Ethereum plunges below $2,500: Is the price bottom yet to come?

- Ethereum’s value declined by practically 8% within the final 24 hours alone.

- A whale with observe document offered ETH at a loss.

Ethereum [ETH] traders had been having a troublesome time because the king of altcoins’ value dropped drastically final week. Whereas a number of may count on this to be ETH’s market backside, that may not be the case as per a latest evaluation. Let’s see what’s occurring with ETH.

Ethereum bears take management

CoinMarketCap’s data revealed that Ethereum bears pushed the token’s value down by greater than 4% final week. Issues acquired worse within the final 24 hours because the token witnessed an almost 8% value plummet.

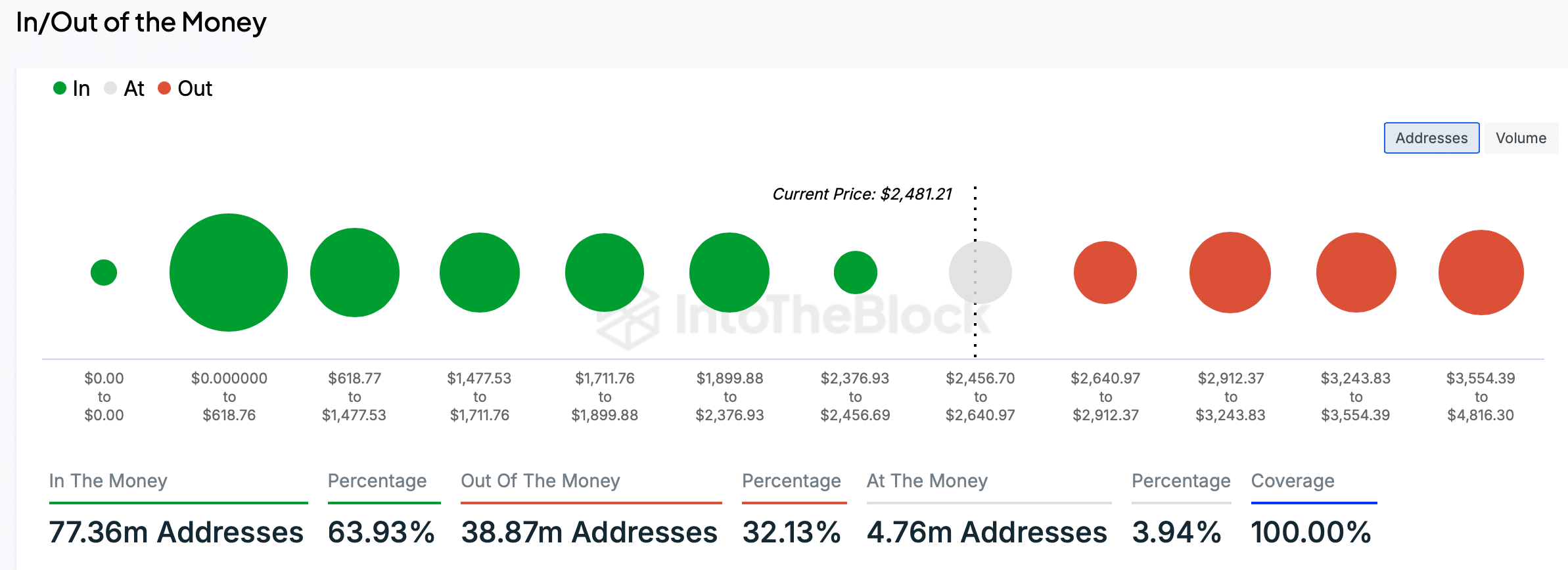

On the time of writing, ETH was buying and selling at $2,481.07 with a market capitalization of over $298.4 billion. After the value decline, about 77 million ETH addresses remained worthwhile, which accounted for 63.9% of all ETH addresses.

Supply: IntoTheBlock

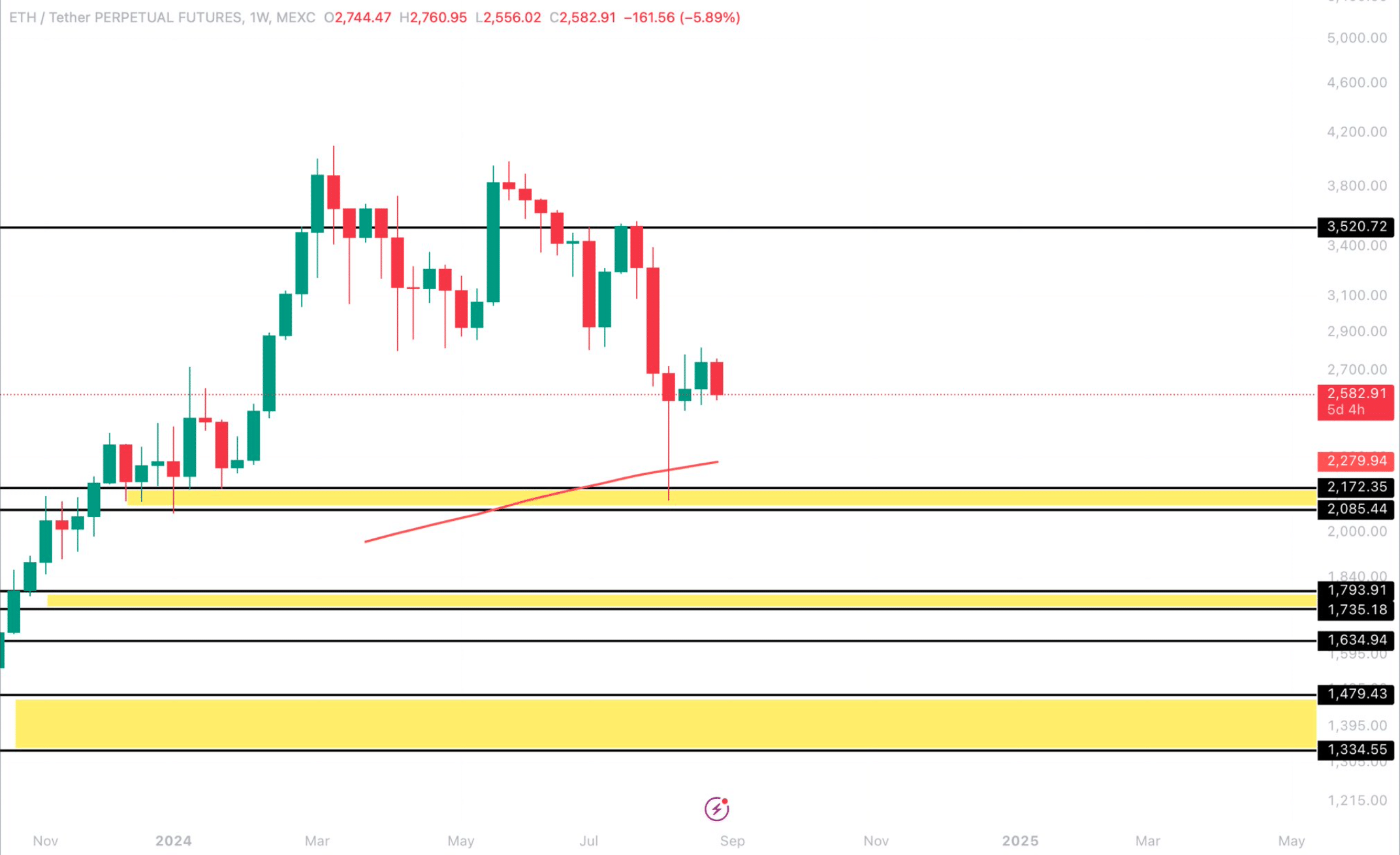

Whereas the newest value drop already regarded regarding, a modern evaluation urged that there have been probabilities of Ethereum happening additional. UNKNOWN TRADER, a preferred crypto analyst, lately posted a tweet highlighting a number of “yellow” zones.

The tweet talked about that the analyst would think about shopping for ETH as soon as the token’s value enters these yellow zones, like $2,172-$2,085.

Supply: X

Due to this fact, AMBCrypto deliberate to examine the general market sentiment round ETH to seek out out whether or not traders had been ready for an additional drop or did they begin shopping for the dip.

Are traders promoting ETH?

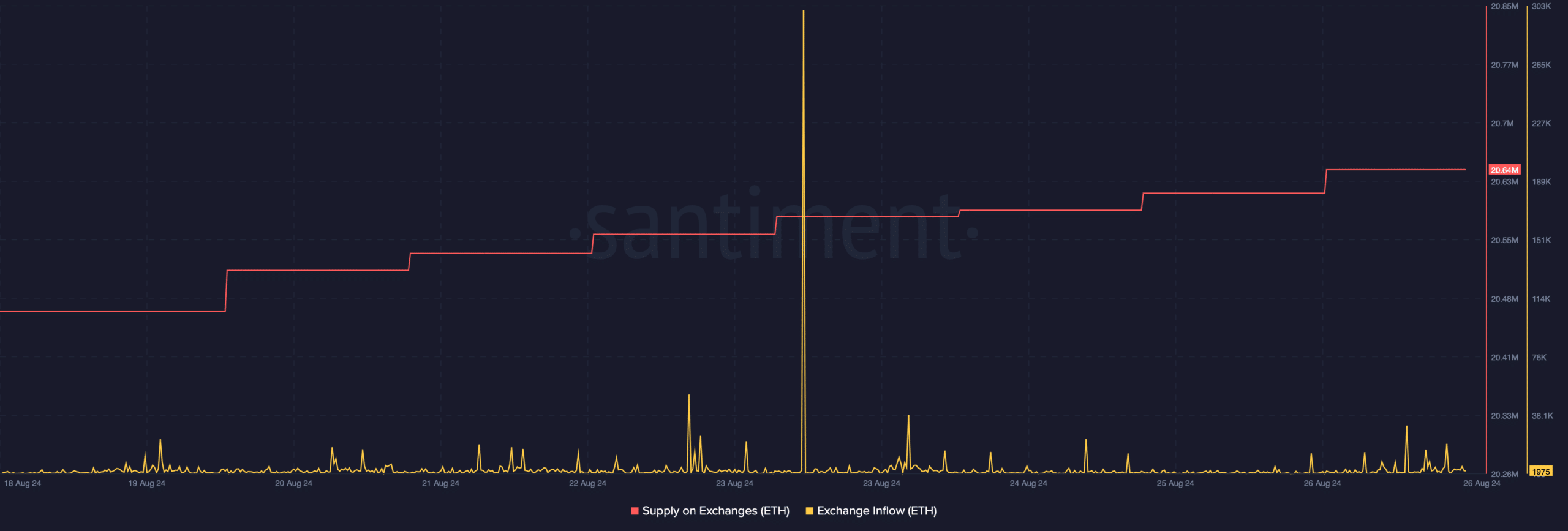

AMBCrypto’s evaluation of Santiment’s information revealed that ETH’s provide on exchanges was rising. A hike within the metric signifies that traders are promoting extra.

Moreover, Ethereum’s trade influx additionally spiked, additional proving the truth that promoting stress was excessive.

Supply: Santiment

Lookonchain lately posted a tweet highlighting an attention-grabbing growth. A whale with observe document, offered 5,088 ETH, $13.58 million, at a lack of $3.66 million. Does this imply that ETH’s value would plummet additional?

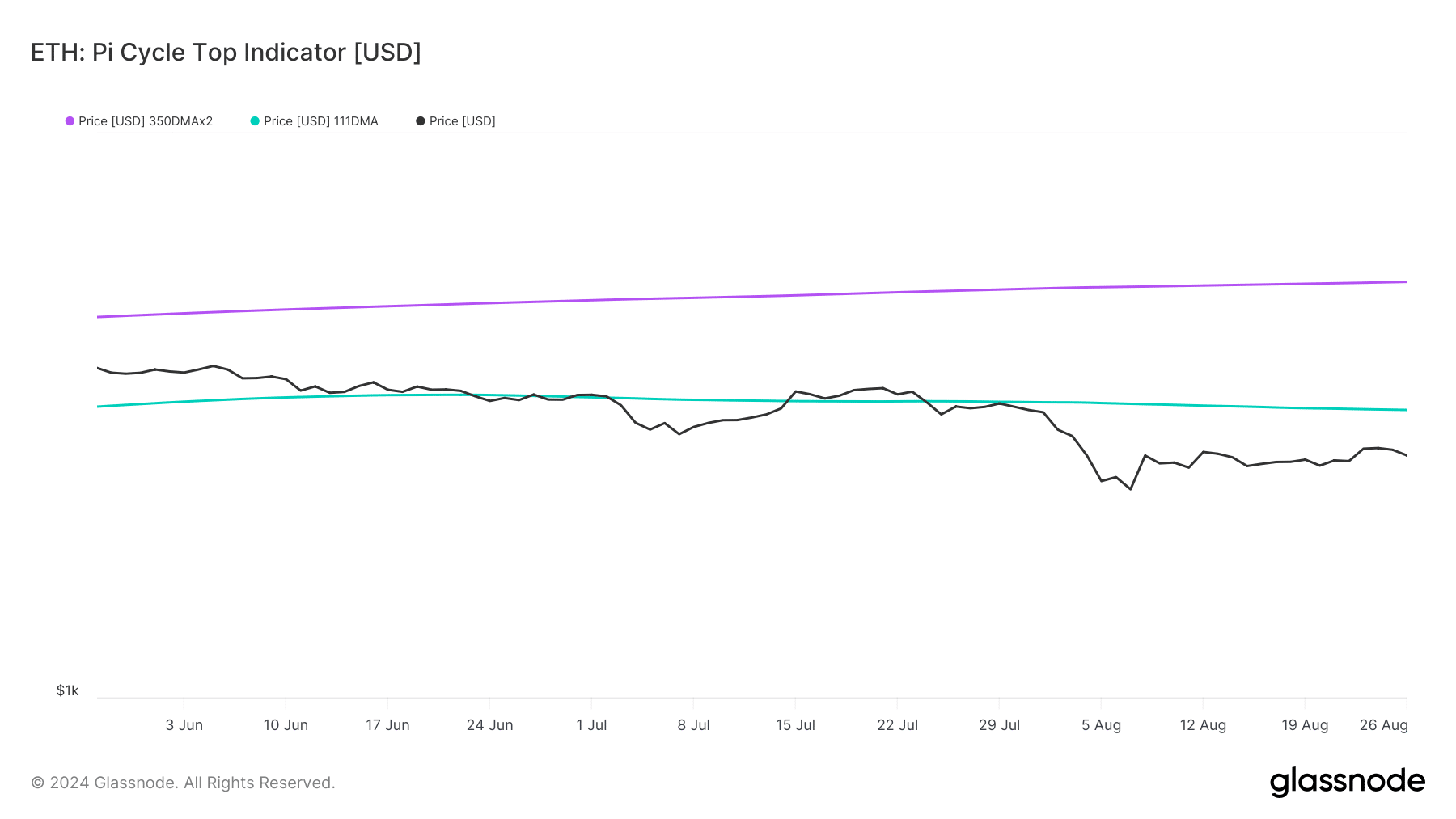

Curiously, AMBCrypto’s have a look at Glassnode’s information revealed that ETH was already buying and selling method beneath its attainable market backside.

In response to the Pi Cycle Prime indicator, Ethereum’s market backside was at $3.2k. This urged that the potential for a bullish takeover can’t be dominated out.

Supply: Glassnode

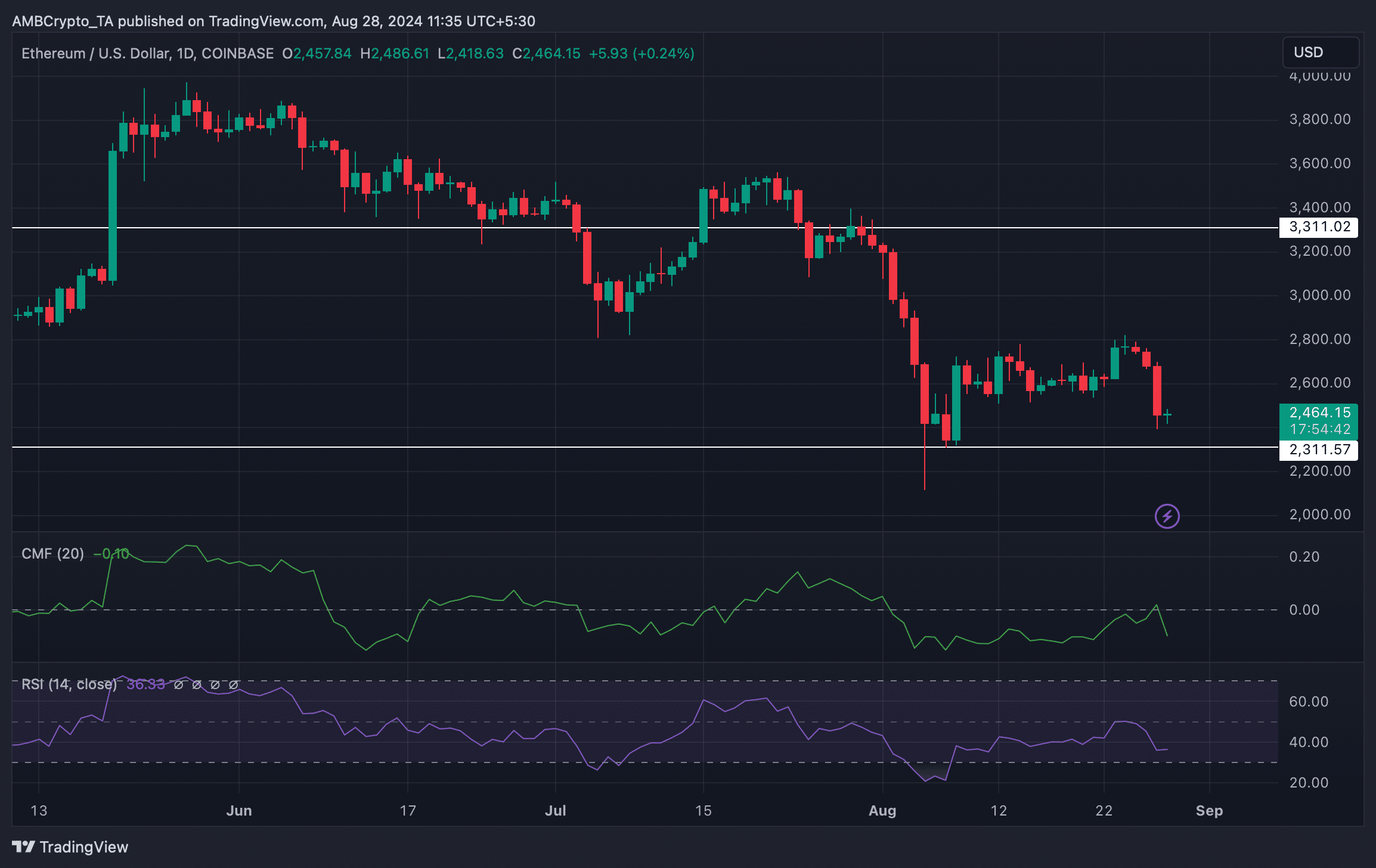

AMBCrypto then checked the king of altcoins’ day by day chart to higher perceive what to anticipate from it within the coming days.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Although the Pi Cycle Prime indicator revealed that ETH was underneath its market backside, most technical indicators urged an additional value decline.

As an example the Chaikin Cash Stream (CMF) registered a downtick. Ethereum’s Relative Energy Index (RSI) additionally adopted the same declining development, indicating a continued value drop in direction of $2,311.

Supply: TradingView