XRP whales buy the dip – Analyzing impact on price action

- XRP has declined once more after a slight rebound within the final buying and selling session.

- Whales remained within the accumulation mode regardless of value decline.

Ripple’s [XRP] current value decline has caught the eye of huge buyers, with on-chain information revealing vital whale accumulation.

Coupled with a impartial MVRV ratio and stabilization at key assist ranges, these developments recommend a possible bullish reversal for the token.

Ripple whale accumulation in full swing

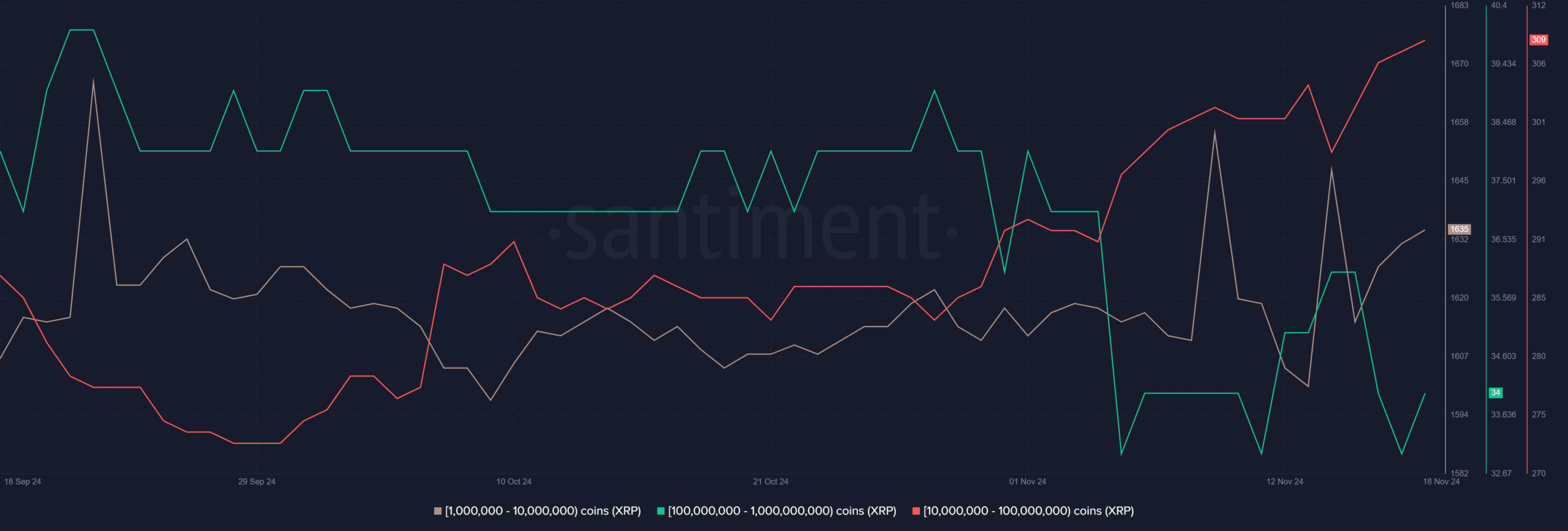

The Whale Holdings Distribution chart exhibits a gradual improve in Ripple‘s balances amongst giant holders. Evaluation of wallets holding 1 million to 100 million XRP signifies a rise in accumulation.

This accumulation part intensified as XRP’s value confronted downward stress, reflecting a traditional “purchase the dip” technique amongst main buyers.

Supply: Santiment

Traditionally, whale accumulation throughout market downturns has usually signaled upcoming value recoveries. Giant holders are likely to place themselves strategically, anticipating vital bullish reversals.

The present pattern highlights rising confidence in XRP’s medium-to-long-term restoration.

Key assist ranges present stability

Ripple’s value has discovered sturdy assist at $2.32, bolstered by the 50-day Transferring Common at $1.59, as proven within the XRP Value chart.

Regardless of struggling to interrupt above the $2.46 Fibonacci retracement degree, the token’s capability to keep up its place above key shifting averages displays underlying bullish sentiment.

Supply: TradingView

Buying and selling quantity stays sturdy, indicating sustained market curiosity. The confluence of whale accumulation and lowered sell-side stress enhances XRP’s capability to navigate its present resistance ranges, paving the best way for a possible rebound.

MVRV ratio signifies waning promote stress

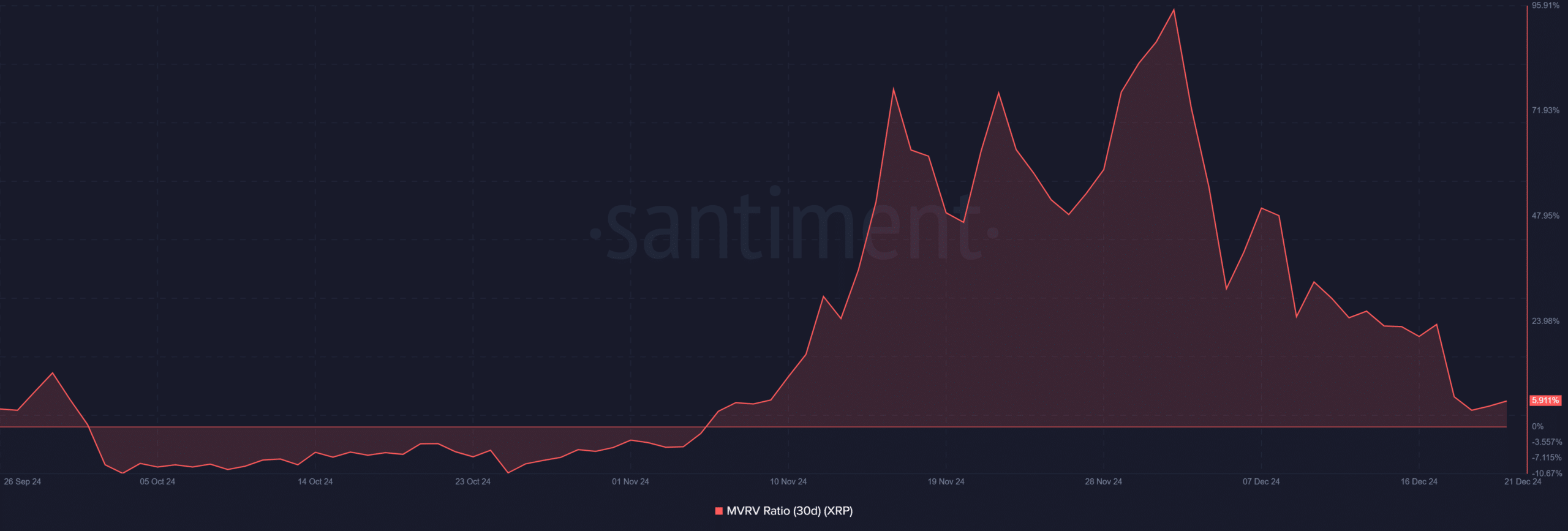

The 30-day MVRV Ratio chart, in line with Santiment, reveals a major decline to roughly 5.91%. These metrics sign diminished profit-taking by Ripple holders who acquired the token throughout the previous month.

A impartial or low MVRV ratio reduces the probability of short-term promoting, aligning with the continued accumulation part by whales.

Supply: Santiment

The convergence of lowered profit-taking, elevated whale exercise, and stabilization above key assist ranges recommend a cautiously optimistic outlook for XRP.

Whereas resistance close to $2.46 persists, these indicators collectively trace at the potential for a value restoration within the coming weeks.

– Life like or not, right here’s XRP market cap in BTC’s phrases

XRP’s present market dynamics, characterised by whale accumulation and lowered promoting stress, present a strong basis for a possible restoration.

Because the token stabilizes at crucial ranges, the market’s focus shifts as to if it might probably overcome resistance and prolong its features. The following few buying and selling periods will possible reveal whether or not XRP’s resilience interprets right into a sustained bullish breakout.