XLM prices stay stagnant despite the foundation’s latest venture

- Stellar Improvement Basis introduced its funding in MoneyGram Worldwide on 15 August.

- XLM Day by day merchants, nevertheless, proceed to exit their positions for revenue.

The worth of Stellar Lumens [XLM], the native token of the Stellar community, has didn’t impress traders with its stagnant trajectory. As of this writing, XLM traded at round $0.12, a 4 % lower from the day earlier than.

Examine XLM’s value prediction for 2023/2024

The Stellar Improvement Basis’s (SDF) announcement on 15 August additionally didn’t strike a response from the token. The muse mentioned it has invested an undisclosed quantity in MoneyGram Worldwide, a significant cash switch firm.

The choice to spend money on @MoneyGram was a straightforward one. After years of attending to know the enterprise and the groups, we’re excited to participate in MGI’s subsequent chapter. It’s been an superior few years working collectively, and we’re excited for what’s subsequent!https://t.co/PYAKHeXRxx

— Denelle Dixon (@DenelleDixon) August 15, 2023

Within the announcement, the inspiration behind the open-source, decentralized protocol famous that its funding within the monetary establishment can be channeled in the direction of:

“Increasing its digital enterprise, exploring blockchain expertise, and contributing to the numerous different methods this monetary expertise firm allows shoppers and companies to maneuver and handle cash in almost each nation all over the world.”

All’s properly that ends properly

Between 15 June and 13 July, XLM’s worth rallied considerably. It skilled a 104% development in its market capitalization and a corresponding uptick in value from $0.07 to $0.15 throughout that interval, information from Santiment confirmed.

Supply: Santiment

This led it to rank as one of many best-performing high cryptocurrencies in June and July, per information from CoinMarketCap.

The worth started its descent as consumers’ exhaustion beset the XLM market shortly after. Buying and selling at $0.12 at press time, the alt’s worth has since fallen by 20%.

Though SDF’s funding in MoneyGram represented a major milestone towards attaining the community’s goal, XLM’s each day merchants stay unmoved by the information.

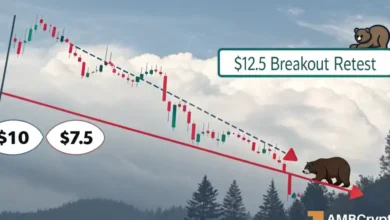

An evaluation of value actions on a 12-hour chart revealed important promoting stress. A take a look at XLM’s Directional Motion Index (DMI) confirmed that sellers managed the intraday buying and selling session.

At press time, the optimistic directional motion index (inexperienced), which tracks the energy of an asset’s uptrend, rested beneath the damaging directional motion index (purple), which measures the energy of the downtrend. This signaled that XLM that sellers had pressured consumers out of market management.

Moreso, key momentum indicators rested at oversold positions as of this writing. For instance, XLM’s Relative Energy Index (RSI) was removed from its 50-neutral line at 30.23. Likewise, the alt’s Cash Circulation Index was 24.25 at press time. These instructed elevated XLM sell-offs within the final 24 hours.

Supply: XLM/USDT on TradingView

How a lot are 1,10,100 XLMs value at this time?

Vote of no-confidence

As XLM’s value craters within the final month, its Open Curiosity within the futures market has additionally plummeted. When an asset’s Open Curiosity declines on this method, it implies that merchants have develop into much less assured available in the market and are decreasing their publicity.

Revenue-taking exercise has climbed within the XLM market as traders take to exiting their positions.

Supply: Coinglass