Ethereum traders feel the pinch: A surge in liquidations

- The ETH value decline has led to consecutive lengthy liquidations.

- ETH has declined by over 3% within the final three days.

Ethereum [ETH] skilled consecutive uptrends that just about introduced it again to its all-time excessive not too long ago. Nonetheless, a pattern reversal halted this progress, leading to vital losses for lengthy merchants over the previous few days.

Ethereum uptrend stalls

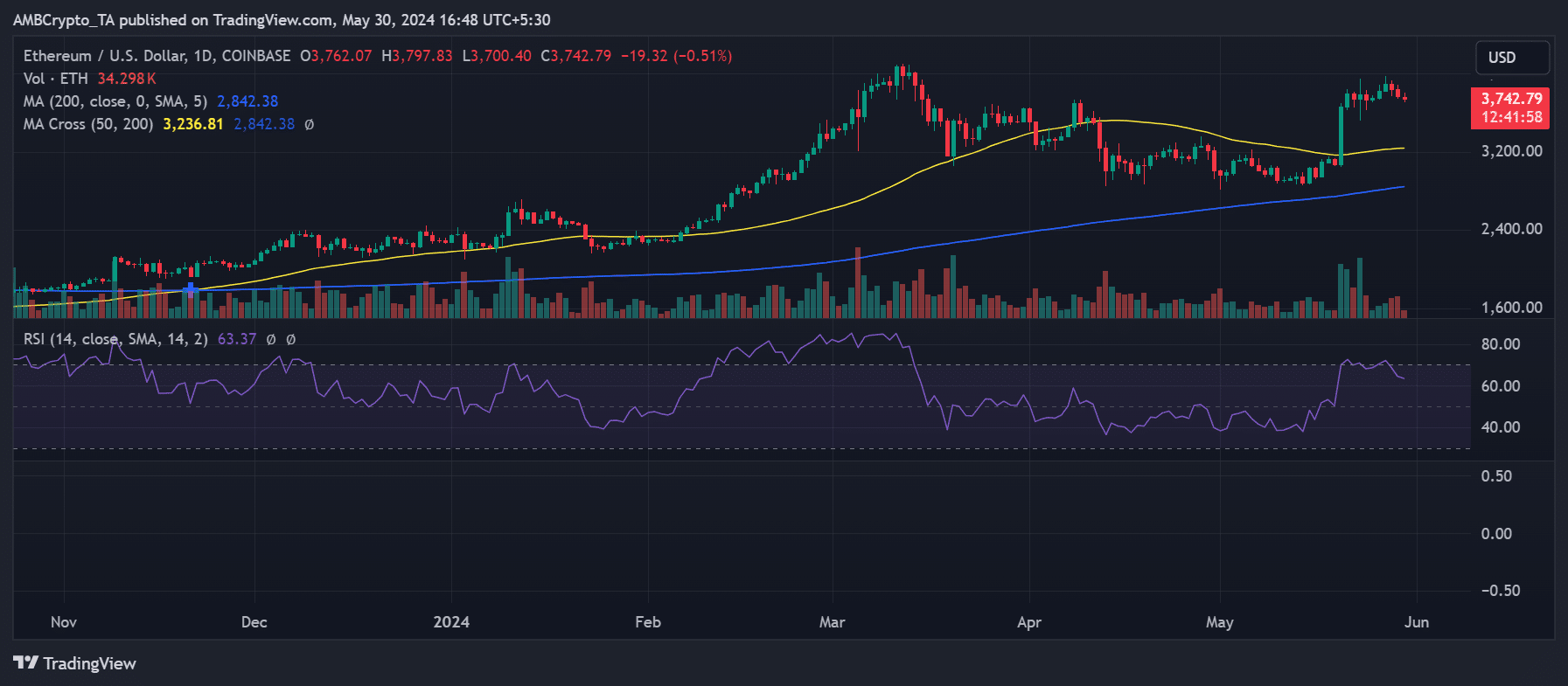

Evaluation of Ethereum on a every day timeframe signifies that it has skilled consecutive downtrends over the previous three days.

These latest downtrends adopted consecutive uptrends, which had pushed its value to roughly $3,890 on twenty seventh Could. As of this writing, ETH was buying and selling at round $3,740, reflecting a decline of lower than 1%.

Supply: TradingView

Moreover, regardless of the latest decline, the general pattern for ETH remained bullish. The chart indicated that, as of now, it was buying and selling above its brief Transferring Common (yellow line), which is a constructive sign.

Moreover, evaluation of its Relative Power Index (RSI) reveals a studying above 60, reinforcing the presence of a robust bullish pattern.

Ethereum lengthy merchants take hits

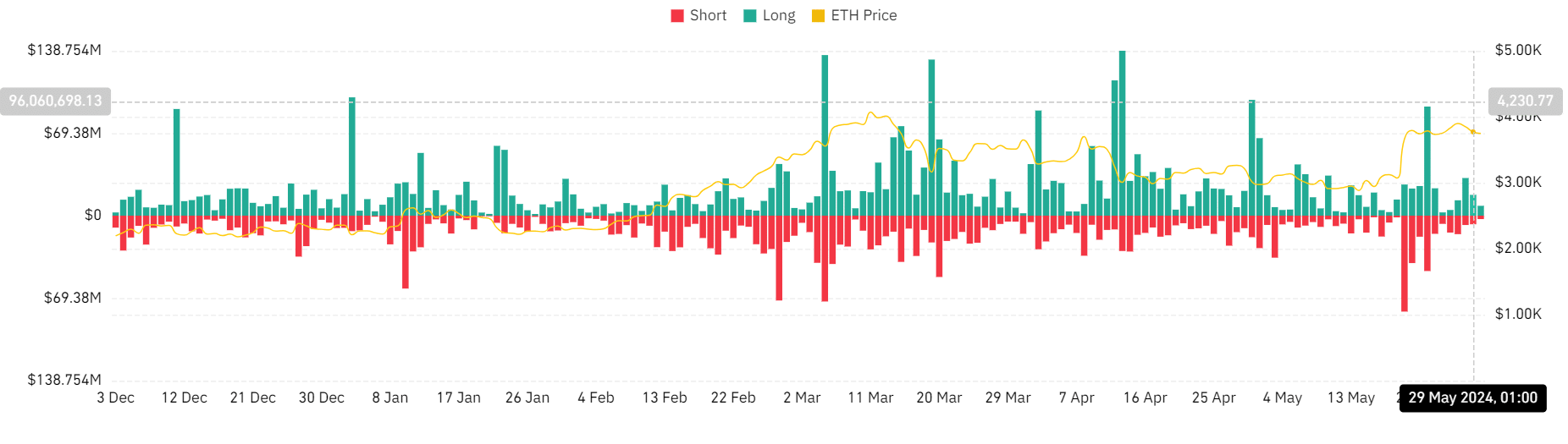

In accordance with the evaluation of liquidation knowledge on Coinglass, Ethereum lengthy merchants have skilled elevated liquidations over the previous few days.

Supply: Coinglass

On twenty eighth Could, when the worth decline started, the lengthy liquidation quantity was roughly $31.6 million.

The next day, it was round $17.5 million, and as of the present writing, it’s over $8 million.

This brings the overall lengthy liquidation quantity during the last three days to greater than $57 million, in comparison with simply over $18 million in brief liquidation quantity.

Ethereum Open Curiosity stays excessive

Regardless of the decline in value, curiosity in Ethereum stays robust. Evaluation of the Open Curiosity chart on Coinglass reveals that Open Curiosity peaked at $17 billion on twenty eighth Could, marking the best stage in over a 12 months.

As of this writing, the Open Curiosity was round $16.7 billion, which continues to be one of many highest factors in over a 12 months. This means sustained investor engagement and curiosity in Ethereum.

Learn Ethereum (ETH) Value Prediction 2024-25

Moreover, an evaluation of the funding price indicated that sentiment round ETH remained constructive. The chart confirmed that the funding price has stayed above zero, presently at 0.013%.

This means that patrons proceed to dominate, indicating a robust perception in a possible additional rise in ETH’s value.