Will Ethereum Rally Continue? These Could Be The Factors To Watch

The info of two on-chain indicators could also be referred to for locating out whether or not the newest Ethereum rally can go on or not.

Ethereum Has Loved A Sharp Rally Of Extra Than 12% In The Previous Week

Like the remainder of the cryptocurrency market, Ethereum has noticed a rally throughout the previous few days. Though the coin’s bullish momentum hasn’t been fairly as robust as Bitcoin’s, its weekly beneficial properties of 12% are nonetheless nonetheless vital.

Yesterday, the asset had been carrying even greater income, as its value had touched above $1,850. Previously day, although, ETH has famous some drawdown, because it’s now buying and selling underneath the $1,800 stage.

ETH has registered some sharp development in current days | Supply: ETHUSD on TradingView

After the pullback, some traders have been questioning whether or not the Ethereum rally is finished for now or if it has hopes for persevering with additional. On-chain knowledge from Santiment could maintain some hints about that.

ETH Trade Provide Has Plunged, Whereas Whale Transfers Have Spiked

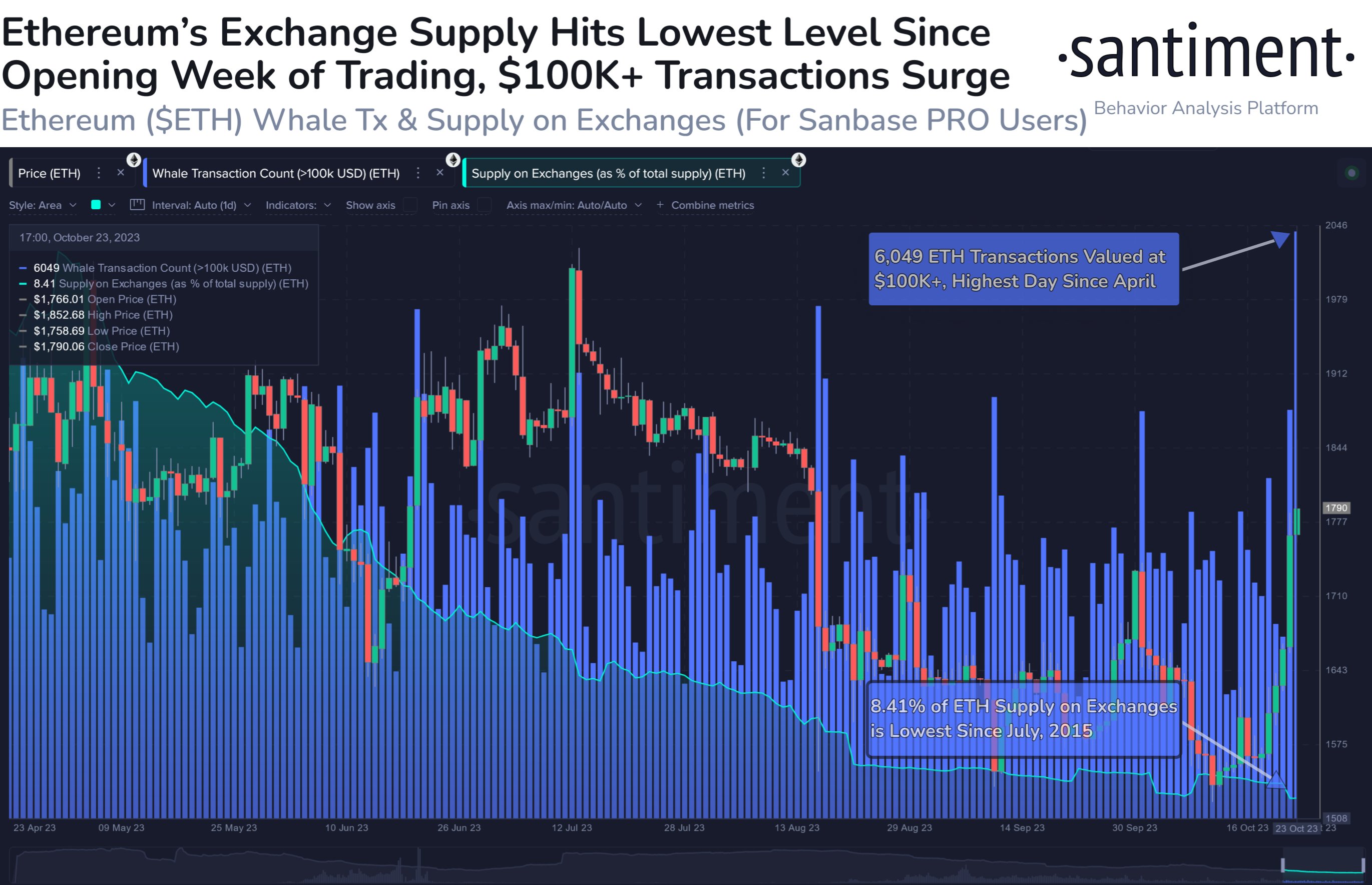

In a brand new post on X, the on-chain analytics agency Santiment has mentioned two necessary ETH metrics. The primary of those is the “whale transaction rely,” which retains monitor of the whole variety of Ethereum transactions that carry a price of at the least $100,000.

Typically, solely the whale entities are able to transferring such a lot of the asset with a single switch, so transactions of this scale are assumed to mirror the habits of those humongous traders.

The under chart reveals the development on this ETH indicator over the previous few months.

Seems to be like the worth of the metric has been fairly excessive in current days | Supply: Santiment on X

As displayed within the above graph, the Ethereum whale transaction rely has noticed some fairly excessive values not too long ago. This implies that these giant holders have been fairly lively out there.

On the peak of this spike, the indicator had a price of 6,049, which is the best variety of every day transactions that the whales have made on the community since April of this 12 months.

The whale transaction rely metric by itself can’t level in direction of a bullish or bearish consequence for the cryptocurrency, as each promoting and shopping for transfers are included within the rely.

It’s true, nevertheless, that whales would wish to remain lively if the rally has to proceed, as their contribution will present the required gasoline for it. Up to now, the whales have been lively certainly, however it stays to be seen whether or not they’re nonetheless shopping for or if they’re pivoting in direction of promoting. The pullback within the Ethereum value could trace in direction of the latter.

The opposite indicator that Santiment has connected to the chart is the “provide on exchanges,” which measures the proportion of the whole circulating ETH provide that’s sitting within the wallets of all centralized exchanges.

From the graph, it’s seen that this indicator has solely continued to slip down for the reason that rally began, implying that traders have continued to make internet withdrawals from these platforms.

At current, 8.41% of the ETH provide is on exchanges, which is the bottom stage since July 2015. Holders persevering with to withdraw their cash is usually a constructive signal for the cryptocurrency, as it may be an indication that accumulation is occurring.

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, Santiment.internet