$3B in crypto options expire today — Will it trigger a market drop?

- $3B in crypto choices expired on the sixteenth of Might, however subsequent week positioning was considerably bullish.

- For June, Possibility merchants anticipated BTC to rally to $110K-$125K with a $95K as flooring value.

On the sixteenth of Might, at 8:00 UTC, $3 billion price of crypto choices expired. Bitcoin [BTC] accounted for $2.6B of the notional worth, whereas Ethereum [ETH] had $252 million.

Based on Deribit knowledge, BTC had a max ache of $100K, and the ETH stage was at $2,200. Max ache is a stage that the majority choices will expire nugatory, and typically act as a value magnet.

On the positioning entrance, Deribit stated,

“BTC skew is impartial, ETH places barely outweigh calls. Worth motion might get fascinating.”

Supply: Deribit

The positioning was mirrored by the Put/Name ratio. A worth above 1 signifies extra places (bearish bets) than calls (bullish bets) whereas values beneath 1 lean in the direction of the bulls’ facet.

Put merely, ETH had extra bearish bets forward of the Friday expiry, whereas BTC was at 1 — impartial.

Put up-Friday expiry market response

On the time of writing, about 2 hours after the 15 Might expiry, BTC was valued at $103.8K, jumped 2% from Thursday’s low of $101K.

For ETH, it traded at $2.6K, up 6% from Thursday’s low of $2.4K.

This confirmed ETH was comparatively risky than BTC, and the $3B expiry didn’t stir a lot retracement as earlier feared.

Wanting ahead, Amberdata’s 25RR (25-delta threat reversal) have been optimistic for subsequent Friday’s (23 Might) and finish of Might (thirtieth) expiries.

The metric’s optimistic studying meant that calls outpaced places (extra bullish than bearish bets), reflecting optimistic market sentiment for the final a part of Might.

Nonetheless, there was no robust macro or crypto-centric catalyst to push BTC larger after the U.S.-China commerce deal lifted it to over $100K the earlier week.

Whether or not Fed price expectations will drive BTC going ahead stays to be seen. Nonetheless, the most well-liked name shopping for previously 24 hours was concentrating on $ 110K-$120K for finish June expiries.

For the twenty third of Might expiry, the $107K name possibility was common, too. Nonetheless, the $95K put for June expiry appeared because the probably flooring value in early summer time.

General, the positioning confirmed that possibility merchants anticipated a possible BTC all-time-high (ATH) in late Might or June with a draw back threat goal of $95K.

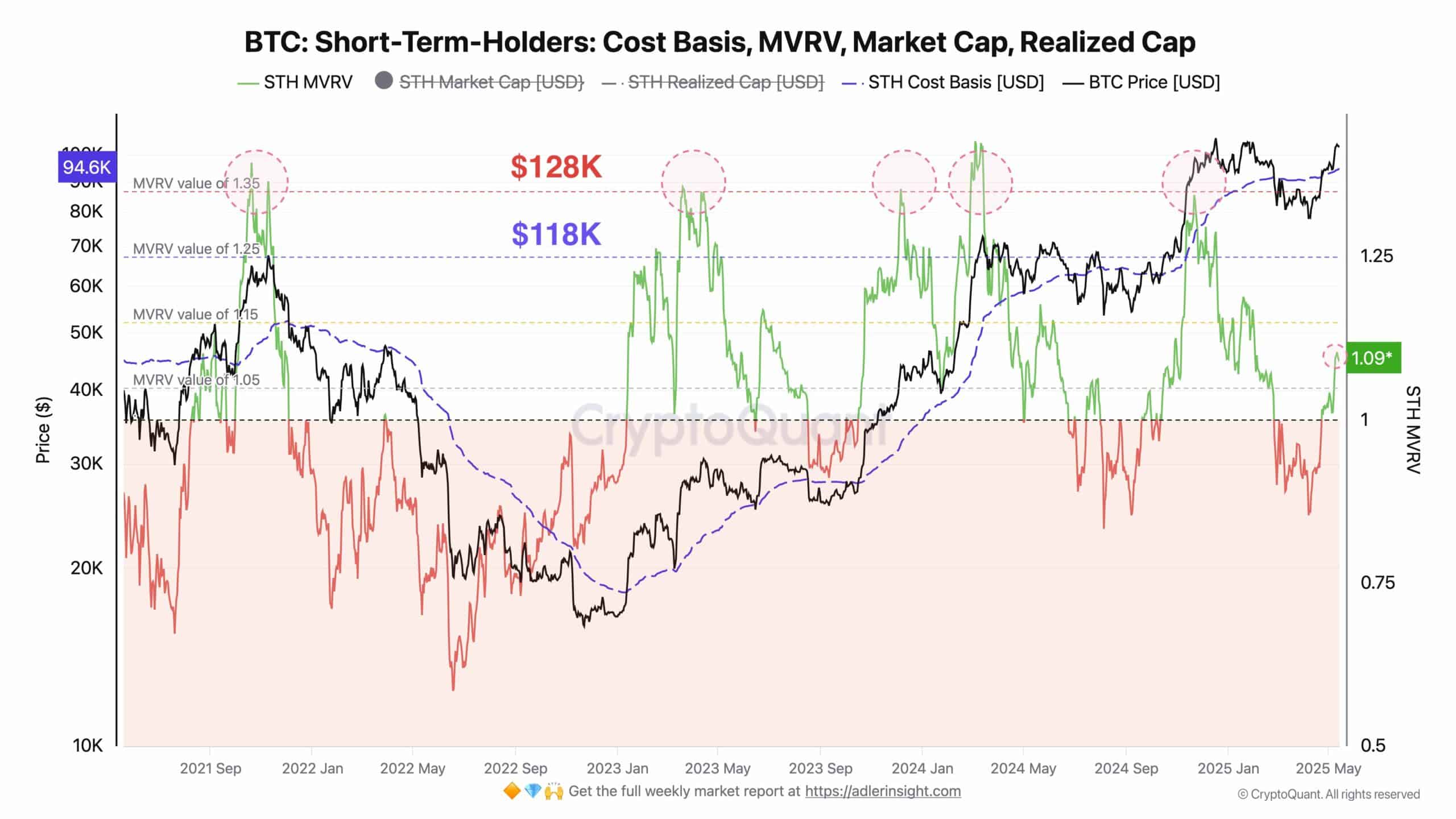

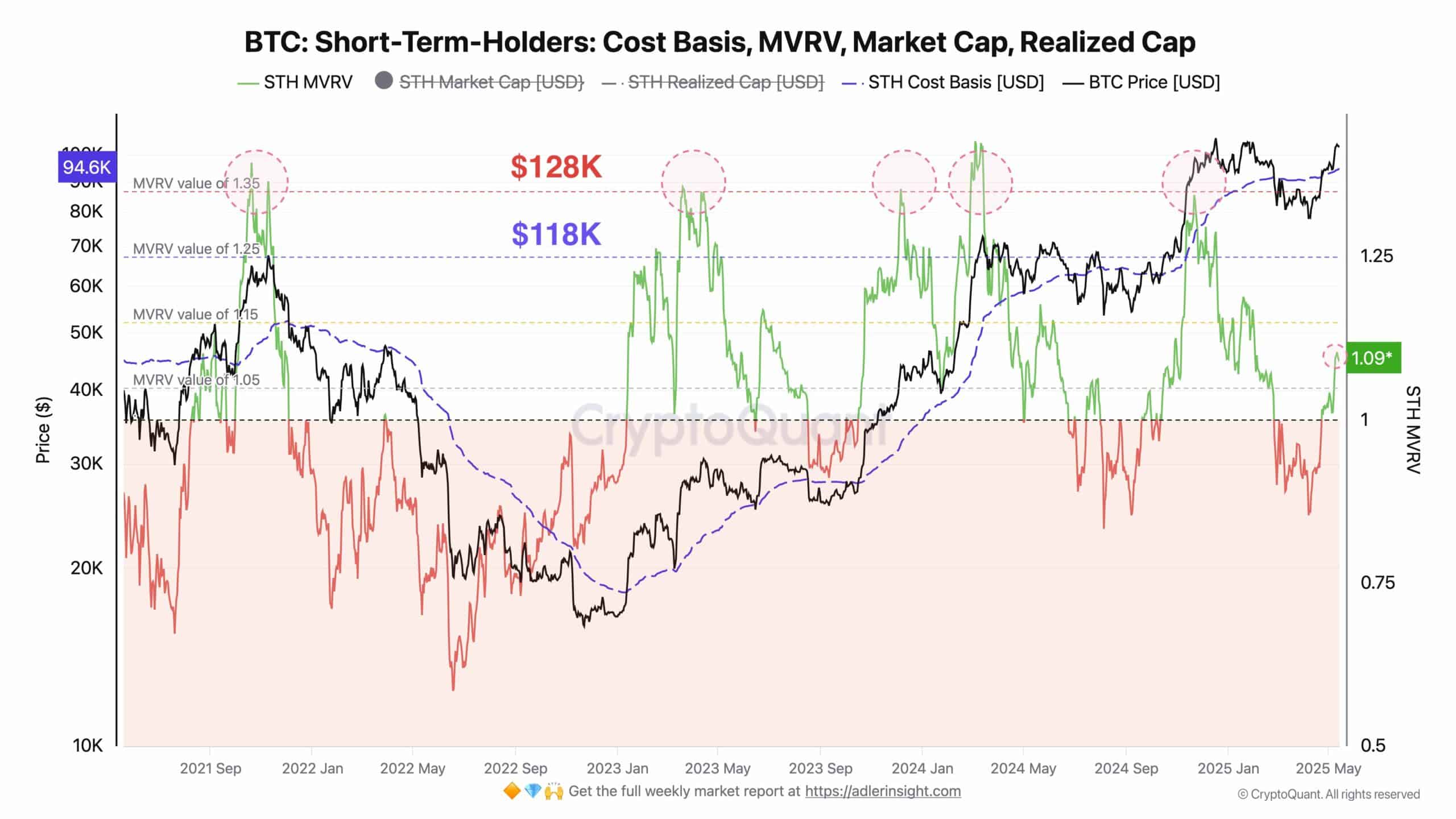

CryptoQuant analyst Axel Adler reiterated the same projection, stating that BTC was presently undervalued from the STH (Brief-term holder) MVRV metric.

He highlighted that, if there isn’t a adverse market catalyst, BTC stress might heighten at $118K in June.

“The present STH MVRV is 1.09. The primary important wave of promoting stress is anticipated round 1.25 (value goal ≈ $118K), with a stronger one probably at 1.35 (≈ $128K)”

Supply: Axel Adler/X