Will Gas Fees Drop Even In A Bull Market?

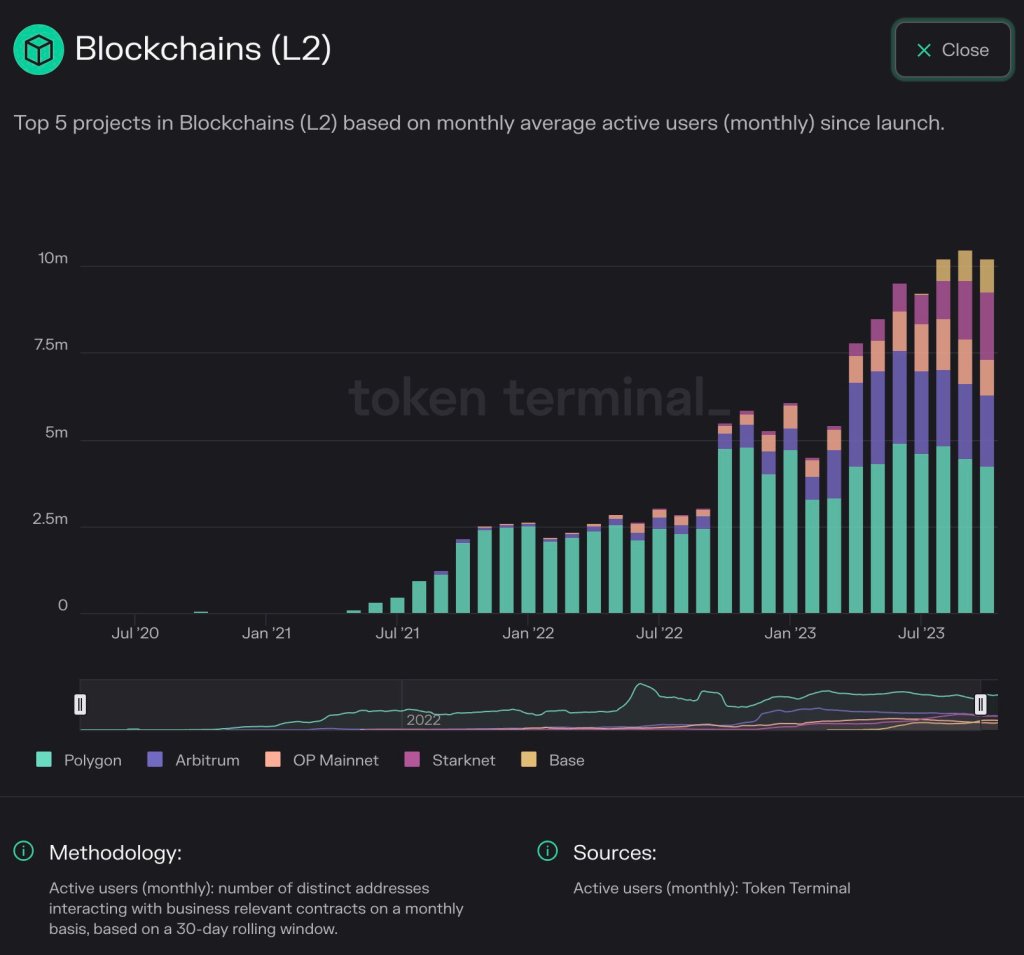

The adoption of Ethereum layer-2s is on the rise if Token Terminal information shared on November 6 is something to go by. In response to statistics from the blockchain analytics platform shared by Erik Smith, the Chief Funding Officer (CIO) of 401 Monetary, the typical lively addresses over the previous three months has exceeded 10 million, an almost 2X enlargement from early 2023.

Associated Studying: Can The ADA Value Climb Above $20 In The Bull Market? Analyst Gives Solutions

Ethereum Layer-2s Discovering Extra Adoption

Wanting on the chart, Polygon, an Ethereum sidechain, stays the preferred. On the identical time, Arbitrum and OP Mainnet, that are frequent layer-2s adopting the roll-up expertise, are actively getting used.

Even so, OP Mainnet’s share is regularly dropping. Base, a layer-2 backed by Coinbase, and StarkNet are additionally discovering adoption, increasing their share over the previous three months.

In crypto, lively addresses discuss with the variety of distinctive pockets addresses (sending and receiving) which have interacted with the blockchain, on this case, Ethereum, over a given interval.

An uptick or contraction within the variety of lively addresses can be utilized to measure sentiment and the extent of uptake. In bear markets, lively addresses are inclined to drop, solely rising when bulls stream in, pointing to a potential scramble for arising alternatives.

The latest uptrend coincides with the speedy enlargement of main crypto costs. Ethereum (ETH) costs are inching nearer to the $1,870 resistance degree, with a breakout above this line a possible set off for a leg up which may see the coin retest $2,100 and even register new 2023 highs.

Often, rising crypto costs are inclined to revive demand because the variety of lively addresses and, in some situations, the entire worth locked (TVL) in decentralized finance (DeFi), and extra.

What Will Occur To Gasoline Charges?

Ethereum is the world’s most lively sensible contract platform, stretching its dominance primarily due to its first-mover benefit. The blockchain anchors extra DeFi, non-fungible tokens (NFTs), and gaming exercise. Deploying protocols, relying on their targets, can both immediately launch on the mainnet or layer-2s.

The mainnet is immediately secured by validators, whereas layer-2 options rely on the mainnet for safety however typically re-route transactions off-chain. On this association, extra transactions may be processed cheaply and effectively, relieving the mainnet.

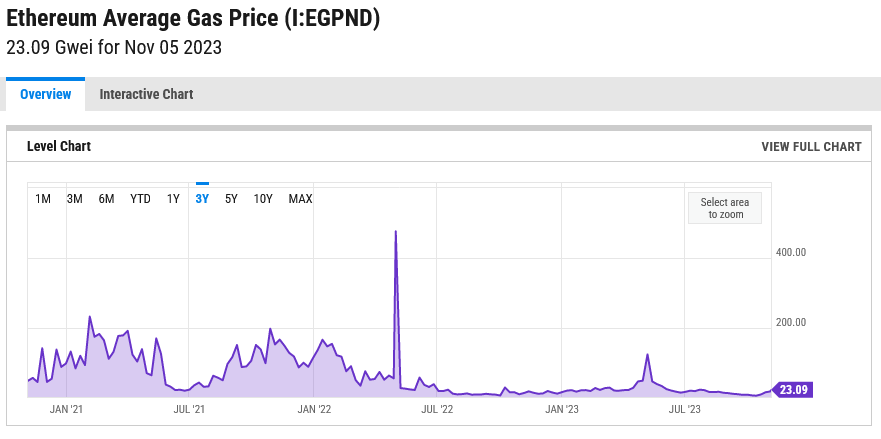

Although the Ethereum base layer is safe, its peak transaction throughput stays comparatively decrease at round 15 TPS. This implies throughout peak demand, fuel charges are usually larger, impacting consumer demand.

Nonetheless, Ethereum fuel charges stay at a multi-year low at round 23 Gwei, in response to trackers, as seen on the chart under. That is down from 240 Gwei recorded in February 2021 when crypto property quickly rose.

For now, whether or not fuel charges will enhance because the market recovers is but to be seen. What’s evident is that as customers go for layer-2s, the mainnet will seemingly be relieved, maintaining fuel price fluctuation low.

Function picture from Canva, chart from TradingView