BNB Going Strong Short-Term Despite Outflows On Binance

Binance finds itself entangled in a lawsuit filed by the US Securities and Change Fee (SEC), dealing a heavy blow to BNB, the token issued by Binance. The allegations leveled towards the crypto trade counsel its involvement in illegal actions, particularly a number of violations of securities legal guidelines.

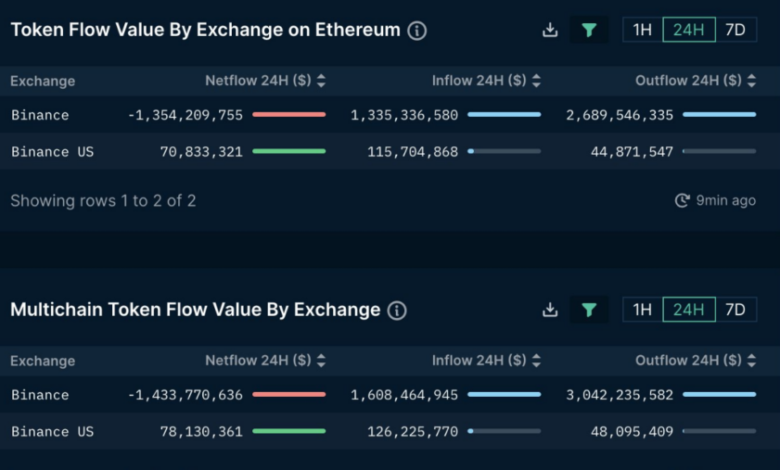

Consequently, the affect of those allegations manifested as substantial outflows from the trade, prompting Changpeng Zhao, the CEO, to disclose an astonishing determine of over $392 million in web outflows within the final 24 hours. It’s price noting that Binance has handled important outflows earlier than, indicating a historical past of navigating such challenges.

In accordance with our information, final 24hrs, @Binance web outflow is about $392m.

Our pockets addresses are public. Some third celebration analytics measure Change in AUM (asset below administration) in USD equal as outflow. This would come with crypto value drops (which lower AUM) as “outflow”.…

— CZ 🔶 Binance (@cz_binance) June 10, 2023

In the meantime, within the wake of the SEC submitting, Nansen information indicates that Binance witnessed a staggering quantity of almost $3 billion in outflows. The aftermath of the current lawsuit has triggered BNB to plummet in worth. Coingecko reports that the token has skilled a drastic decline of over 23% in simply the span of per week.

Supply: Nansen

Binance Vs. The SEC: What’s The Gist?

In accordance with the official SEC press launch, the corporate and 13 different entities are being sued for the operation of an unregistered trade and the commingling of buyer funds by way of corporations associated to Binance.

The regulatory physique additionally alleges that Binance had data of the laws relating to exchanges and securities however selected to disregard these legal guidelines, placing investor funds in danger simply to maximise income.

In addition they highlighted the sale of unregistered securities. The SEC targets the corporate’s “Easy Earn” and “BNB Vault” crypto-lending merchandise. These merchandise are a part of Binance’s staking service and, with the current crackdown on staking providers by the SEC, are thought of securities by the regulatory physique.

BNB market cap presently at $36.6 billion on the weekend chart: TradingView.com

The SEC additionally focused Binance’s failure to limit the trade’s providers to US residents. Simply this March, the Commodity Futures Buying and selling Fee (CFTC) alleged that the corporate is breaking varied monetary legal guidelines together with those supposed to cease cash laundering. The SEC additionally remarked that Binance misled clients by way of “strategic and focused wash buying and selling”.

BNB But To Make A Comeback

Since then, BNB is the one altcoin that has not rebounded because the basic market downturn. Nevertheless, analysts are nonetheless considerably bullish within the short-term capability of the coin regardless of the market’s current slippage.

Supply - Coingecko

On the token’s present value level of $235, BNB bulls ought to defend the $234 help degree to focus on increased highs within the quick time period so long as no bearish information hits the market. However for the time being, evidently the burden of the bears will defeat any try for a bullish breakout.

Nevertheless, if the bulls are in a position to defend this help degree, a return to the $300 value level could be attainable. Regardless of the optimism out there, developments within the lawsuit will certainly have an effect on BNB in the long run.

Featured picture from Protos