Ethereum Funding Rates surge: Multi-month highs signal bullish sentiment

- Ethereum’s Funding Charges hit 0.03%, signaling bullish sentiment and rising market curiosity.

- The important thing ranges to look at are $3,800 resistance and $3,700 assist as momentum builds.

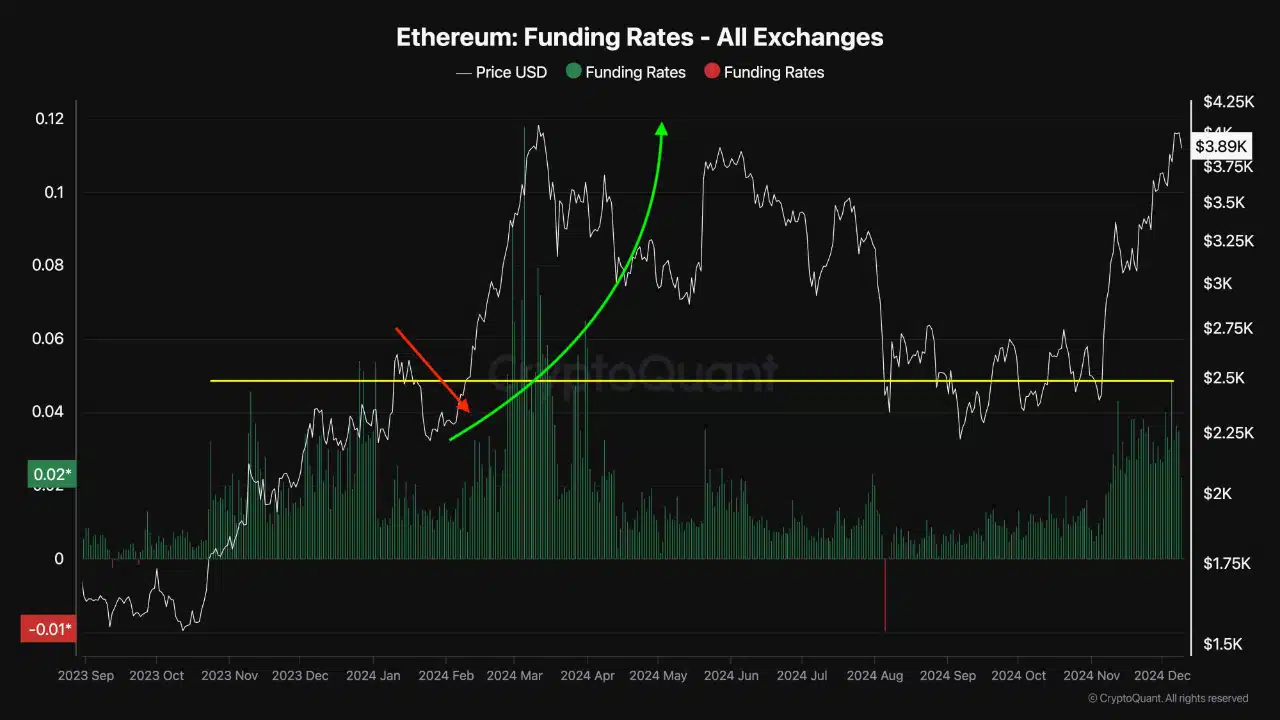

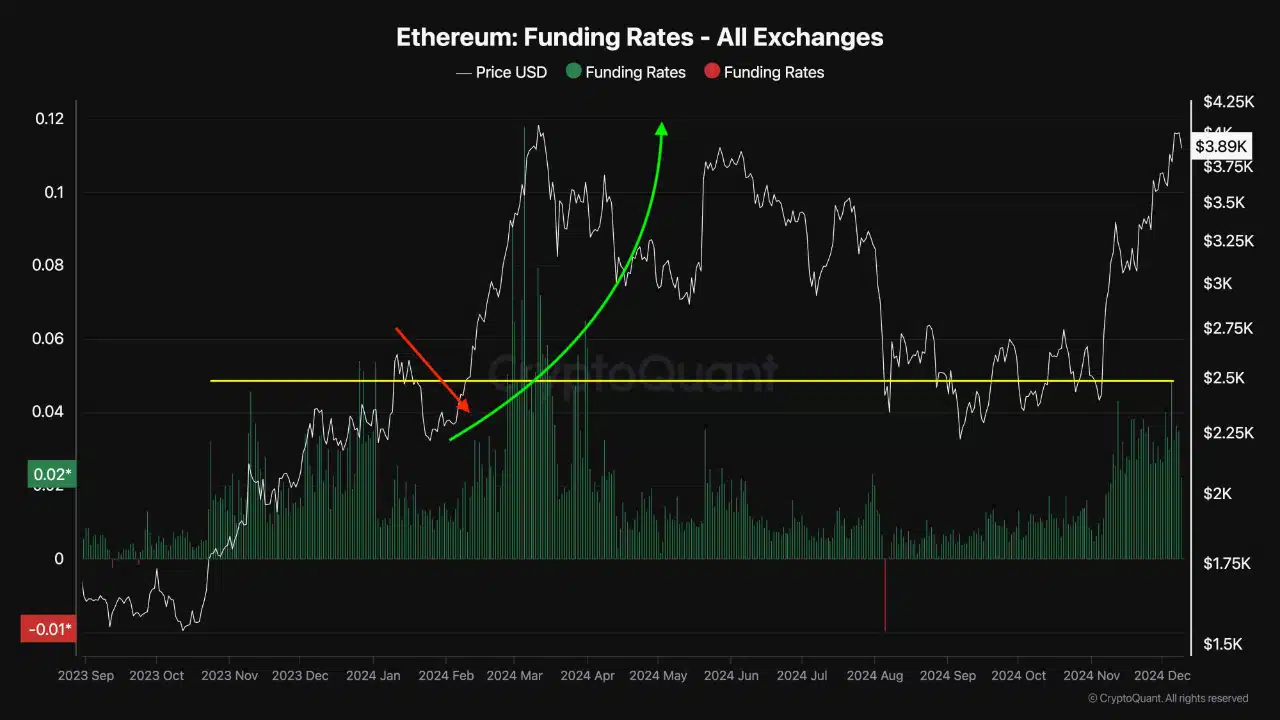

Ethereum’s Funding Charges have surged to multi-month highs, reaching ranges final noticed in January 2024, when ETH skilled an 88% rally. This enhance displays rising bullish sentiment within the derivatives market, pushed by an increase in open curiosity and shifts in dealer positions.

The metrics counsel potential upside momentum for Ethereum because the market watches important worth ranges.

Ethereum Funding Charges hit a significant milestone

The Ethereum Funding Charges chart, per CryptoQuant, reveals a big enhance to 0.03%, marking a pivotal second in market dynamics.

Elevated funding charges traditionally point out merchants leaning closely towards lengthy positions, reflecting expectations of additional worth development. In January 2024, when funding charges reached comparable ranges, Ethereum launched into a pointy upward rally.

This funding price milestone might now foreshadow renewed bullish developments if historic patterns maintain.

Supply: CryptoQuant

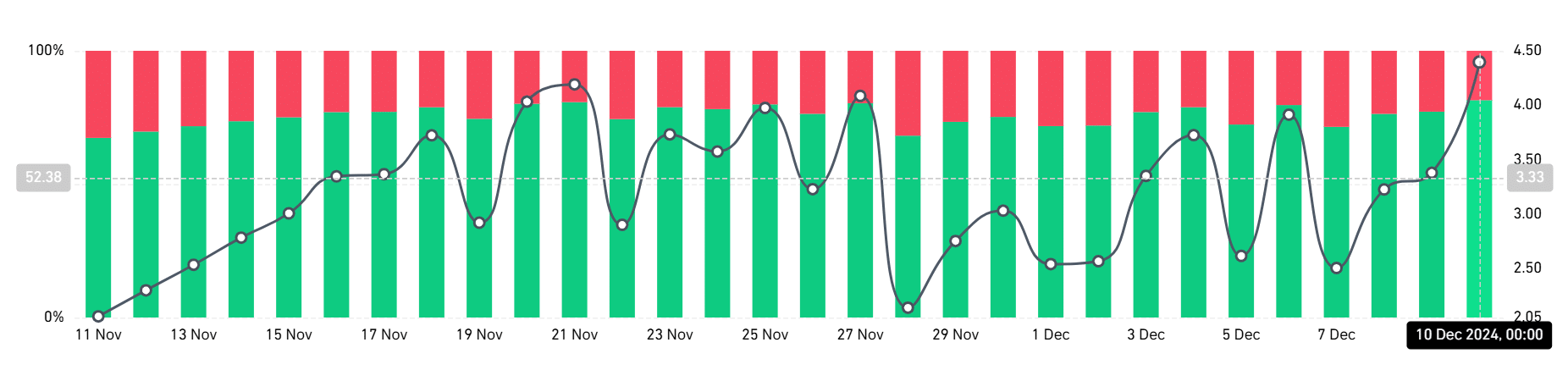

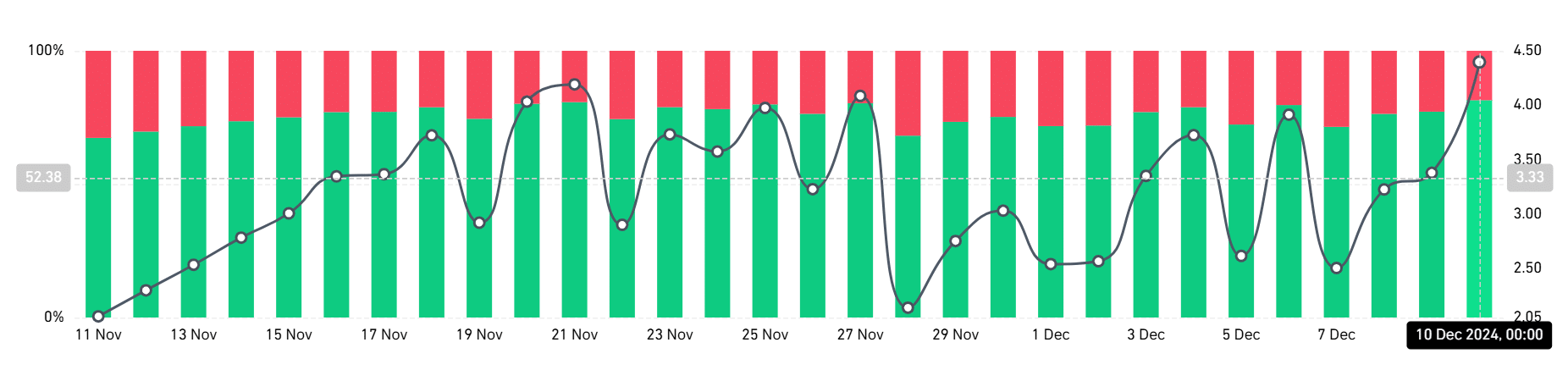

Lengthy/brief ratio reveals nuanced market sentiment

The lengthy/brief ratio, per Coinglass, was 0.9301% at press time, with lengthy positions accounting for 48.18% and brief positions at 51.81%.

Nonetheless, analyzing the variety of dealer accounts reveals a stark distinction, with lengthy accounts at 81.47% and brief accounts at 18.53%, leading to a long-to-short account ratio of 4.40.

This disparity highlights a market the place fewer merchants maintain giant brief positions whereas a big majority are betting on Ethereum’s long-term worth appreciation.

This imbalance might result in heightened volatility, as any substantial liquidation might set off sharp worth actions.

Supply: Coinglass

Open curiosity: Rising market participation

Ethereum’s open curiosity rose to over $19.5 billion, reflecting elevated buying and selling exercise and rising investor curiosity in ETH derivatives. This regular rise in open curiosity, mixed with greater Ethereum Funding Charges, signifies a robust influx of capital into the market.

Traditionally, such circumstances have preceded main worth actions, and the present pattern means that Ethereum could also be poised for one more important rally.

Nonetheless, the open curiosity has dropped considerably lately. The evaluation confirmed a drop to round $17.5 billion. Regardless of the drop, the bullish sentiment stays excessive.

Momentum builds round key Ethereum ranges

Ethereum is buying and selling at $3,722.55, sustaining a constructive momentum. The each day chart displays a robust bullish construction, with key technical indicators aligning to assist additional development.

The 50-day transferring common, at the moment at $3,140, offers strong assist, whereas the 200-day transferring common at $3,003 confirms a long-term uptrend. The Relative Energy Index (RSI) is at 57.74, indicating reasonable bullish sentiment.

Supply: TradingView

Ethereum lately examined resistance close to $3,800 however encountered promoting strain, resulting in a slight pullback. A profitable breakout above $3,800 might pave the way in which for Ethereum to check the psychological $4,000 mark.

On the draw back, fast assist lies at $3,700, with stronger assist close to the 50-day transferring common.

Buying and selling volumes have additionally elevated with open curiosity and the Ethereum Funding Charges, signaling sturdy market participation and lowering the chance of false breakouts. This convergence of metrics reinforces the bullish case for Ethereum’s worth motion.

The surge in Ethereum Funding Charges, rising open curiosity and a nuanced lengthy/brief ratio replicate the market’s growing optimism about Ethereum’s future.

Learn Ethereum (ETH) Value Prediction 2024-25

Whereas historic developments level to the potential for a big rally, merchants ought to be conscious of potential volatility attributable to over-leveraged positions.

Ethereum’s capacity to interrupt above key resistance ranges will decide whether or not this bullish momentum may be sustained within the coming days.