Will Ethereum turn bearish in the short-term? Analyzing key trends

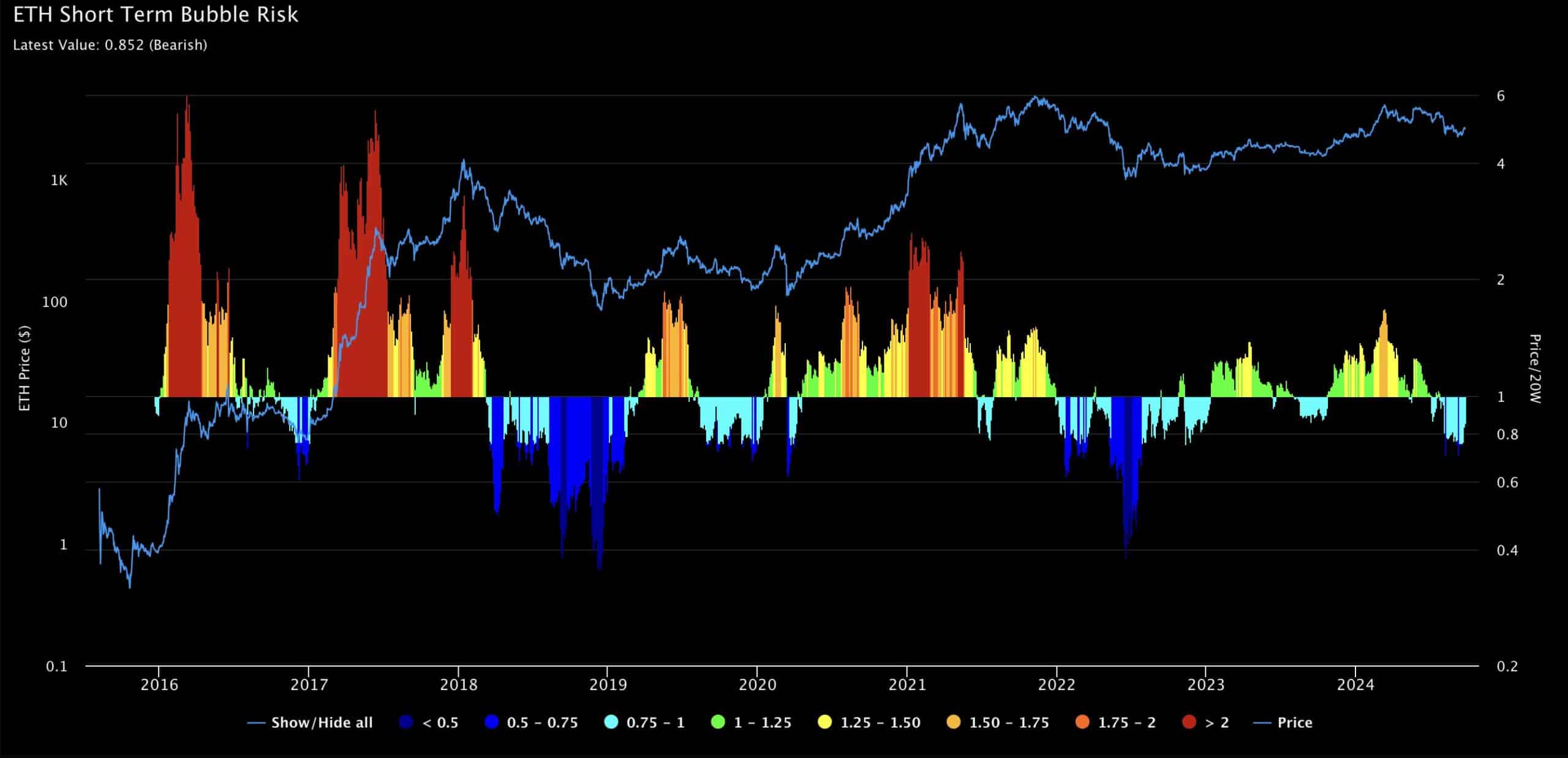

- Ethereum’s short-term bubble threat signaled bearish sentiment.

- However, ETH flipped the 200 EMA on the 4-hour timeframe.

Ethereum [ETH] is hinting at shifting market sentiment This autumn 2024 approaches, which is extensively anticipated to be bullish.

Information analyzed by AMBCrypto confirmed that Ethereum flagged potential short-term fluctuations, with the ETH Quick-Time period Bubble Danger indicator flipping bearish.

This steered {that a} transient correction may very well be on the horizon, regardless of the general bullish outlook for the broader crypto market.

Supply: IntoTheCryptoverse

A full flip to bearish sentiment appears unlikely with out a important market occasion. The present bullishness, nevertheless, is main the narrative, leaving the query of what lies forward for ETH as we gear up for This autumn.

Ethereum in correction

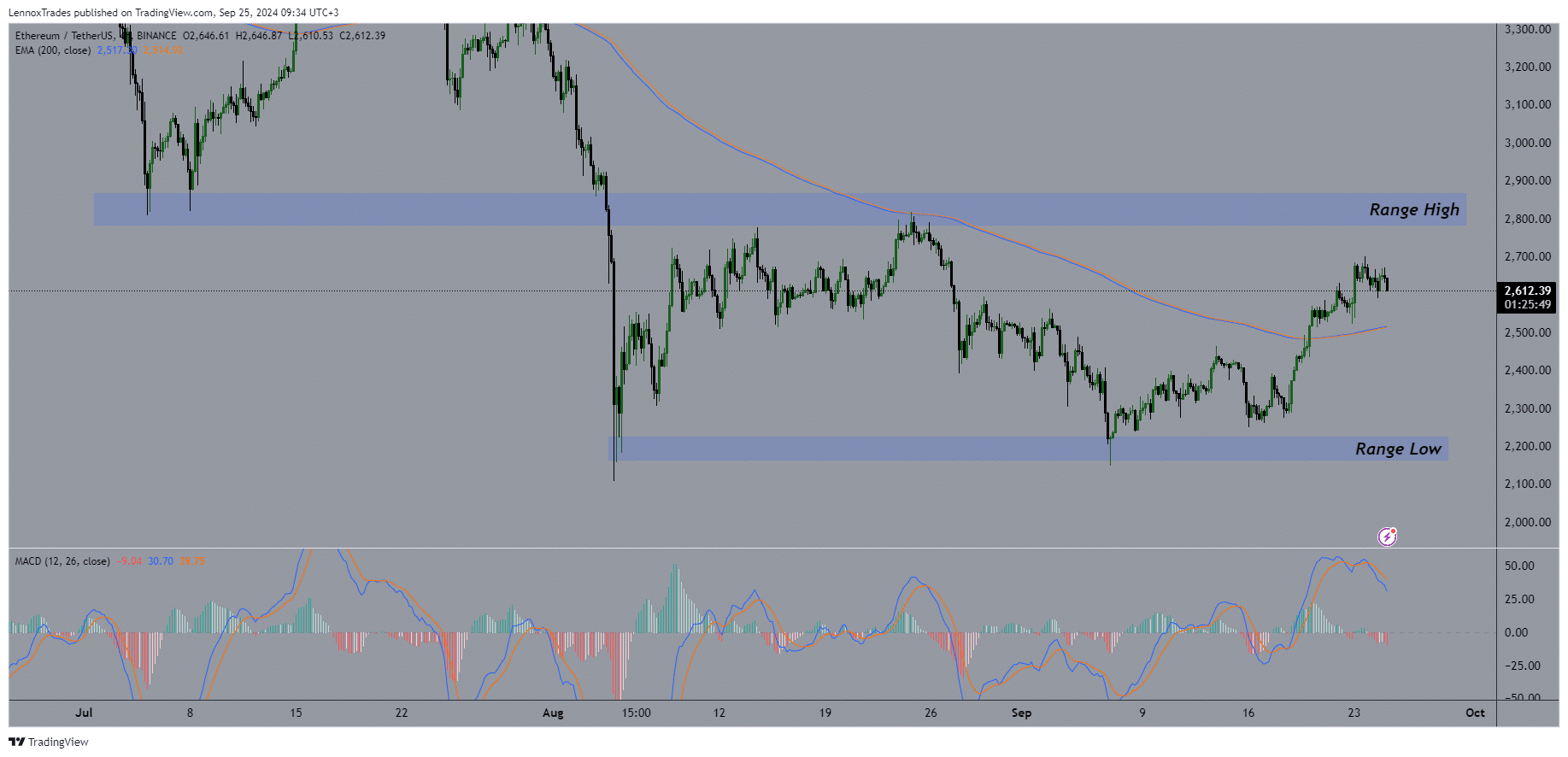

Analyzing the ETH/USDT pair, Ethereum has not too long ago damaged above the 4-hour 200 Exponential Transferring Common (EMA), a crucial indicator of low to mid-term traits.

The value eyed the $2,800 vary excessive at press time, a key stage that ETH wants to interrupt to exit the confirmed short-term correction.

If Ethereum efficiently strikes past this stage, it may sign an advance towards the $3,000 value mark.

Supply: TradingView

Nevertheless, the MACD indicator at present exhibits a bearish outlook, with momentum favoring sellers, signaling that ETH may want extra time to achieve power for a bullish reversal.

Buterin on solo staking in ETH

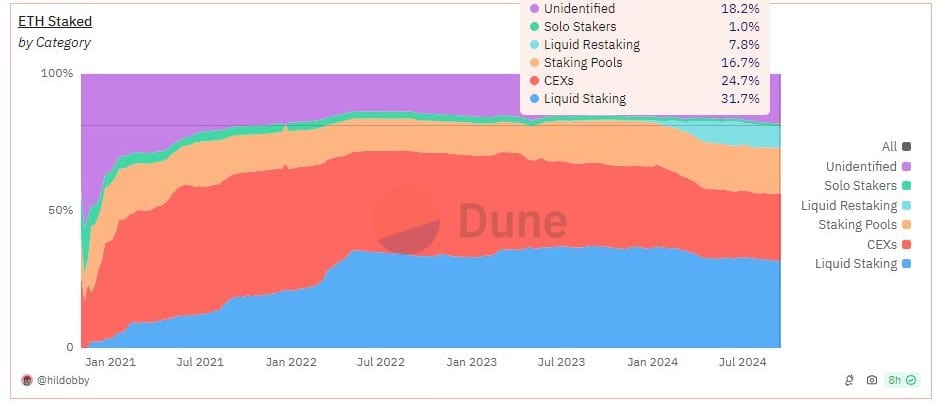

To spice up safety, Ethereum co-founder Vitalik Buterin has proposed methods to scale back potential vulnerabilities, reminiscent of mitigating dangers from massive node operator bribery and rising solo stakers.

Buterin’s post on X, previously Twitter, learn,

“Some ideas on solo staking, what reasonable worth solo (+ small-business and group) stakers may present to the community, and what modifications L1 could make to raised help solo stakers.”

Solo stakers are important in sustaining Ethereum’s decentralization and censorship resistance.

Since they’re impartial of huge organizations, solo stakers are much less prone to regulatory stress, which helps forestall transaction censorship.

Supply: Dune

Additionally they play a significant position in blocking 67% finalization, a crucial protection that ensures malicious chains can not take over the community with out dealing with important penalties.

This improvement in ETH staking signifies that mitigating threat in staking would imply bullish for ETH.

Social dominance and buying and selling exercise

Moreover, Santiment knowledge signifies that Ethereum’s market worth has rebounded to as excessive as $2,700, fueling rising curiosity in ETH throughout social media and buying and selling platforms.

The margin and leverage exercise in ETH wallets has additionally surged, reaching 7-week highs. These elements counsel that ETH may see its value rise greater as soon as the short-term bearish correction concludes.

Supply: Santiment

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Ethereum stays positioned for potential progress after navigating its present short-term correction section.

As market exercise will increase, notably with bullish social media and buying and selling momentum, ETH is prone to see additional upward motion in value within the coming months.