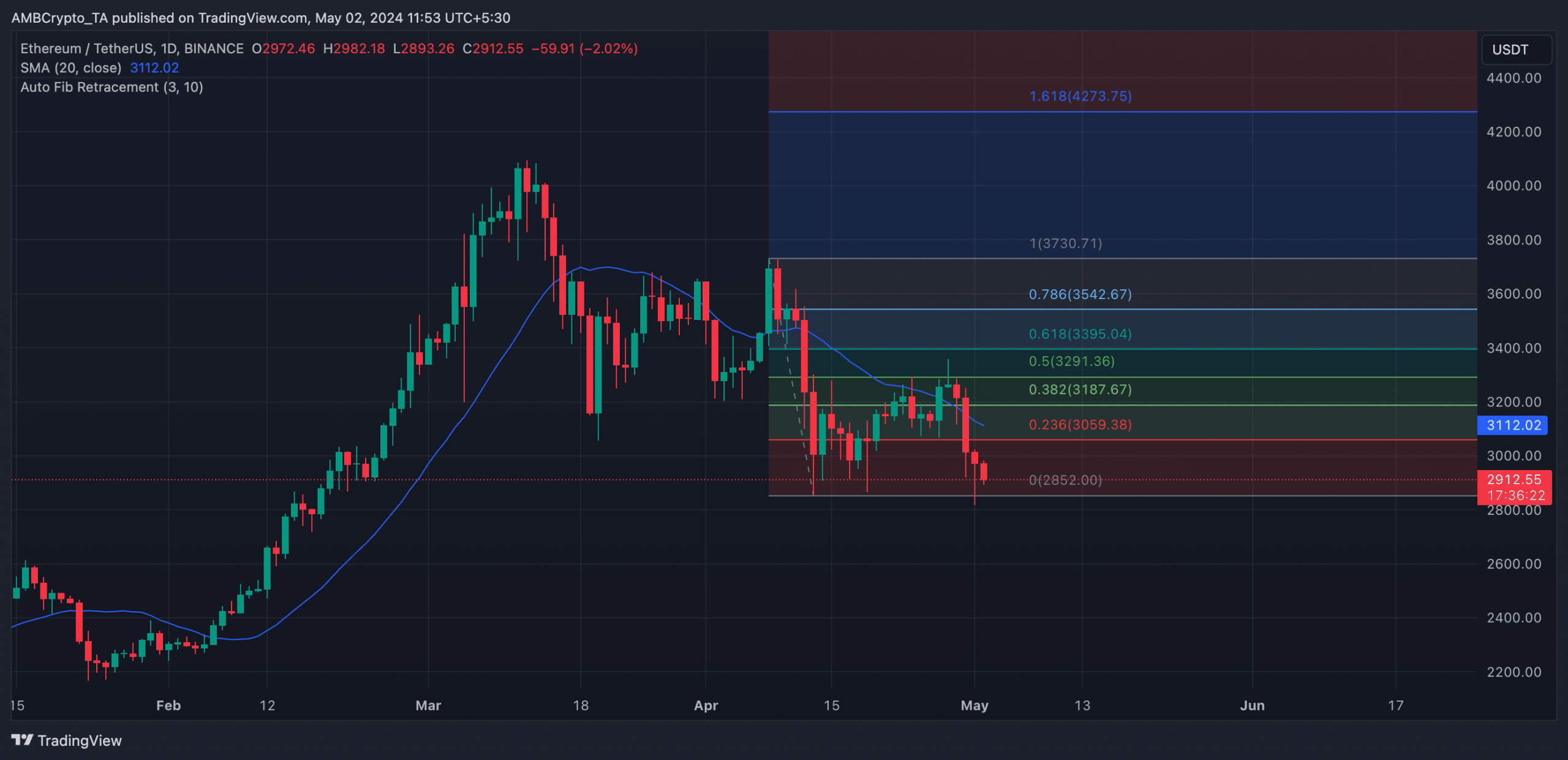

Ethereum [ETH] just lately crossed under its 20-day easy shifting common (SMA), placing it prone to an additional decline within the quick time period.

When an asset’s worth falls under its 20-day SMA, it means that the short-term pattern for the asset is downward.

Market members typically view this as an indication that sellers are in management and that the asset’s worth will doubtless proceed declining.

Readings from ETH’s worth motion on a 1-day chart confirmed that its worth fell under its 20-day SMA on the thirtieth of April.

As coin selloffs intensified, ETH broke assist and closed the buying and selling session on the first of Might at a low of $2850.

Supply: ETH/USDT on TradingView

Bulls are nowhere to be discovered

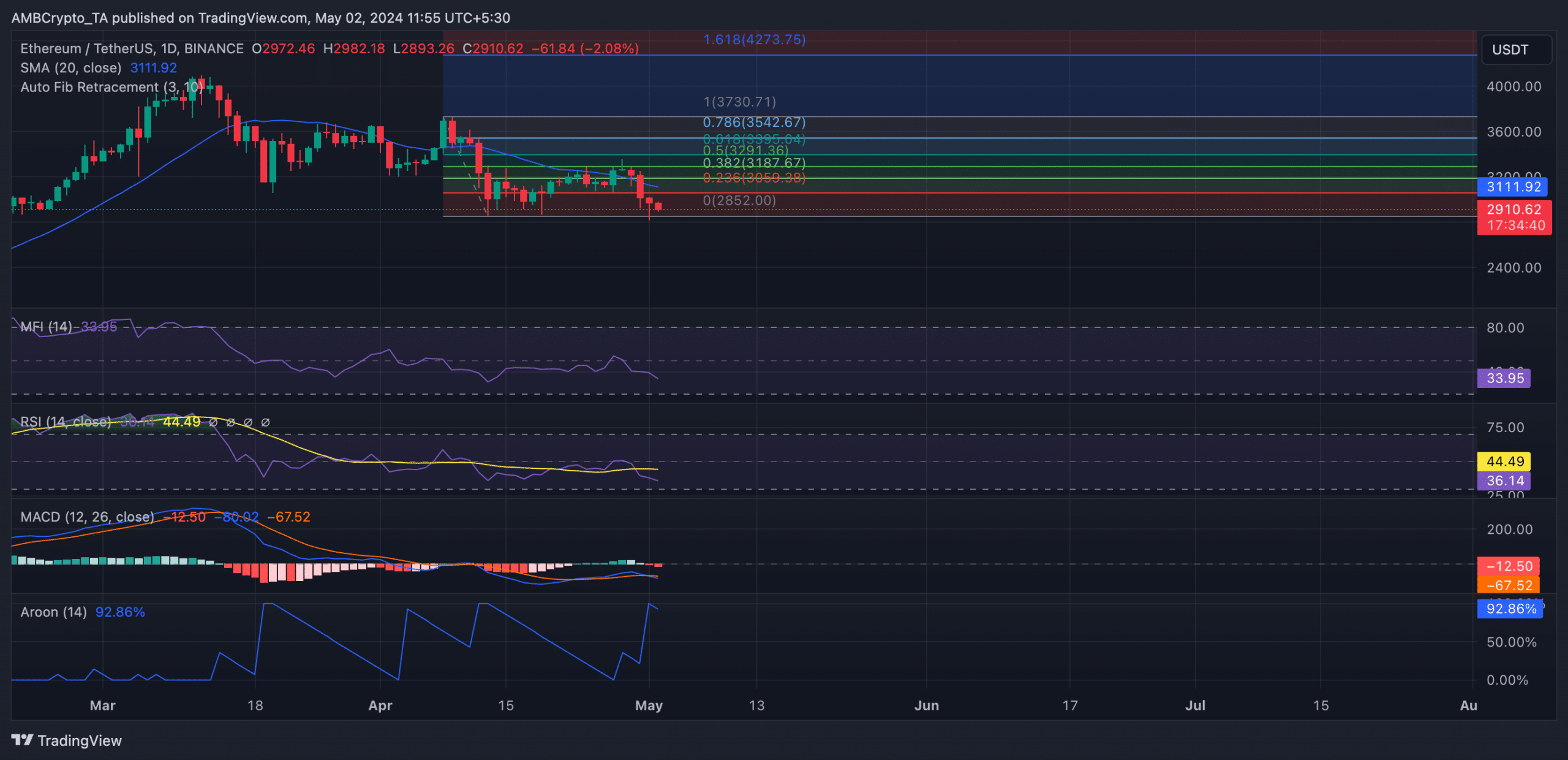

Though the coin’s worth retraced within the final 24 hours to alternate fingers at $2,913 on the time of press, bullish strain stays too weak to maintain any important rally within the quick time period.

AMBCrypto discovered that on the first of Might, ETH’s MACD line (blue) intersected its sign line (orange) in a downtrend when the coin’s fell broke under assist.

This intersection is a bearish signal. Each strains under the zero line, when it occurred, confirmed the prevailing downtrend and signaled the potential of an additional decline in ETH’s worth.

Additionally confirming the energy of the present market downtrend, ETH’s Aroon Down Line (blue) was 92.86% as of this writing.

This indicator identifies an asset’s pattern energy and potential pattern reversal factors in its worth motion.

When the Aroon Down line is near 100, it signifies that the downtrend is powerful and that the latest low was reached comparatively just lately.

Additional, ETH’s key momentum indicators pointed to a big decline in demand for the altcoin. Its Relative Power Index (RSI) was 36.46, whereas its Cash Movement Index (MFI) was 33.96.

The values of those indicators confirmed that market members favored ETH distribution over the buildup of newer cash.

Supply: ETH/USDT on TradingView

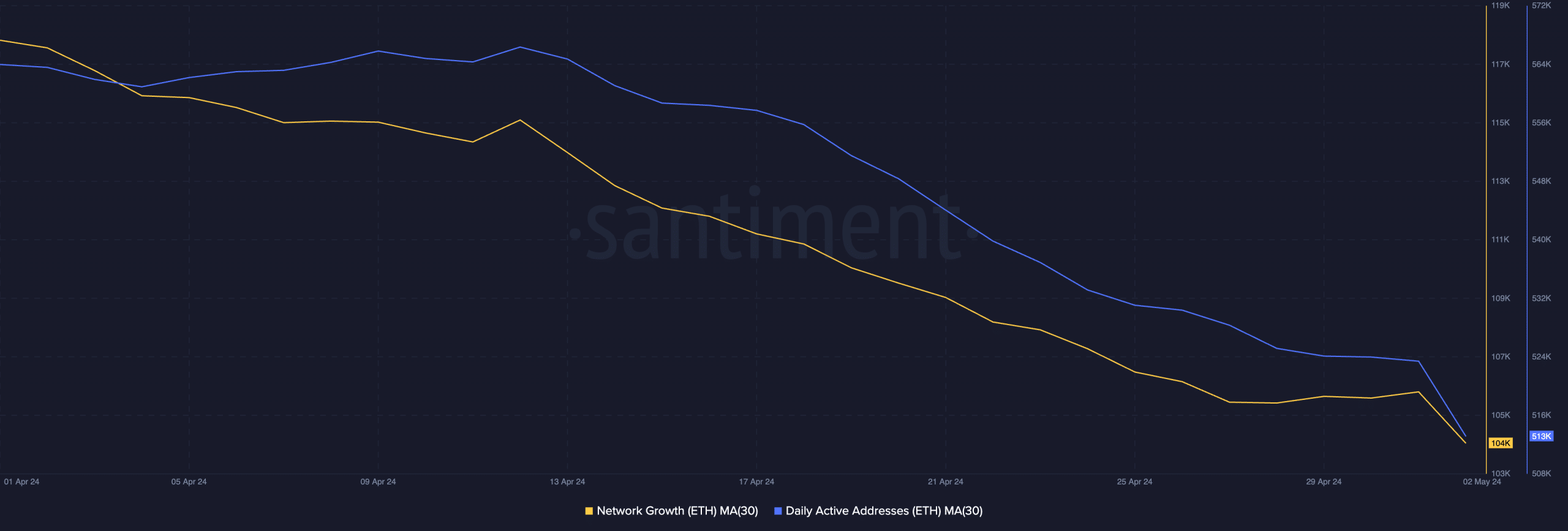

AMBCrypto’s evaluation of ETH’s community exercise utilizing a 30-day common confirmed the decline in demand for the altcoin within the final month.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

In response to Santiment’s information, the each day rely of addresses concerned in a minimum of one ETH commerce within the final month has dropped by 7%.

Equally, the variety of new addresses created to ETH has decreased within the final month. On-chain information confirmed that this has fallen by 10% up to now 30 days.

Supply: Santiment