Bitcoin, Ethereum lead May’s NFT scene amidst sales dip – How?

- Over the last seven days, BTC’s NFT gross sales quantity declined by 4%.

- Weekly value charts of each cash remained inexperienced.

Bitcoin [BTC] and Ethereum [ETH], two of the biggest blockchains, continued to dominate the NFT market in Could.

Though at first look this appeared optimistic, nearer inspection revealed that each ETH and BTC’s NFT gross sales quantity really dropped within the final 30 days.

Bitcoin, Ethereum NFTs in Could

Coin98 Analytics posted a tweet revealing how a number of blockchains did in Could. As per the tweet, BTC and ETH topped the record of blockchains when it comes to complete gross sales quantity in Could.

Whereas BTC’s gross sales quantity touched $157 million, ETH’s stood at $147 million.

Solana [SOL] made it to the highest three on the identical record. It was fascinating to notice that Blast was the one layer-2 blockchain that earned a spot on the record, as its gross sales quantity reached $36 million.

As per DappRadar’s data, Node Monkes, Bitcoin Puppets, and Runestine have been the highest three NFT collections of Bitcoin final month.

Equally, Bored Ape Yacht Membership, Mutant Ape Yacht Membership, and Pudgy Penguins have been the highest three Ethereum NFT collections.

AMBCrypto’s evaluation of CRYPTOSLAM’s data revealed that although ETH and BTC topped the record, their gross sales quantity really declined in Could.

To be exact, BTC’s NFT gross sales quantity dropped by 71%, and ETH’s numbers dropped by over 56%.

June is wanting higher

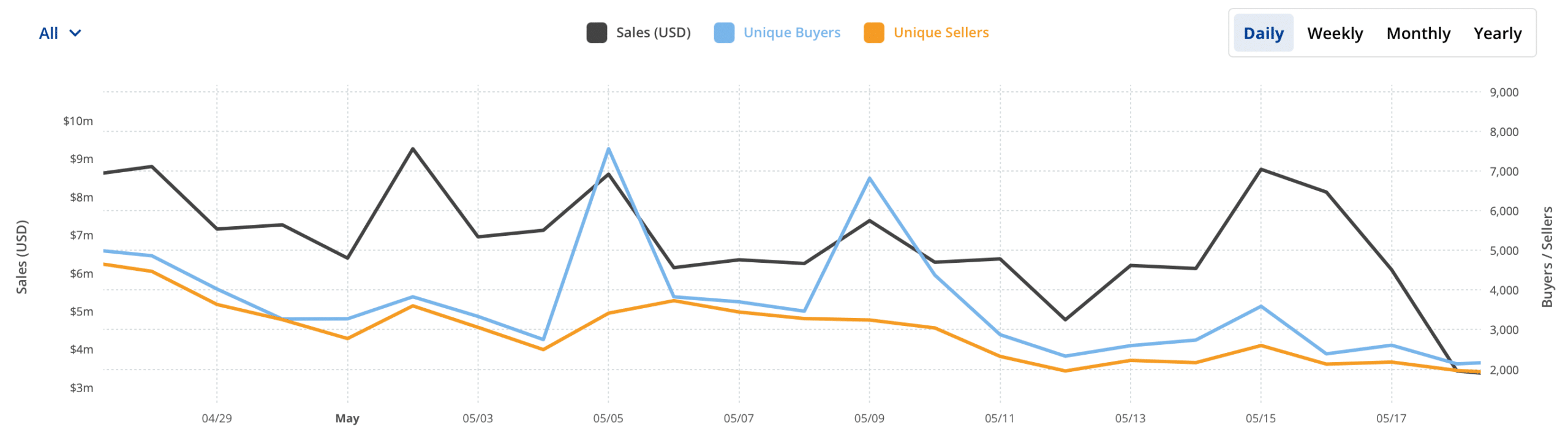

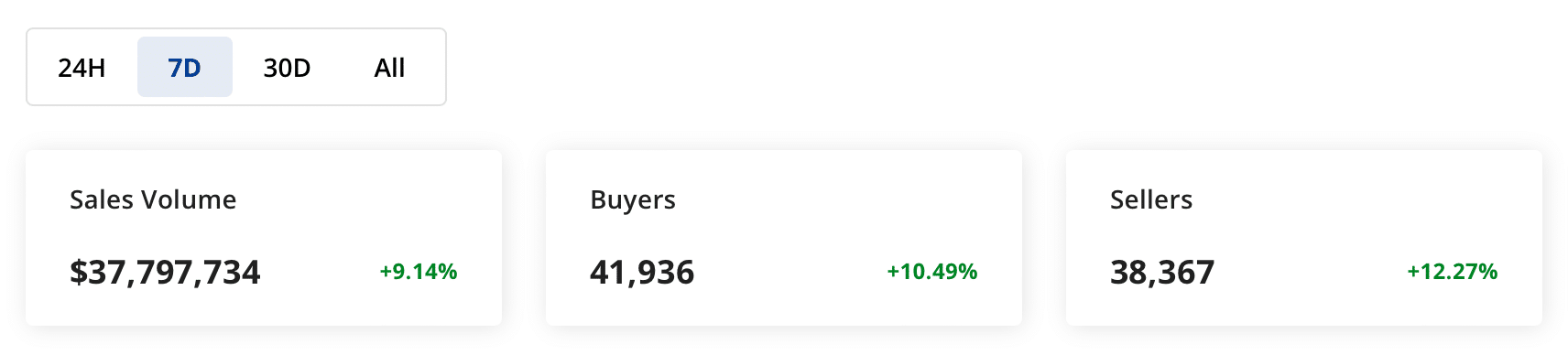

Although NFT gross sales volumes dropped final month, the previous week noticed indicators of restoration. BTC’s variety of NFT consumers and sellers elevated by greater than 20%. Nevertheless, its gross sales quantity nonetheless dropped by 4%.

Supply: CRYPTOSLAM

Ethereum’s state when it comes to gross sales quantity was higher than that of BTC’s, because the quantity surged by greater than 4%.

Other than that, ETH’s variety of sellers and consumers additionally elevated by greater than 10% within the final seven days.

Supply: CRYPTOSLAM

BTC and ETH stay bullish

Whereas all this occurred, CoinMarketCap’s data revealed that the weekly charts of the highest two cash remained inexperienced.

Bitcoin and Ethereum’s costs surged by 4.2% and a pair of.2%, respectively, final week. At press time, BTC was buying and selling at $71,091, whereas ETH had a price of $3,815.

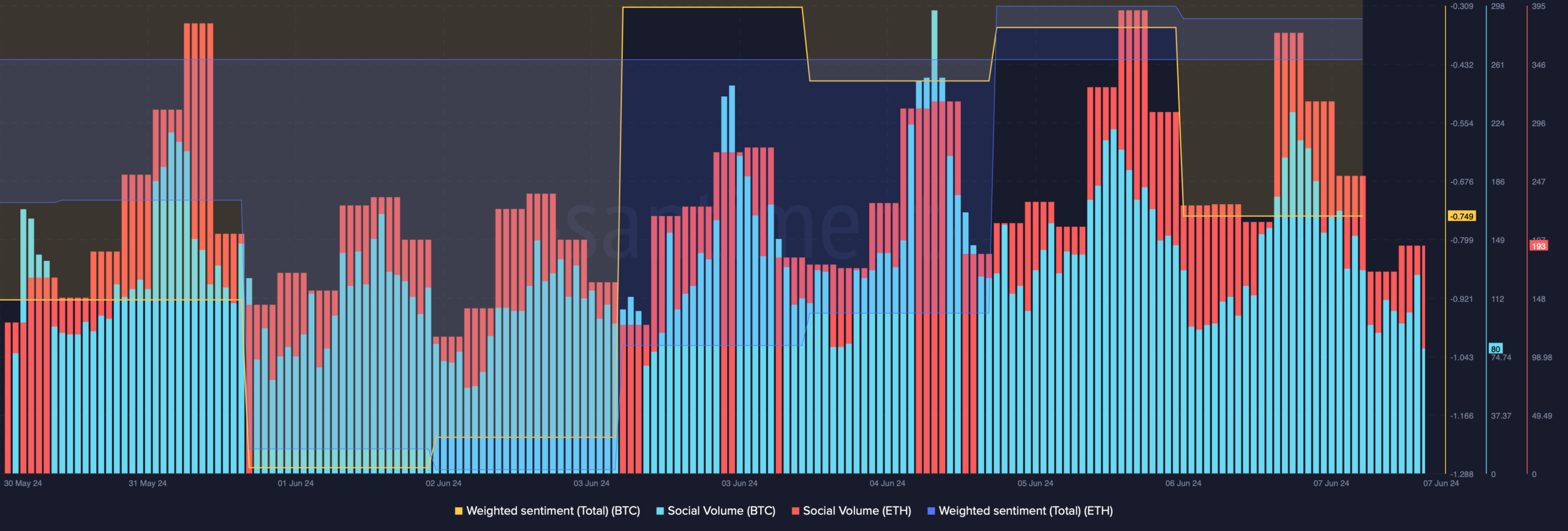

AMBCrypto’s evaluation of Santiment’s information revealed that each Bitcoin and Ethereum’s social volumes remained excessive all through the final week.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Because of the value uptick, ETH’s weighted sentiment entered the constructive zone.

Nevertheless, it was stunning to see that, regardless of an increase in worth, BTC’s weighted sentiment was within the adverse zone. This meant that bearish sentiment across the king of cryptos was dominant available in the market.

Supply: Santiment