XRP in Q2: Of SEC lawsuits, dwindling metrics, volatility and much more

- Circulating market capitalization of XRP fell by 10.7% Quarter on Quarter, from $27.8 billion to $24.8 billion.

- Q3’s starting was additionally not at par as its value had declined by almost 3%

Ripple [XRP] witnessed a rollercoaster of ups and downs when it comes to its on-chain metrics through the second quarter of 2023. Messari not too long ago posted its newest XRP Q2 report, highlighting how its community exercise, worth, and value reacted in Q2 2023.

A take a look at the statistics in Q3 didn’t paint a contented image for XRP both as its value registered a decline. Will XRP have the ability to meet buyers’ expectations within the third quarter of the 12 months?

6/ For an in-depth take a look at $XRP Ledger Q2 2023 key metrics, together with a monetary evaluation, community evaluation, and ecosystem evaluation, discover the total quarterly report for FREE from @redvelvetzip.https://t.co/HG5cxptz8T

— Messari (@MessariCrypto) July 8, 2023

How a lot are 1,10,100 XRPs value as we speak

XRP’s Q2 didn’t go as deliberate

As per Messari’s analysis, the circulating market capitalization of XRP fell by 10.7% quarter-on-quarter, from $27.8 billion to $24.8 billion, trailing the 0.4% rise available in the market capitalization of different cryptocurrencies. The token’s value fell 11.7% QoQ from $0.54 to $0.47 because of the 1.1% QoQ inflation fee. Regardless of this, it was fascinating to notice that XRP’s market cap stayed up 42.5% 12 months so far, which might be attributed to the rise in its worth in Q1.

The Ripple vs. SEC lawsuit additionally performed a job in affecting the blockchain’s metrics. As an illustration, XRP’s value motion in latest months was affected considerably by SEC’s ongoing case with Ripple, which started in 2020. The large income spike in June additionally occurred after the information of the lawsuit.

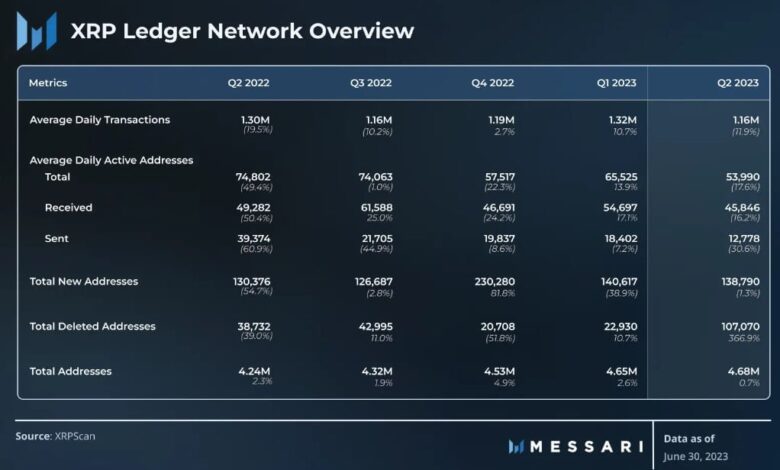

Not solely did Messari’s report spotlight XRP’s efficiency, but it surely additionally took under consideration XRPL’s state. As per the evaluation, XRPL’s community exercise metrics took a decline throughout the board in Q2. Common day by day transactions declined 11.9% QoQ from 1.32 million to 1.16 million. This meant that it returned to a degree final seen in Q3 2022.

Supply: Messari

The variety of common day by day energetic addresses fell considerably as nicely, from 66,000 to 54,000, or down 17.6% QoQ. The excellent news was that the whole variety of accounts climbed by 0.7% to 4.68 million in Q2, whereas the variety of new addresses through the quarter was nearly equal to Q1.

XRP and NFTs in Q2

The NFT ecosystem was one of many few areas through which the blockchain registered progress within the final quarter. NFT transactions on common rose from 13,800 to fifteen,500 per day, a 12.7% QoQ rise.

Among the many transactions, NFTokenAcceptOffers witnessed the very best progress because it went from 3,100 to three,900, up by 25.5% QoQ. As per Messari’s report, NFTokenCreateOffers grew by the biggest absolute phrases, rising by over 1,000 common day by day calls in Q2.

Supply: Messari

A take a look at Santiment’s chart revealed how market sentiment was round XRP over the past quarter. Social quantity appeared to have declined over the months. Nonetheless, a spike was famous within the month of June. This may be attributed to the rumors that got here out at the moment concerning the lawsuit. The rumors prompt that the case may quickly come to an finish, sparking constructive sentiment in the neighborhood, as evident from the sharp rise in its weighted sentiment.

Supply: Santiment

How is XRP in Q3 2023?

The third quarter additionally didn’t begin on a great notice for XRP when it comes to its value motion, because it didn’t align with buyers’ pursuits. Based on CoinMarketCap, XRP was down by almost 3% over the past week. On the time of writing, it was buying and selling at $0.4697 with a market cap of over $24 billion, making it the sixth largest crypto.

The start of the quarter additionally witnessed a decline in curiosity from buyers in buying and selling the token, as evident from the drop in its buying and selling quantity. Nonetheless, its MVRV Ratio recovered barely in the previous few days, which was a constructive sign. Its Binance funding fee was additionally inexperienced, reflecting its demand within the derivatives market.

Supply: Santiment

Life like or not, right here’s XRP market cap in BTC‘s phrases

A take a look at XRP’s day by day chart prompt that buyers ought to count on a couple of extra slow-moving days. This appeared probably as each the Relative Power Index (RSI) and Cash Circulation Index (MFI) took a sideways path close to the impartial zone.

The MACD’s information revealed that the bulls and the bears had been in a battle. Which considered one of them seems to be victorious will likely be fascinating to observe.

Supply: TradingView