Ethereum: Investors, know this before FOMO kicks in!

- ETH bulls are in management however it won’t be sufficient to help a powerful breakout.

- The demand for derivatives gave the impression to be progressively recovering.

Ethereum [ETH] is off to a promising begin this week after delivering a bullish efficiency for 4 consecutive days. Whereas this will usher in some pleasure associated to weekend accumulation, there are some things that traders ought to think about earlier than going all in.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

ETH’s bullish efficiency within the final 4 days marks the primary time that the value has favored a selected course for over three days. Many analysts could translate this as an indication that demand is rising and outpacing promote strain. Nonetheless, a have a look at extra knowledge factors is vital to ascertain whether or not ETH is constructing in the direction of doubtlessly breaking out of its 2-week limbo.

In accordance with the most recent Glassnode knowledge, the quantity of ETH provide final energetic within the final 3 – 6 months simply reached a 10-month low. A affirmation that almost all ETH holders aren’t transferring their cash. This means that there’s nonetheless a long-term focus. On-chain change circulation knowledge reveals that extra ETH has been flowing out of exchanges than the quantity flowing in.

📊 Day by day On-Chain Change Move#Bitcoin $BTC

➡️ $343.9M in

⬅️ $345.5M out

📉 Internet circulation: -$1.6M#Ethereum $ETH

➡️ $175.5M in

⬅️ $252.3M out

📉 Internet circulation: -$76.8M#Tether (ERC20) $USDT

➡️ $241.9M in

⬅️ $250.2M out

📉 Internet circulation: -$8.3Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) May 28, 2023

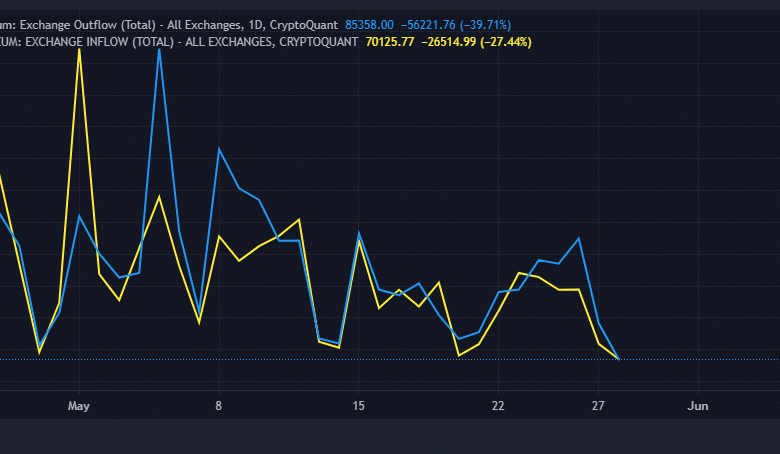

A eager have a look at ETH whole change inflows and outflows confirms that demand is at the moment outweighing promote strain. Nonetheless, there’s something way more notable concerning the present change flows. Change circulation volumes at the moment are right down to ranges the place we have now beforehand seen a surge in on-chain volumes.

Supply: CryptoQuant

The above statement is vital as a result of it means ETH may even see a resurgence of volumes quickly. If that occurs, then it is going to doubtless get away of its slender vary the place the cryptocurrency has been caught for the final two weeks.

Are ETH whales shopping for?

The likelihood of a breakout or break beneath the latest vary is basically depending on robust demand from whales and establishments. Addresses holding not less than 1000 ETH have been on a downward trajectory for the final two weeks. This is a sign that whales have been progressively offloading a few of their cash.

Supply: Glassnode

The identical applies for ETH’s futures open curiosity which slid within the final 5 days. That is regardless of the 5% upside that the cryptocurrency has achieved throughout the identical 5-day interval. There are a couple of notables, such because the latest dip within the estimated leverage ratio, which means that the present upside isn’t supported by a variety of hypothesis.

Additionally, change reserves are at month-to-month lows whereas funding charges are on the rise.

Supply: CryptoQuant

The above underscores a cautious however optimistic outlook within the derivatives market, thus the absence of robust leverage.

How a lot are 1,10,100 ETHs price right this moment?

Nonetheless, the latest upside has not pushed out of the slender 2-week value vary, therefore underscoring weak prevailing demand. As such, it may be too early to find out if the present upside represents a breakout.

ETH exchanged fingers at $1,842 on the time of writing. It’s nonetheless buying and selling inside the slender band wherein it traded inside the final two weeks.