Ethereum: What $781M outflows in 7 days means for ETH’s prices

- Ethereum’s Provide on Exchanges elevated in the previous couple of days.

- ETH was down by over 2%, and indicators seemed bearish.

Ethereum [ETH] has witnessed a substantial quantity of outflow from exchanges over the past week. This occurred whereas its value motion was bullish.

Nevertheless, the market turned bearish within the final 24 hours. Did this have a unfavorable affect on ETH’s outflow?

Ethereum’s outflow surged!

Ethereum’s value rested comfortably above the $3k mark as its value rallied by greater than 6% within the final seven days.

Whereas that occurred, buyers stockpiled ETH, hinting that they anticipated the token’s value to rise additional within the coming days.

Titan of Crypto, a preferred crypto analyst, just lately posted a tweet highlighting this reality.

As per the tweet, crypto exchanges witnessed an outflow of over 260,000 ETH, equal to greater than $781 million, inside the previous seven days.

Moreover, Justin Solar additionally accrued ETH. As per a current tweet from Lookonchain, a pockets that probably belongs to Solar withdrew 15,389 ETH, value $49.78 million, from Binance once more.

The pockets earlier had purchased 147,442 ETH, value $469.9 million at $3,179 because the eighth of April.

Nevertheless, the final 24 hours witnessed a change in market sentiment as most cryptos’ costs dropped. Based on CoinMarketCap, ETH was down by over 2%.

At press time, the king of altcoins was buying and selling at $3,165.53 with a market capitalization of over $386 billion.

Is ETH’s value drop affecting shopping for strain?

Because the token’s value dropped, AMBCrypto checked its metrics to search out whether or not this had any affect on shopping for strain.

Our evaluation of CryptoQuant’s data revealed that ETH’s internet deposit on exchanges was excessive in comparison with the final seven days’ common. This signaled that buyers have began to promote ETH.

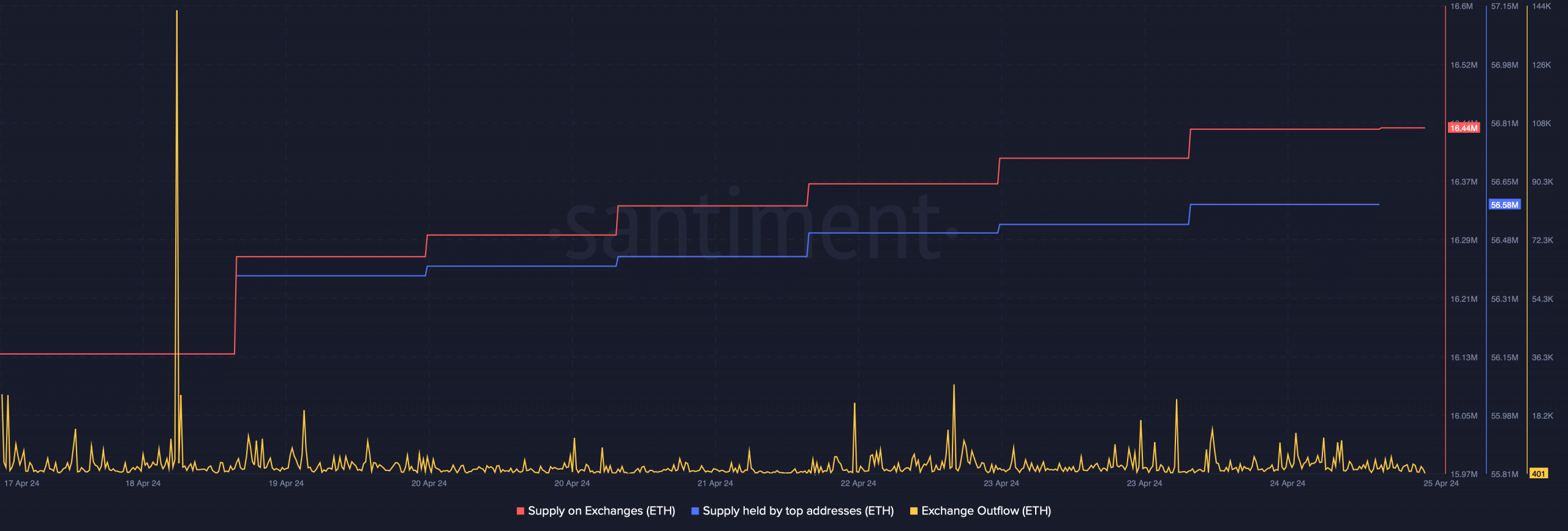

The token’s change outflow declined in the previous couple of days. Moreover, the truth that buyers have been promoting Ethereum was additional confirmed by its supply-on-exchange graph because it went up.

Notably, the worth decline didn’t have an effect on whale accumulation. This gave the impression to be the case as ETH’s provide held by high addresses continued to rise final week.

Supply: Santiment

Going ahead

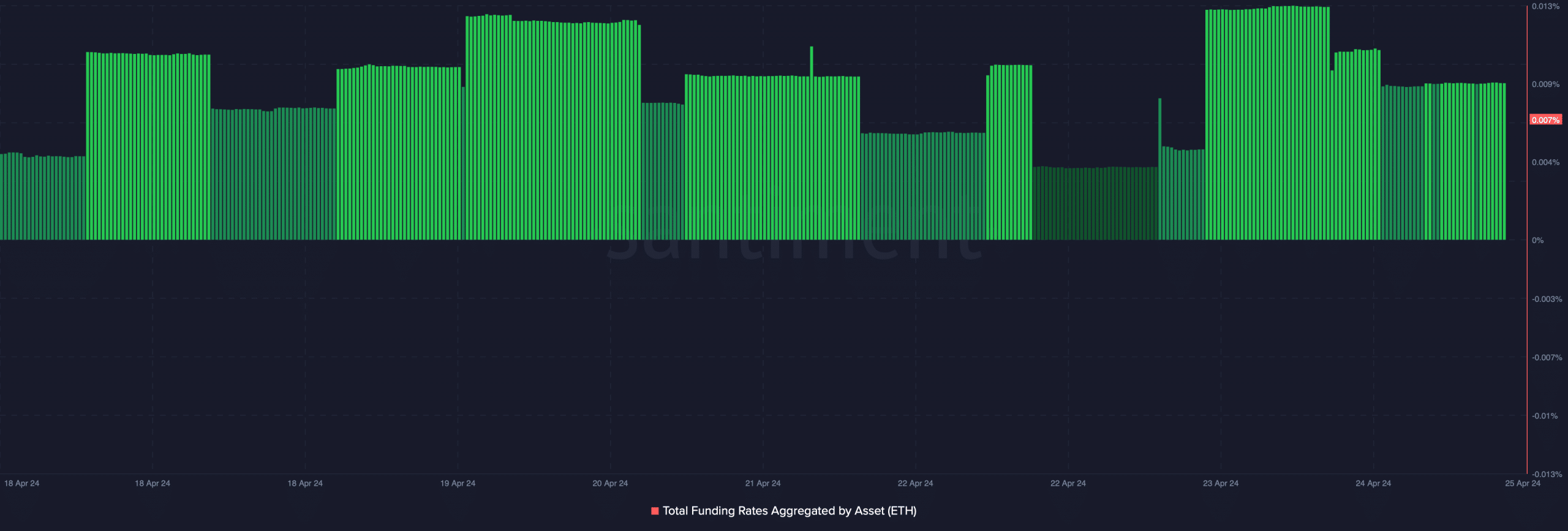

AMBCrypto then analyzed ETH’s derivatives metrics and technical indicators to see if the rise in promoting strain might additional affect its value. The token’s Funding Charge elevated.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Usually, costs have a tendency to maneuver the opposite method than the Funding Charge. This motion advised a continued value drop for ETH.

Supply: Santiment

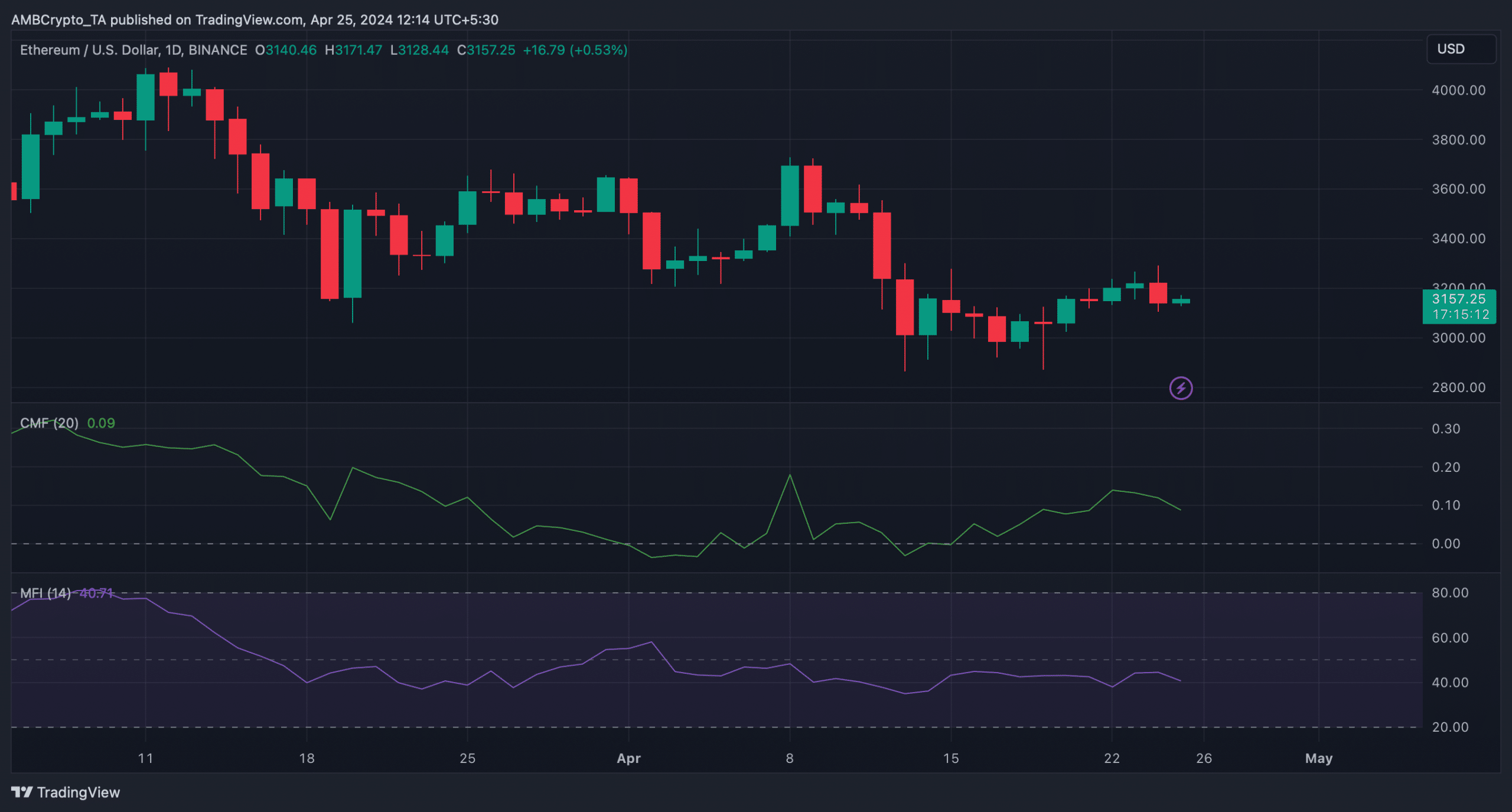

Technical indicators additionally seemed bearish. As an example, each ETH’s Chaikin Cash Circulation (CMF) and Cash Circulation Index (MFI) began to say no, displaying a continued value drop within the coming days.

Supply: TradingView