XRP whales are accumulating fast – Hinting at a massive rally ahead?

- Whale transactions over $1M signaled strategic accumulation, driving XRP’s bullish undertone.

- Worth consolidated close to $2.20–$2.50; a breakout may set off bullish momentum

XRP not too long ago witnessed a big uptick in whale transactions, with single trades exceeding $40 million.

This aggressive accumulation coincides with a gradual climb in value, suggesting that institutional and high-net-worth buyers are eyeing Ripple’s native token for its subsequent huge breakout.

As XRP inches nearer to crucial resistance ranges, these actions gas hypothesis about whether or not the token is primed for a rally or merely consolidating for the following section of market exercise.

A surge in transactions past $1 million

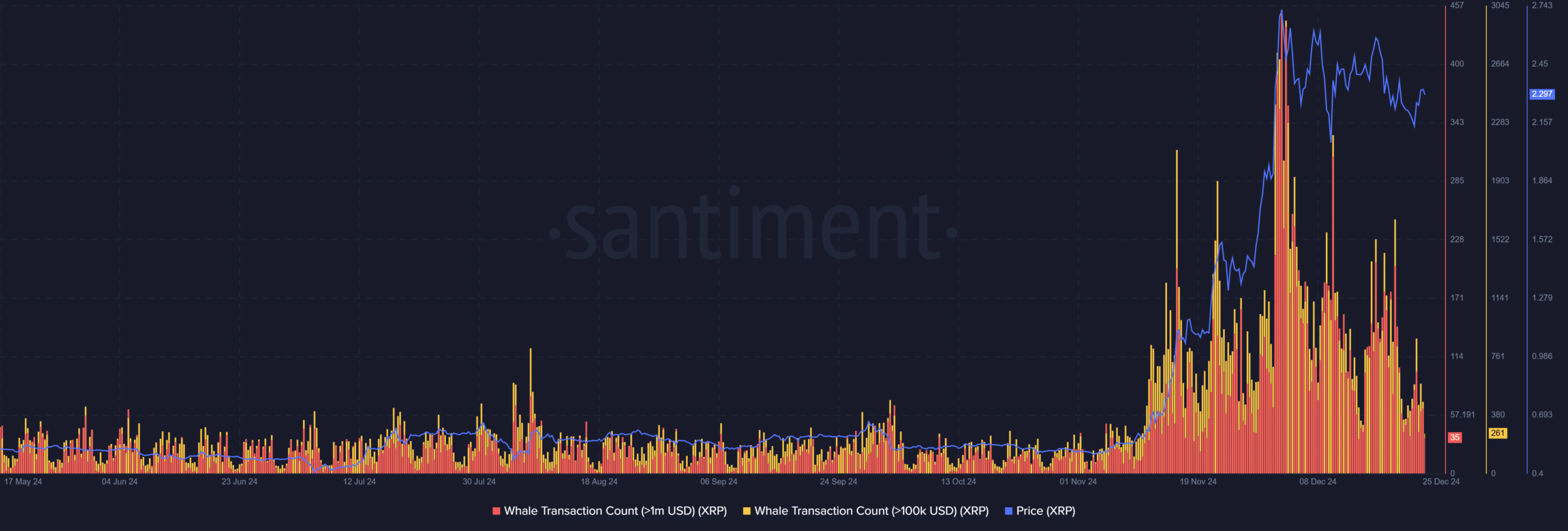

Latest knowledge revealed a outstanding improve in XRP whale transactions, significantly these exceeding the $1 million mark.

The chart underscored two key patterns: a constant rise in giant transactions and their correlation with value will increase.

Transactions price over $1 million peaked alongside a value surge, highlighting the strategic function of whales in XRP’s market dynamics.

Supply: Santiment

Apparently, whale transactions price have additionally surged, suggesting smaller institutional gamers are becoming a member of the fray.

The synchronized exercise between these tiers signifies a strong accumulation section, with whales driving liquidity and stability throughout value rallies.

Such habits usually indicators confidence in long-term value potential, as giant holders not often execute impulsive trades, additional solidifying XRP’s present bullish undertone.

Worth motion and technical overview

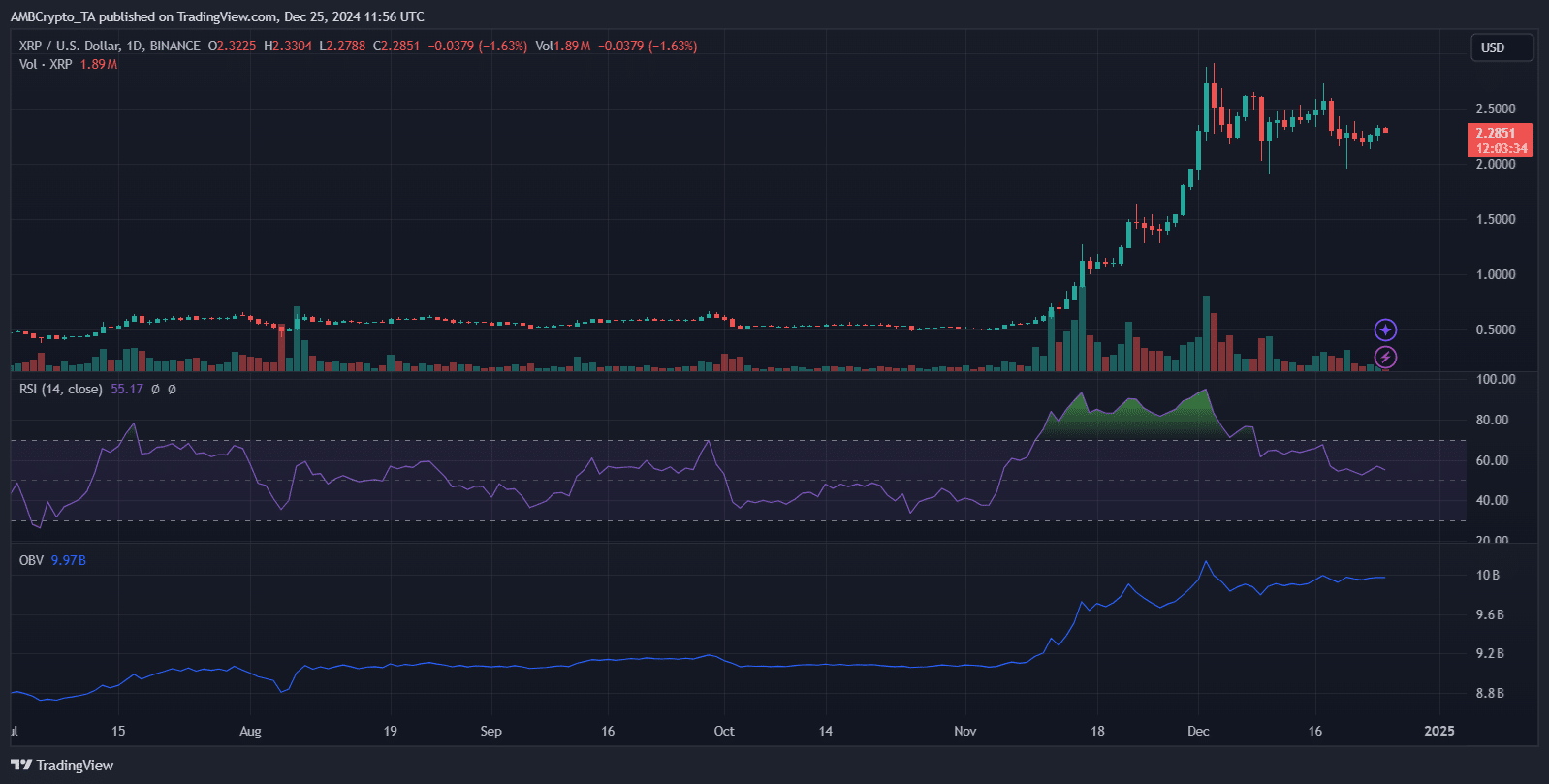

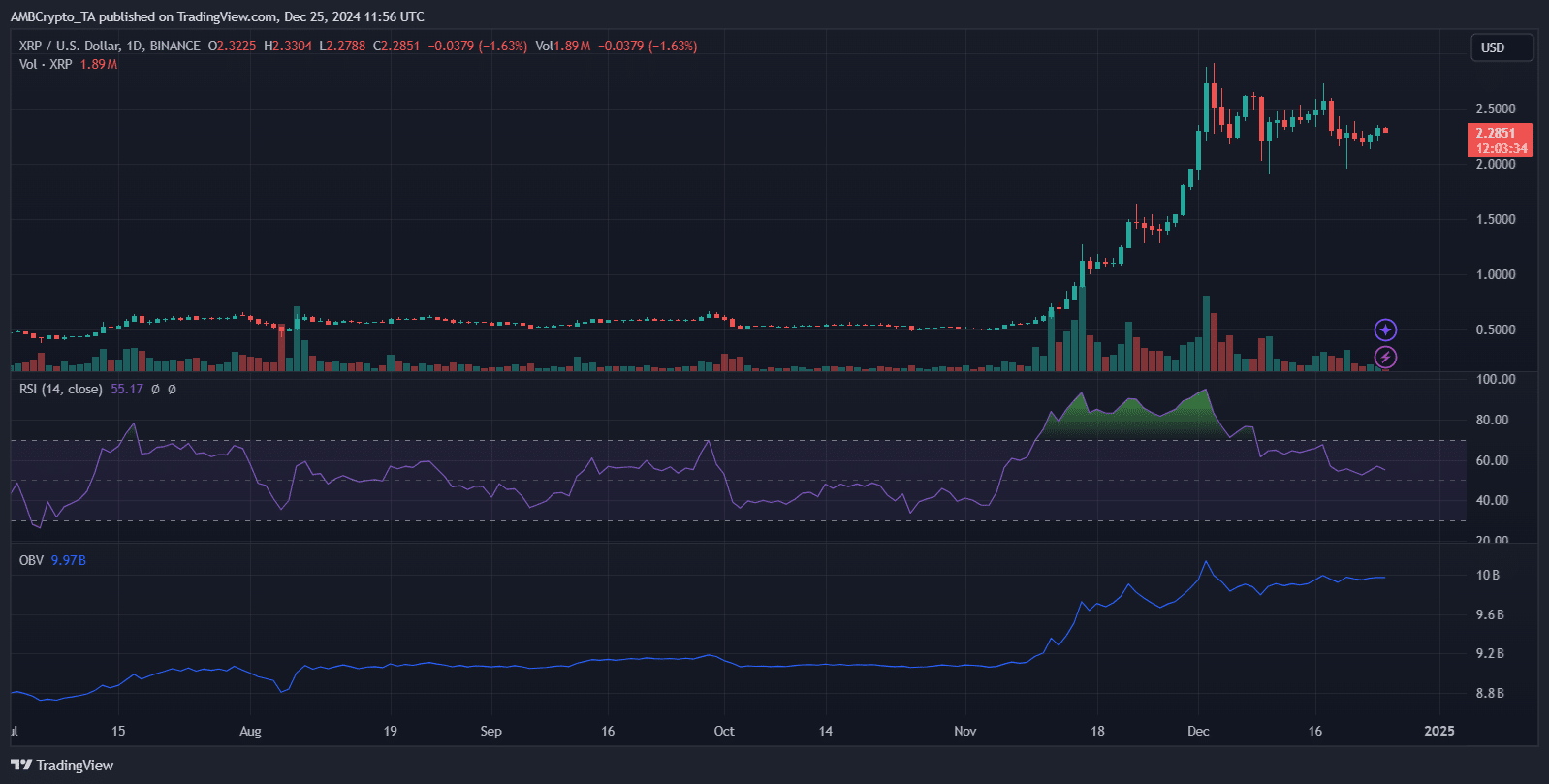

Supply: TradingView

XRP was buying and selling at $2.2851 at press time, reflecting a 1.48% intraday decline. The RSI at 55.17 indicated impartial momentum, suggesting neither overbought nor oversold situations.

The OBV was at 9.97B, exhibiting sustained accumulation regardless of value consolidation. Quantity tendencies highlighted weakening buy-side momentum as every day volumes taper off.

The candlestick sample signaled the potential for additional consolidation beneath $2.50, with assist close to $2.20 appearing as a crucial zone.

Breakout resistance remained at $2.50, a stage examined a number of occasions with out a decisive breach. Shifting averages maintained a bullish alignment, indicating long-term upward bias.

Nevertheless, diminished volatility instructed that whales could also be stabilizing costs, awaiting a catalyst for the following directional transfer.

Market drivers and potential retail implications

XRP’s value dynamics are influenced by institutional exercise and up to date authorized readability, significantly following its victory in opposition to the SEC.

Whale accumulation, evidenced by excessive OBV ranges and subdued value volatility, suggests managed provide. Macroeconomic elements, together with market tendencies and regulatory updates, may catalyze the following transfer.

For retail buyers, sustained consolidation close to $2.20–$2.50 indicators cautious sentiment, probably deterring short-term merchants.

The RSI neutrality implies restricted quick upside, whereas diminished volumes replicate decrease retail participation.

Learn XRP’s Worth Prediction 2024–2025

A decisive breakout above $2.50 may reignite bullish momentum, however failure to carry assist at $2.20 might set off sell-offs.

Retail buyers ought to monitor quantity spikes and information occasions intently to anticipate potential volatility and align methods accordingly.