Worldcoin: Can WLD reclaim $4 amid sell-off from Smart DEX whales?

- Sensible Dex merchants and whales bought Worldcoin at a mean worth of $3.85.

- If this order holds, WLD might pivot to reverse its current losses.

Sensible DEX merchants and whales bought Worldcoin [WLD] at a mean worth of $3.85. The gross sales by Sensible DEX merchants occurred at $3.8 whereas whales bought at $3.9, indicating a possible profit-taking part.

After these gross sales, there was a noticeable lack of considerable shopping for exercise, suggesting merchants are cautious. Publish-sale, only some have begun to build up once more, hinting at divided sentiment in the direction of midterm funding potential.

At the moment, at $2.4, buyers look like taking a wait-and-see strategy.

Supply: iCryptoAI/X

The dearth of rapid shopping for submit vital gross sales prompt a possible for additional worth dips or consolidation at these ranges. If WLD can stabilize or present indicators of bullish sentiment, it might appeal to patrons again.

Nevertheless, given the current sell-off by vital gamers, a cautious watch on market response within the short-term could be prudent for Worldcoin merchants or buyers.

This shut might illuminate the path WLD’s worth will take following the withdrawal of Sensible DEX merchants and whales.

WLD’s worth motion and prediction

Evaluation of the WLD/USDT pair confirmed an prolonged downtrend all through the latter half of 2024. The decline was interrupted by a resistance-turned-support degree at $1.50.

WLD declined to the $2.41 order block after a rally from $1.50 to $4, the place Sensible DEX and whales took earnings across the peaks. If the order block holds, WLD might pivot to reverse its current losses.

The MACD confirmed potential for a momentum shift, because the histogram shortened within the bearish territory, suggesting a lower in downward momentum.

Supply: TradingView

Moreover, WLD examined this help a number of occasions, indicating sustained purchaser curiosity at this degree. If the order block help at $2.41 stays intact, WLD might problem ranges above $4 within the quick time period.

A profitable breach of the $6.01 degree might result in a retest of upper resistance at $9.519, marking a possible bullish part for WLD within the early months of 2025.

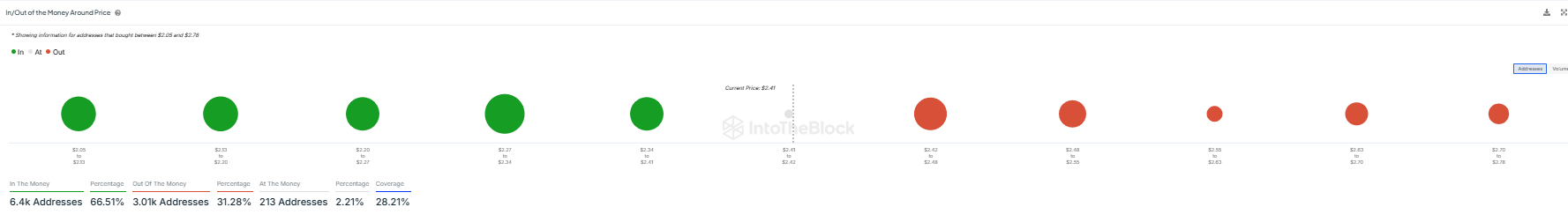

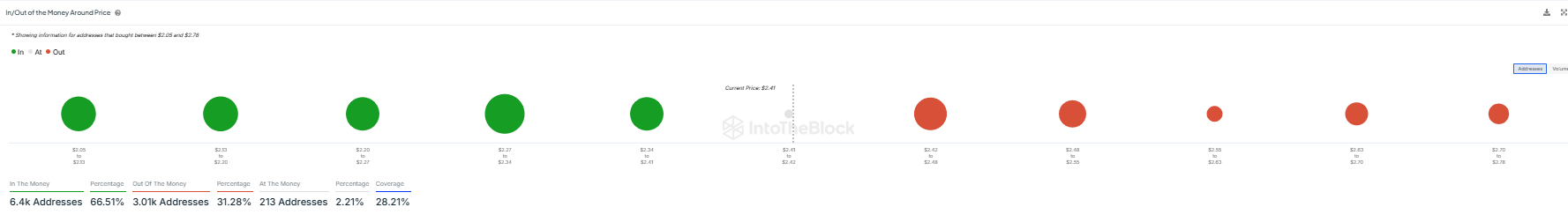

In/Out of the cash across the present worth

WLD’s profitability across the present worth reveals distinct investor positions.

At $2.41, 66.51% of addresses are ‘within the cash,’ indicating a possible help degree since these holders are worthwhile. In distinction, 31.28% of addresses are ‘out of the cash,’ reflecting unprofitable positions.

If WLD’s worth rises, the substantial majority ‘within the cash’ might present a stabilizing impact.

Supply: IntoTheBlock

Conversely, resistance might materialize close to the higher worth factors the place holders had been nonetheless at a loss, probably capping beneficial properties.

Real looking or not, right here’s WLD market cap in BTC’s phrases

Real looking or not, right here’s WLD market cap in BTC’s phrases

This distribution of worthwhile and unprofitable positions might affect WLD’s worth actions within the close to time period, as holders’ reactions to breakeven factors form the market dynamics.