Will FTX Liquidate $3.4 Billion In Bitcoin And Crypto?

FTX, the bankrupt cryptocurrency change, is slated to look in Delaware Chapter Courtroom on Wednesday, September 13, to hunt approval for the liquidation of $3.4 billion in Bitcoin and crypto belongings. The occasion has raised issues amongst market analysts and contributors, who worry that the sale may put vital promoting strain on an already struggling market.

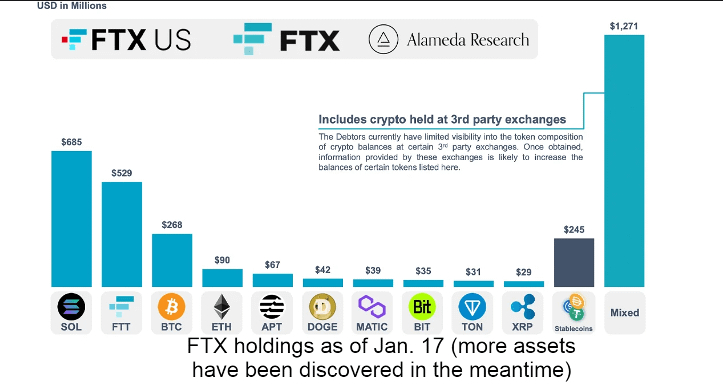

As of January 17, FTX’s crypto holdings had been estimated to incorporate $685 million in locked Solana (SOL) tokens, $529 million in FTT tokens, $268 million in Bitcoin (BTC), $90 million in Ethereum (ETH), and varied different belongings together with Aptos ($67 million), Dogecoin ($42 million), Polygon ($39 million), XRP ($29 million), and stablecoins. A further $1.2 billion is held in crypto on third-party exchanges.

Is A Selloff Looming For Bitcoin And Crypto?

On August 24, FTX proposed a plan to nominate Mike Novogratz’s Galaxy Digital because the funding supervisor accountable for overseeing the sale and administration of those recovered belongings. In line with the plan, FTX could be allowed to promote as much as $100 million price of tokens per week, a restrict that could possibly be elevated to $200 million on a person token foundation. Whereas these propositions aren’t but legally binding, they’re anticipated to be reviewed and presumably permitted by the Delaware Chapter Courtroom on September 13.

The market’s main concern is the potential impression of those gross sales. Billions of cash may hit the market within the creditor sale, and there’s widespread worry that the market might solely recuperate as soon as this overhang has been step by step eradicated. Nonetheless, it’s essential to separate reality from fiction on this situation.

First, it’s extremely unlikely that these cash might be bought en masse on the open market. Second, there’s the proposed restrict per week. Third, it’s extremely doubtless that the majority cash might be bought Over-The-Counter (OTC), and those who aren’t might be bought step by step by way of market makers.

Trying on the holdings, it turns into clear that a large chunk of tokens is in FTT and Solana. Remarkably, FTX’s SOL holdings are locked and can solely be absolutely vested in 2025 or later (till 2028). Any sale would contain a purchaser taking up FTX’s vesting contract.

Whereas FTX’s FTT tokens are marked at $529 million, their present market cap is simply $350 million, elevating questions on who would purchase this considerably devalued asset. As for Bitcoin and Ethereum, the quantities held by FTX are substantial however not giant sufficient to trigger market-wide disruptions. Aptos, with a market cap of $1.17 billion and $67 million price of APT to be bought, is the one asset that might probably trigger concern, however solely whether it is bought unexpectedly, which is unlikely given the intent to maximise worth.

Furthermore, even when the courtroom grants approval for the asset sale on September 13, the precise sale gained’t begin instantly. Regulatory our bodies just like the SEC and CFTC are anticipated to supervise the gross sales, guaranteeing they’re carried out in a way that doesn’t hurt traders. An underwriter will doubtless handle the liquidation course of, guaranteeing compliance with all legal guidelines and rules. This course of, which entails danger evaluation and discovering appropriate patrons, is predicted to span a number of months.

In abstract, whereas there might be some promote strain, a sudden and big sell-off is each unlawful and inconceivable. The worry and uncertainty (FUD) surrounding the occasion appear to be extra damaging than the occasion itself. Bitcoin and crypto market contributors are urged to remain knowledgeable and keep away from succumbing to panic and misinformation.

On account of the rumors, the SOL value plummeted by greater than 7% yesterday. The Bitcoin value noticed a slight downward motion and was buying and selling at $25,859 at press time.

Featured picture from iStock, chart from TradingView.com