XRP Flashes Descending Trendline, Why A Surge To $4 Is Still In The Cards

Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

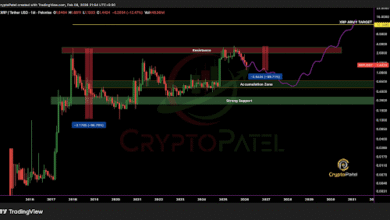

The XRP worth is exhibiting indicators of a possible breakout, with a crypto analyst pointing to key technical indicators that recommend a possible surge to $4. Notably, the cryptocurrency has been buying and selling inside a descending trendline, however a decisive transfer above this resistance might ignite a long-awaited rally to a brand new all-time excessive.

XRP Worth Eyes Breakout To $4

In line with pseudonymous TradingView crypto analyst ONE1iMPACT, the XRP worth has been making decrease highs, forming a descending trendline on the 8-hour chart. The analyst’s chart evaluation highlights key technical indicators based mostly on worth motion that recommend that the XRP worth could also be gearing up for a potential rally to $4.

Associated Studying

XRP’s projected surge to a $4 ATH depends on the way it reacts to the descending trendline, which acts as a important resistance space. With this in thoughts, a breakout and shut above this trendline with higher-than-average quantity indicators bullish momentum for the XRP worth.

Curiously, the analyst disclosed that the market is at the moment hovering close to or simply under a key Shifting Common (MA), indicated by the blue line within the chart. If XRP’s worth can reclaim and maintain above this MA, it could reinforce its bullish place and solidify the analyst’s optimistic worth goal. On the flip aspect, if it stays under this MA, the TradingView skilled believes that it could put a barrier to its upside potential.

Shifting ahead, the analyst has shared key technical areas that might decide XRP’s next price movements. He revealed that if the cryptocurrency breaks above the descending trendline, the following main resistance space is the horizontal degree round $3.40. Moreover, a confirmed breakout might ship its worth towards $3.9 – $4.00, aligning with the goal proven by the gray arrow within the chart.

The TradingView crypto skilled warned traders and merchants to concentrate to the amount and momentum of XRP because it goals for a descending trendline breakout. He defined {that a} low quantity push above the trendline is a transparent indication of a potential fakeout, the place merchants could possibly be lured into coming into lengthy positions, just for the value to hint shortly. However, a excessive quantity surge confirms the conviction of XRP’s bullish potential, resulting in a sustained upward momentum and rising costs.

The analyst additionally added that oscillators just like the Relative Energy Index (RSI) and Shifting Common Convergence Divergence (MACD) might assist merchants gauge whether or not XRP’s momentum is constructing or fading as its worth approaches the descending trendline resistance.

Doable Draw back Goal If Resistance Fails

In his evaluation, ‘ONE1iMPACT’ additionally shared a bearish outlook for the XRP worth if it fails to interrupt and shut above the descending trendline resistance. The TradingView analyst revealed {that a} rejection at this trendline might set off additional consolidation and decline for XRP.

Associated Studying

He has shared a number of vital help ranges that might assist stop a good deeper correction within the XRP worth. The $2.0 and $2.1 area, marked by the pink and grey field on the chart, acts as a robust help space for XRP, the place patrons have stepped in earlier than.

If the XRP worth loses this zone, the analyst predicts a main breakdown towards $1.8 – $1.77. One other decline under this worth low might lead to a a lot bigger correction.

Featured picture from Adobe Inventory, chart from Tradingview.com