Is Bitcoin bottom in? Seller exhaustion suggests BTC is about to…

- Whereas BTC consolidated, whales purchased a considerable quantity of BTC.

- The RSI revealed that there was extra room for purchasing, supporting the potential for a bull rally.

After showcasing spectacular efficiency in November, Bitcoin [BTC] has now entered a consolidation section. Nevertheless, an important BTC metric flashed a sign, which indicated a attainable change in market sentiment. Will this push be sufficient to ship BTC to $100k subsequent?

Is that this a Bitcoin backside?

After touching $99k final week, BTC witnessed a significant correction because it fell to $91k. Nevertheless, issues began to get higher as BTC hovered across the consolidation zone of $96k.

At press time, the king coin was buying and selling at $96,431.49 with a market capitalization of over $1.9 trillion. This all occurred amidst speculations of BTC concentrating on $100k.

The excellent news was that the newest evaluation indicated an analogous chance. Glassnode’s latest tweet revealed that the Vendor Exhaustion Composite for Bitcoin flashed a sign on the weekly timeframe, hinting at a optimistic shift in market sentiment.

This might imply that Bitcoin was in its market backside.

Ali Martinez, a well-liked crypto analyst, additionally posted a tweet hinting at BTC to $99k within the coming days. Martinez’s tweet identified a falling wedge sample on BTC’s chart, which urged a attainable Thanksgiving rally.

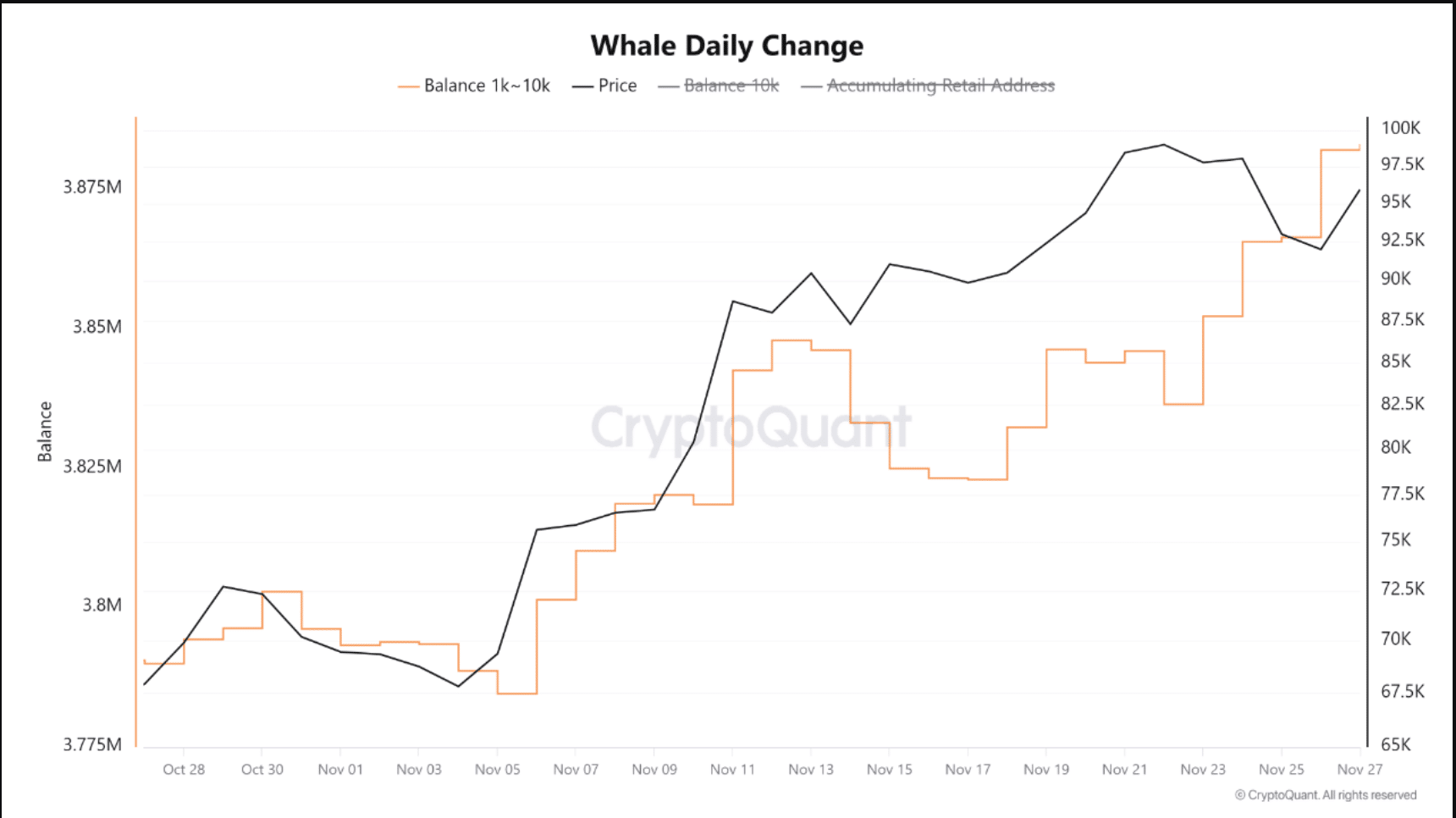

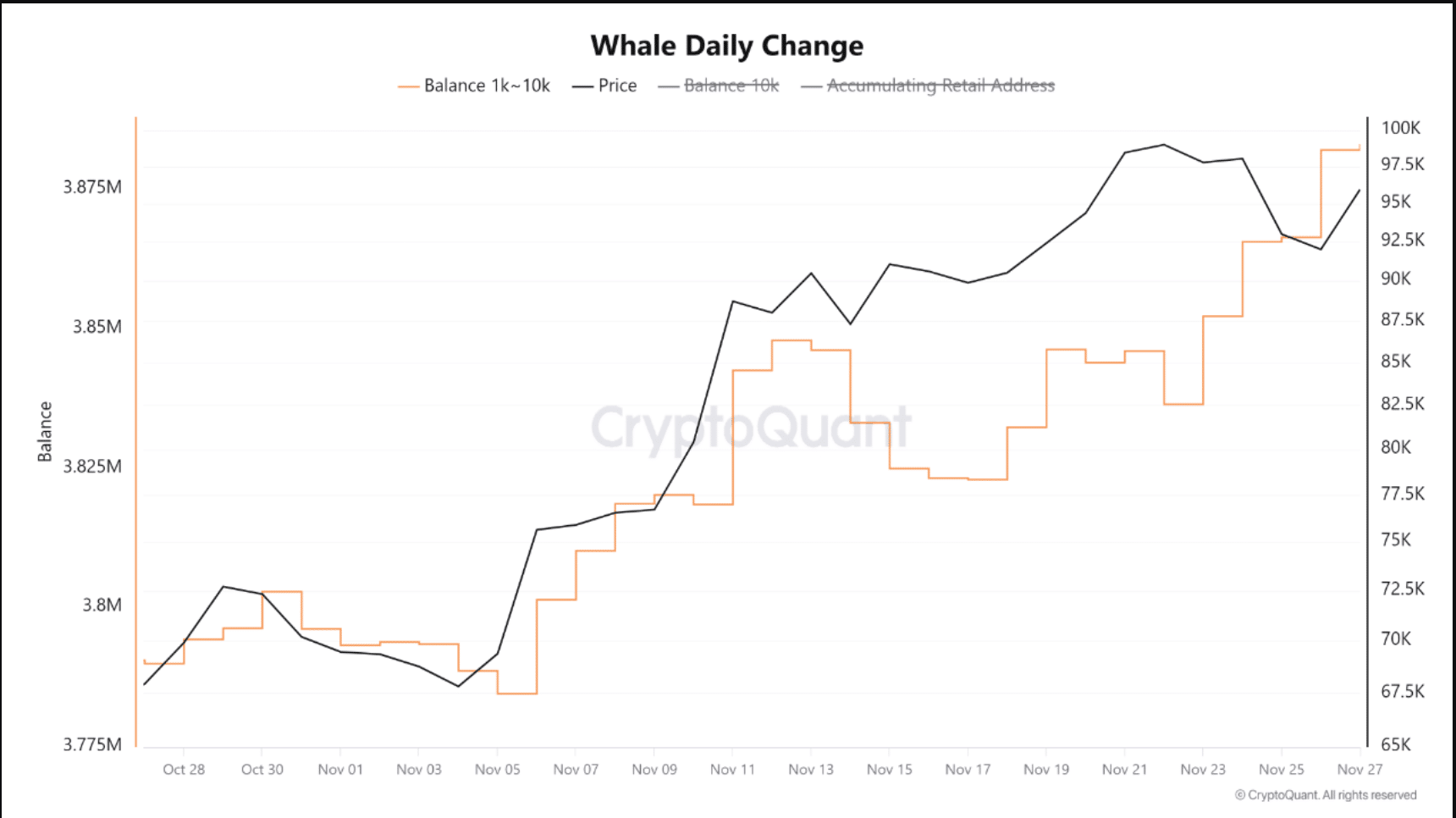

As well as BTC whales are stockpiling the coin. Caueconomy, an creator and analyst at CryptoQuant, posted an analysis revealing that nearly 16,000 BTC entered whale reserves.

This quantity continued to extend, similar to nearly $1.5 billion in on-chain accumulation. This was a transparent instance of ‘purchase the dip’ technique, reflecting the massive pocketed gamers’ confidence in Bitcoin.

Supply: CryptoQuant

Odds of BTC shifting to $100k

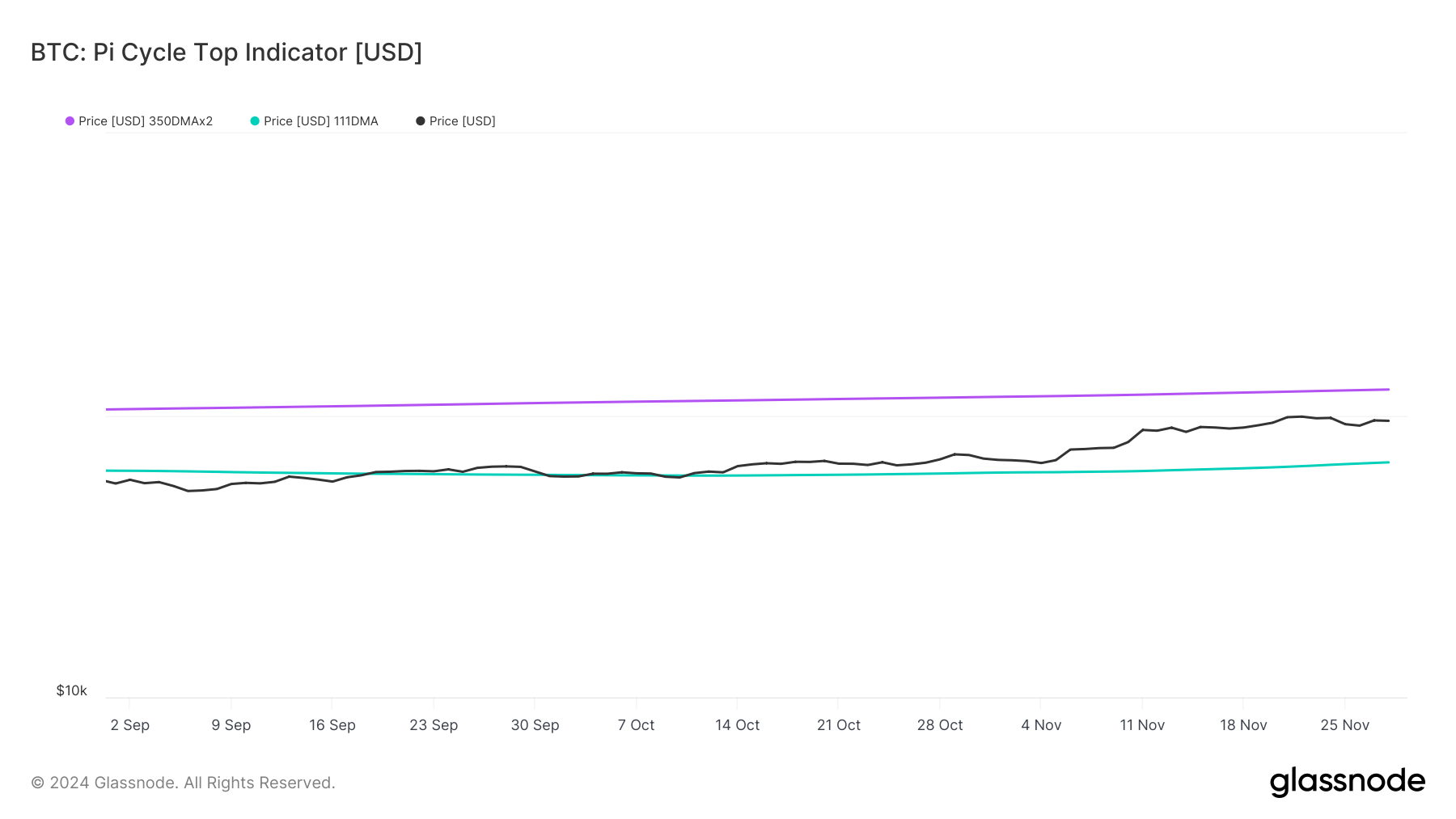

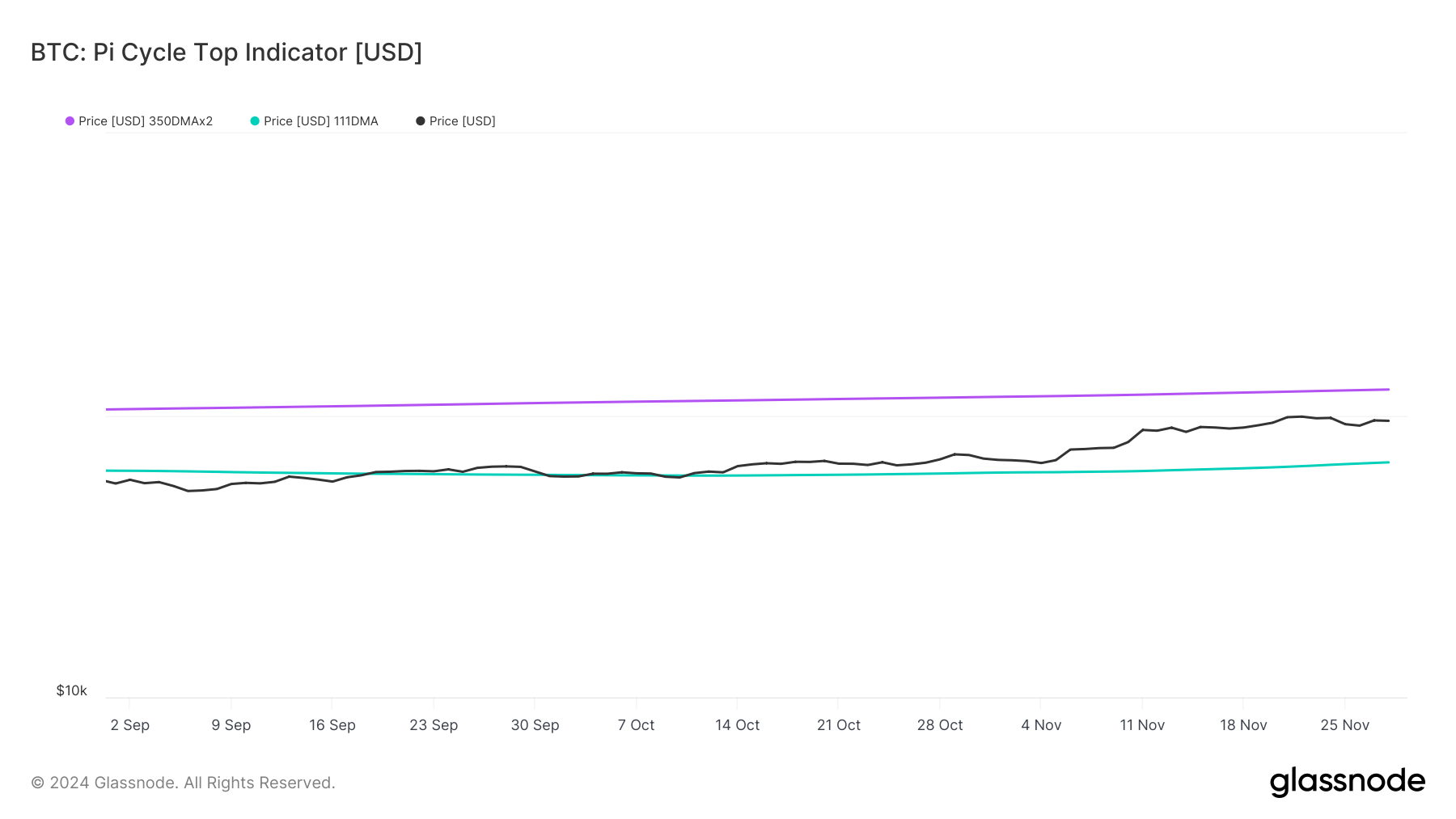

All these metrics that urged a transfer in direction of $100k was additionally backed by Bitcoin’s Pi Cycle high indicator. If the indicator is to be believed, then BTC has a attainable market high above $123k.

Conversely, if BTC’s present worth isn’t its backside, then the king coin may drop to $68k, as urged by the identical indicator.

Supply: Glassnode

AMBCrypto’s evaluation of BTC’s day by day chart revealed that it was testing its resistance of the 9-day MA. In case of a bullish breakout, it’d kickstart a recent rally in direction of $100k as we strategy the festive season.

Actually, after reaching 82, Bitcoin’s Relative Power Index (RSI) dropped to 66.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This meant that there was extra room for purchasing, which may present the required push to interrupt above the resistance within the coming days.

Nevertheless, it should even be essential for BTC to breach the $99k resistance to hit a triple digit worth.

Supply: TradingView