XRP price poised for 35% crash, here’s why

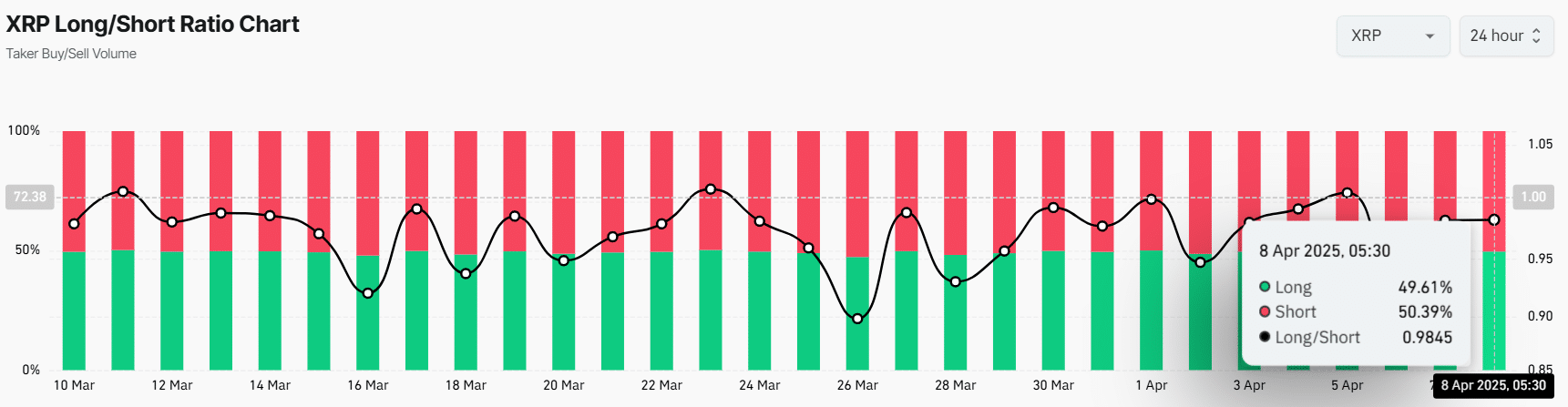

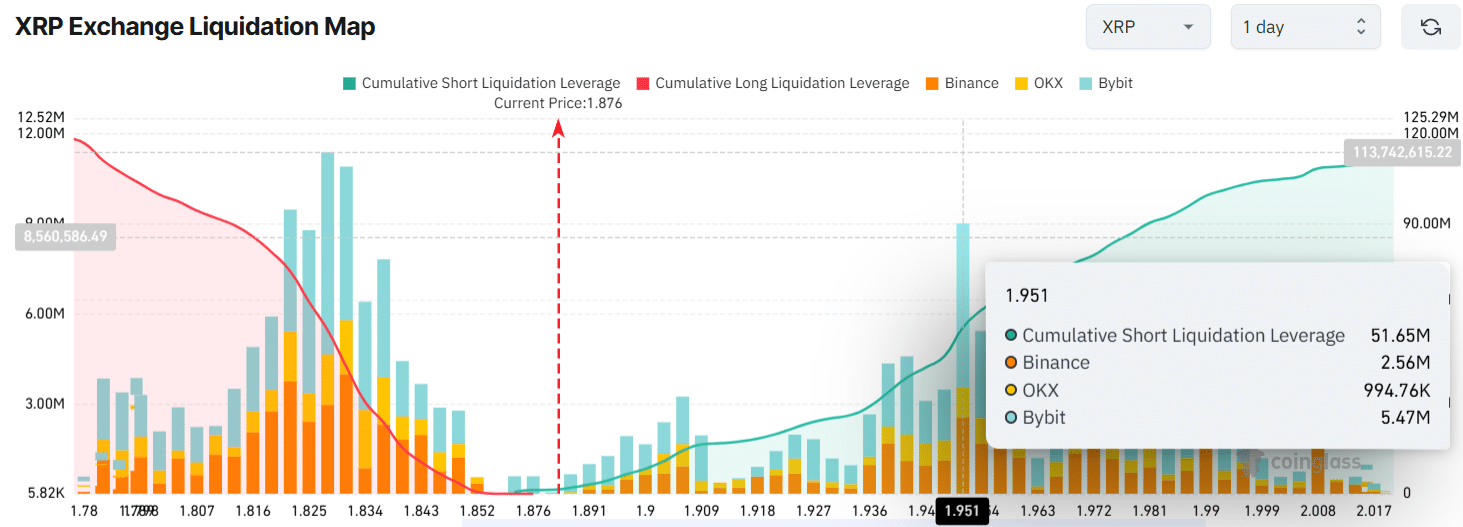

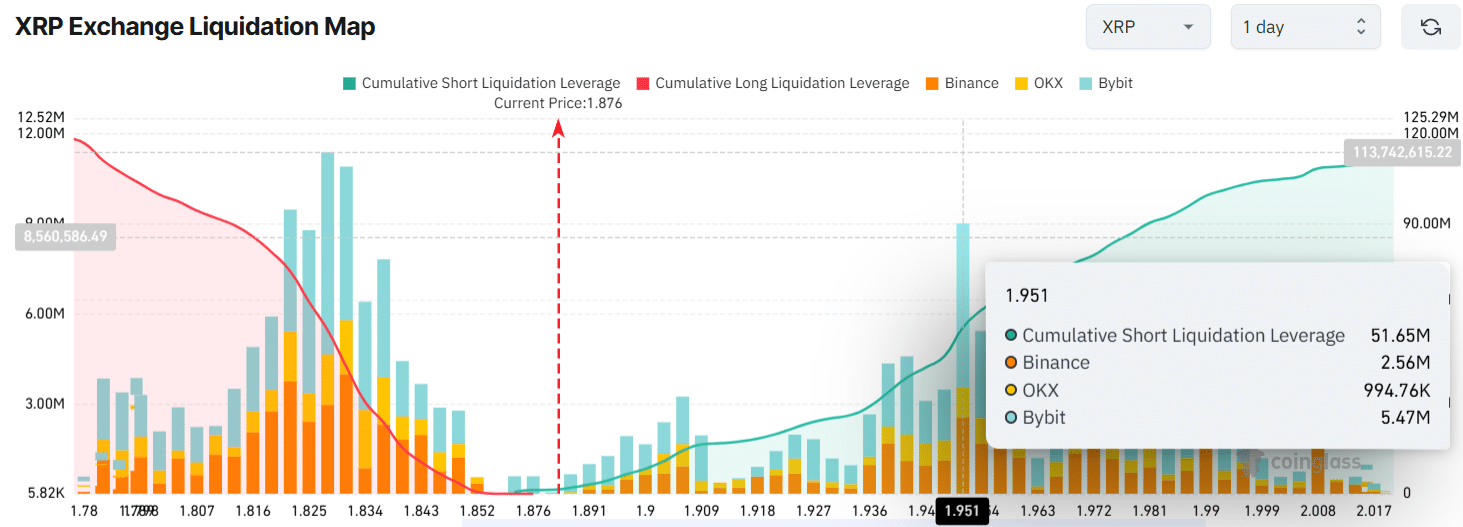

- Merchants are over-leveraged at $1.828 on the decrease aspect (assist) and $1.951 on the higher aspect (resistance).

- Brief positions price $51.65 million have been constructed on the $1.951 stage within the hope that the worth received’t transfer above this resistance.

XRP, Ripple’s native token, appears to be like poised to proceed its downward momentum within the coming days.

The present market sentiment is strongly bearish, and the continuing tariff wars, which present no indicators of ending quickly, are pushing the market additional down.

Present value momentum

At press time, XRP was buying and selling close to $1.85 and had recorded a value surge of 6.50% over the previous 24 hours.

Throughout the identical interval, the asset’s buying and selling quantity dropped by 10%, indicating decrease participation from merchants and traders in comparison with earlier days.

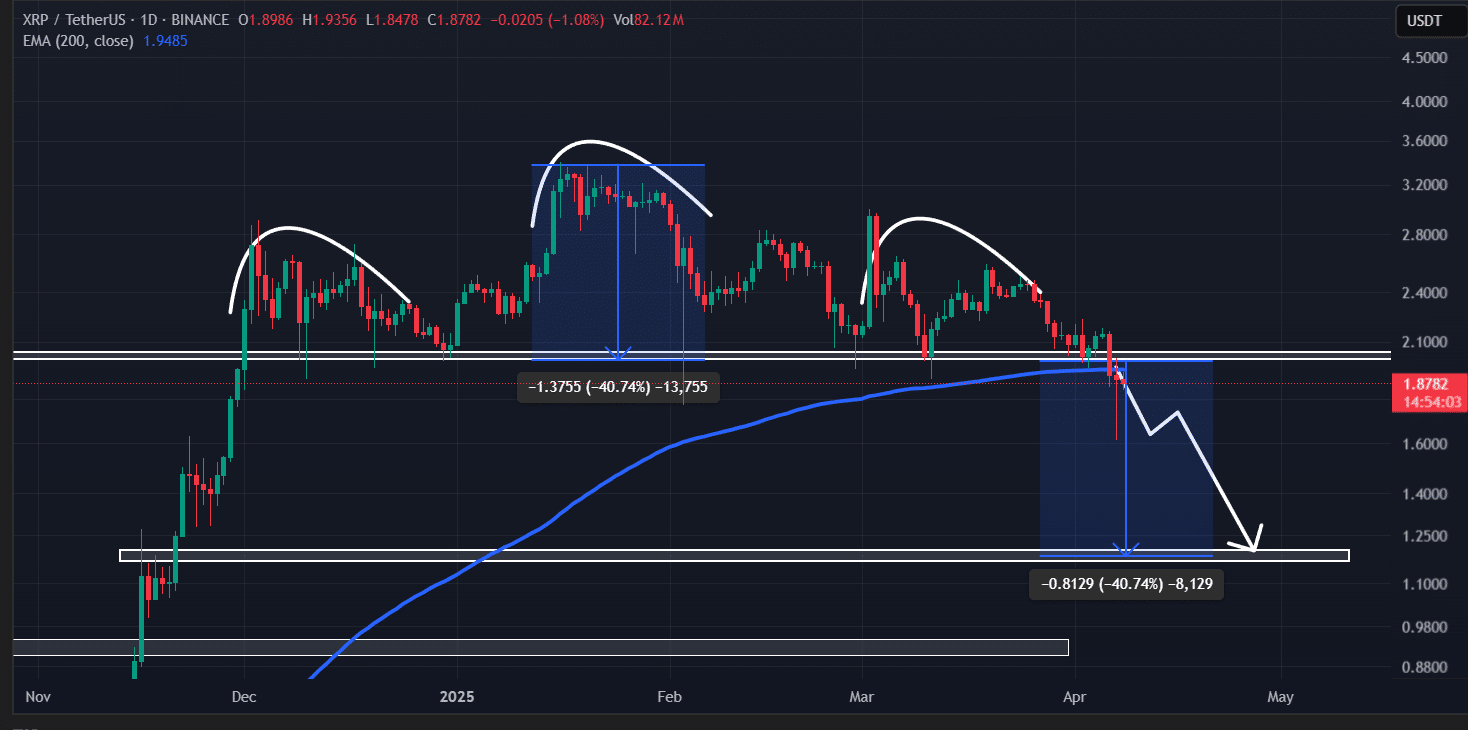

Regardless of this upside momentum, XRP appeared bearish. Based on AMBCrypto’s technical evaluation, the asset just lately broke out of a bearish head and shoulders sample on the each day timeframe.

Moreover, XRP closed its each day candle under the neckline at $1.95, which partially confirmed an extra value decline within the coming days.

Supply: TradingView

Can a 35% crash occur?

This neckline was additionally a key horizontal assist that XRP had been respecting since November 2024.

Beforehand, every time the asset’s value has reached this stage, it persistently skilled upside momentum or a value rebound. Nonetheless, this time, it has lastly damaged under it.

Based mostly on the latest value motion and historic patterns, the break of this key stage has opened the trail for a possible 35% value crash, with XRP presumably dropping to the $1.20 stage within the close to future.

In the meantime, with the latest value drop, XRP has additionally failed to carry above the 200 Exponential Shifting Common (EMA) on the each day timeframe.

Buying and selling under the 200 EMA signifies sturdy bearish sentiment and additional means that sellers are presently in management.

Throughout such occasions, merchants and traders principally search for shorting alternatives as soon as the worth reveals some indicators of upside momentum.

Bearish on-chain metrics

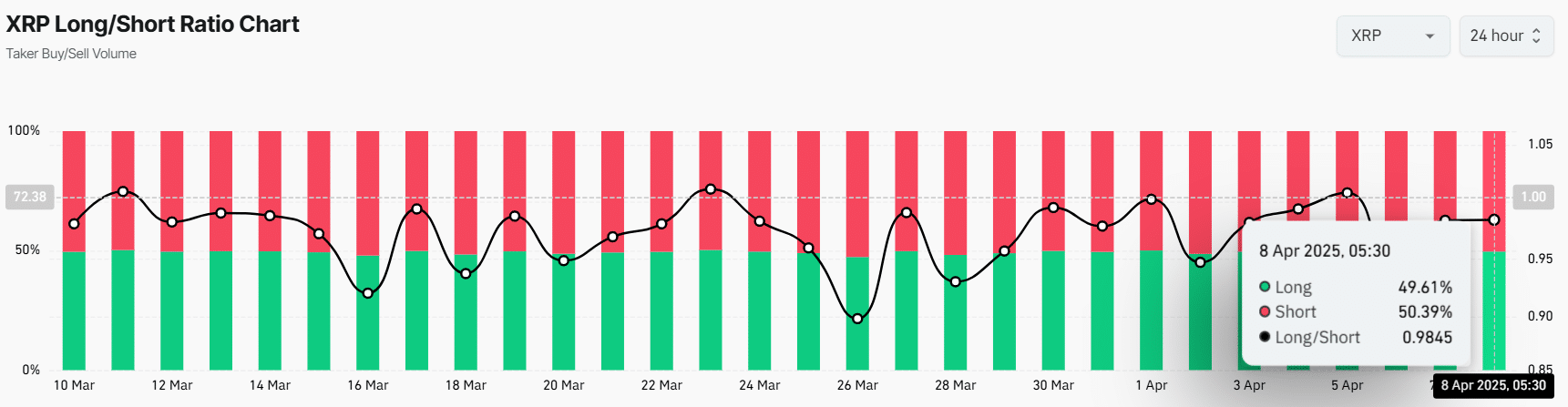

Wanting on the bearish outlook, merchants appear to be following the identical sentiment as they’re strongly betting on the bearish aspect, in response to the on-chain analytics agency Coinglass.

Notably, XRP’s Lengthy/Brief Ratio stood at 0.98 at press time, indicating a bearish bias amongst merchants. Moreover, there have been extra brief positions than lengthy positions out there.

Supply: Coinglass

$51.65 million price of bearish bets

Coinglass knowledge additional revealed that merchants had been over-leveraged at $1.828 on the decrease aspect (assist) and $1.951 on the higher aspect (resistance), with $22.50 million and $51.65 million price of lengthy and brief positions constructed, respectively.

These liquidation ranges and dealer positions clearly mirror the present market sentiment.

Supply: Coinglass

These liquidation ranges and dealer positions are prone to be triggered if the XRP value strikes in both route.