44.2% Of Ethereum Holders Now In Loss, Is This The Bottom?

On-chain information reveals that 44.2% of all Ethereum traders are actually carrying their cash at a loss, an indication that the underside could also be shut for the asset.

Ethereum Proportion Of Holders In Loss Has Surged Lately

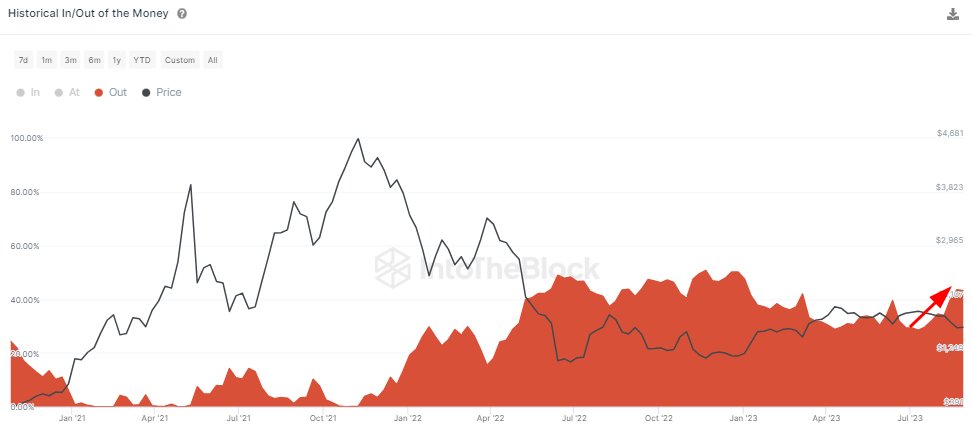

In response to information from the market intelligence platform IntoTheBlock, the share of ETH traders in loss has grown sharply since early July. The related indicator right here is the agency’s “Historic In/Out of the Cash,” which tells us concerning the share of Ethereum traders in income and losses and people which might be simply breaking even.

The metric determines whether or not an investor is in revenue or loss by taking a look at their handle historical past to examine for the typical value at which they acquired their cash. Naturally, if the asset’s present spot value is lower than a holder’s value foundation, then that exact holder is carrying their cash at a internet revenue.

Equally, the price foundation being equal to and fewer than the spot value would indicate that the investor is breaking even on their funding and holding at a loss, respectively.

Now, here’s a chart that reveals the pattern within the Historic In/Out of the Cash indicator for Ethereum over the previous few years:

The worth of the metric appears to have been going up in current weeks | Supply: IntoTheBlock on X

IntoTheBlock has solely listed the information for the Ethereum traders in losses, as that is the variety of curiosity within the present dialogue. The mixed share of the traders breaking even and carrying income can be deduced from this worth, as the whole share should add as much as 100%.

In early July, Ethereum holders underwater have been at about 27%. It’s seen within the graph, nonetheless, that the indicator has noticed a notable uplift since then, as the value of the cryptocurrency has registered a drawdown.

Immediately, the indicator’s worth is at 44.2%, which means that nearly half of the Ethereum consumer base is holding their cash at losses. Typically, the extra the traders get into income, the extra doubtless they turn into to promote to reap these features.

Resulting from this cause, corrections within the asset turn into extra possible to type each time an excessive majority of the market is having fun with income. A big share of the holders being in losses as a substitute, nonetheless, can have the alternative impact on the value since they will lead in the direction of bottoms as revenue sellers turn into exhausted.

Associated Studying: This May Be The Metric To Watch For A Bitcoin Bounce: Santiment

Because the begin of the bear market final 12 months, the best the metric’s worth has gone is 50%, implying that precisely half of the traders had been in losses again then. This worth isn’t too far off from the present one, suggesting that Ethereum could also be near forming a backside.

If an identical loss share is hit with the underside this time, ETH would first undergo from some extra downtrend in order that sufficient traders drop underwater.

ETH Worth

Ethereum has continued to maneuver flat not too long ago; as of this writing, it trades at about $1,600.

Seems like ETH continues to be struggling to seek out any volatility | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, IntoTheBlock.com