XRP’s network activity shrinks, but traders remain unmoved

- XRP’s energetic addresses and community development decreased.

- Open Curiosity fell, however merchants have been bullish on the long-term worth motion.

Ripple’s [XRP] community development has not been one to be enthusiastic about recently, regardless of the partial win over the U.S. SEC in July. In keeping with Santiment, the community development, as of press time, had decreased to 420.

How a lot are 1,10,100 XRPs value at this time?

For a metric that was over 2,000 within the final week of July, the press time state was disappointing.

XRP: Not enticing sufficient

The community development measures the speed of adoption of an asset by contemplating new addresses interacting with the underlying community. So, a rise in community development implies a surge in traction.

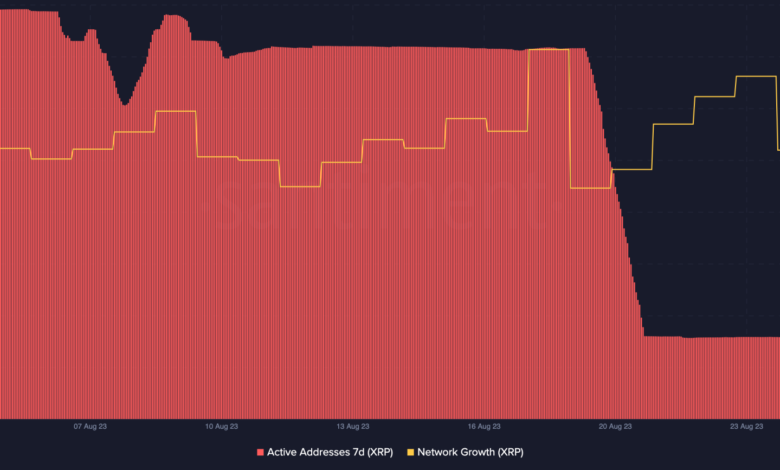

Nonetheless, XRP’s fall on this regard means that new addresses haven’t been flocking to the Ripple community. And for individuals who have joined, XRP transfers haven’t been spectacular. Just like the community development, XRP’s seven-day energetic addresses took an enormous tumble on 19 August.

Since then, the energetic addresses have flattened round 85,800. Energetic addresses present the extent of hypothesis round a token. Subsequently, the lower implies that only a few distinct addresses have been taking part in transfers or buying and selling of the token.

Supply: Santiment

The lackluster consideration given to XRP additionally unfold to the derivatives market, as indicated by Open Curiosity. As an indicator to find out market sentiment and power behind costs, the Open Curiosity takes into consideration the entire variety of futures contracts held each day.

Doubts within the quick time period, bullish for the lengthy

At press time, XRP’s Open Interest was all the way down to $475.08 million. A excessive Open Curiosity signifies a rising dealer confidence within the worth motion. However, a reducing Open Curiosity means that merchants are both unmoved or skeptical in regards to the course the worth of an asset strikes.

This lower highlights how there was a reducing liquidity in contracts linked to the token. And if the Open Curiosity continues to lower, there is likely to be no power to again up XRP above $0.51.

Supply: Coinglass

Regardless of rising to grow to be the fifth asset when it comes to market capitalization, XRP’s efficiency during the last seven days has remained virtually the identical. In keeping with CoinMarketCap, the token worth was $0.51— a lower than 1% improve throughout the aforementioned interval.

However regardless of the efficiency, it appeared that merchants would reasonably be bullish than bearish on the worth motion. One metric that confirms this bias is the funding rate. Funding charges are paid between quick and long-positioned merchants in a bid to maintain their contracts open.

Learn Ripple’s [XRP] Value Prediction 2023-2024

A optimistic funding fee signifies that extra merchants are taking lengthy positions and count on the asset worth to rise sooner or later.

Supply: Santiment

Conversely, a destructive funding fee means that extra merchants have a bearish outlook. In XRP’s case, the funding fee was 0.001%, that means that the long-term efficiency anticipated from XRP was for its worth to extend, not the opposite manner round.