XRP in first major pullback since November: Key price levels to watch

- XRP profit-taking intensifies within the second week of December as bullish exercise cools off.

- A recap of XRP spot flows and the state of the derivatives section.

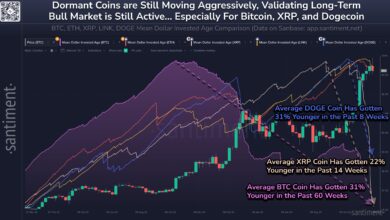

Simply over per week in the past, Ripple’s native coin XRP was having fun with strong bullish momentum. It even achieved a brand new 8-month excessive within the first week of December, constructing on the momentum it achieved in November.

XRP has since bulled again from the current prime as merchants took some income off the desk. For context, XRP topped out at $2.90 on third December. It has since pulled again to a weekly low (to this point) of $1.90, which was equal to a 20% pullback.

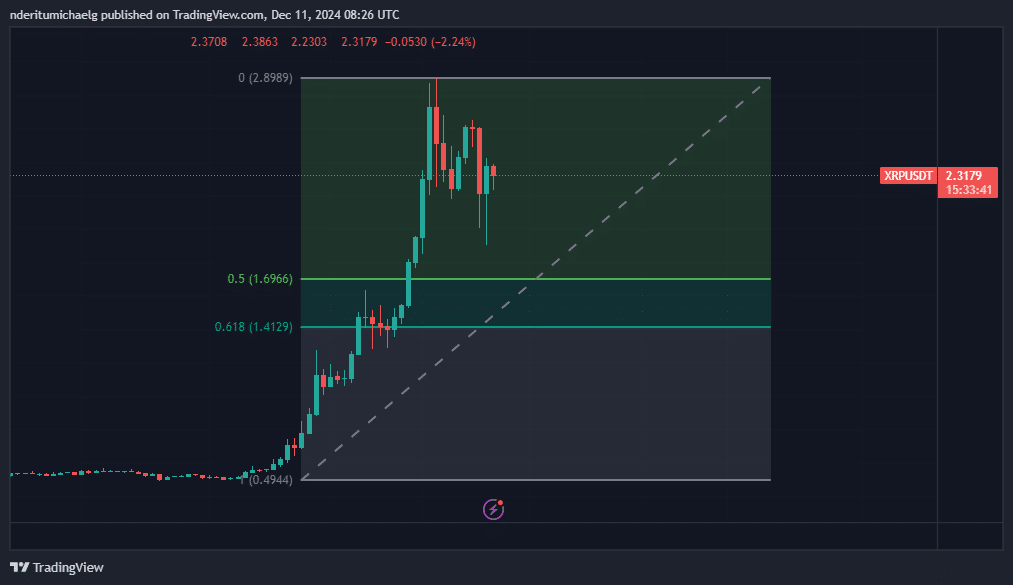

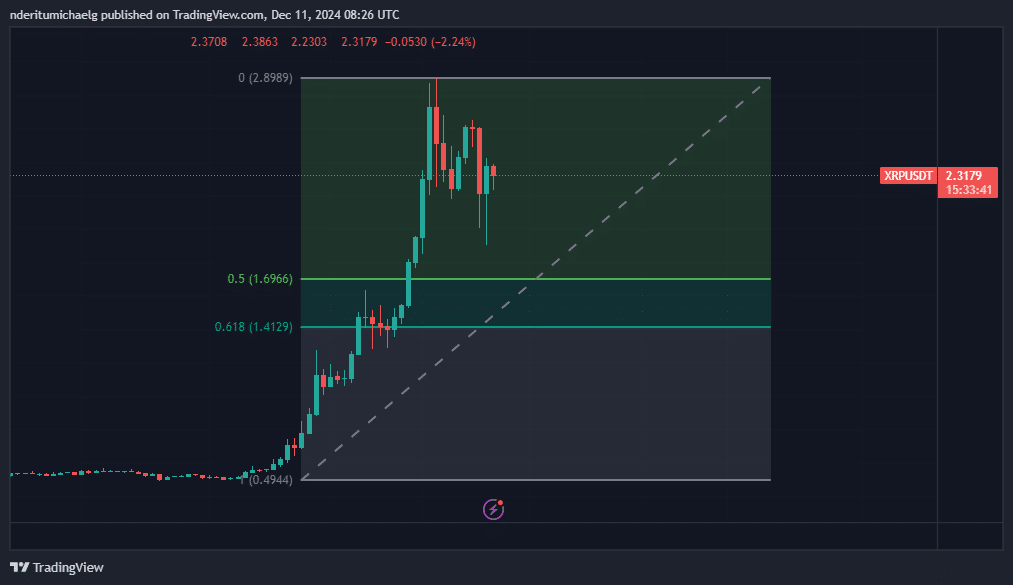

This pullback means we now have a tough concept of the place the most recent rally and began and ended. Mapping a Fibonacci retracement indicator on the underside to prime vary revealed that worth might drop to the $1.41 to $1.69 vary.

Supply: TradingView

The cryptocurrency exchanged fingers at $2.31 on the time of writing. This was after an surprising pullback throughout Tuesday’s buying and selling session. This implies that buyers anticipate extra upside, therefore the resurgence of demand.

Sustained promote stress as market sentiment shifts away from greed to worry might pave the best way for extra XRP draw back. An evaluation of demand and provide forces assist paint a clearer image of the cryptocurrency’s demand ranges.

XRP spot flows point out that the very best spot inflows into the cryptocurrency had been noticed in the beginning of December. Inflows peaked at 177.33 million on 1st December and the most recent influx determine on tenth December got here in at $11.35 million.

supply: Coinglass

The spot flows additionally demonstrated a resurgence of outflows within the final 10 days. XRP outflows peaked at $155.79 million as at 4th December. The entire outflows within the final 10 days have been larger than inflows, reflecting the pullback throughout the identical interval.

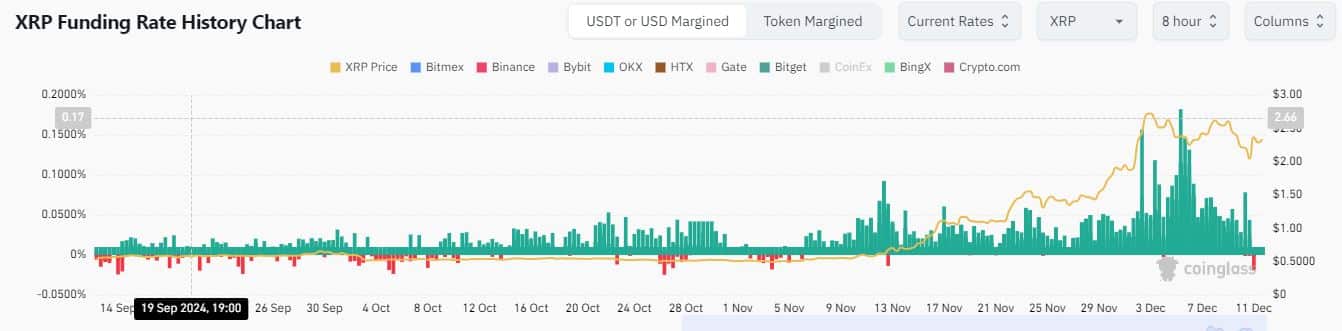

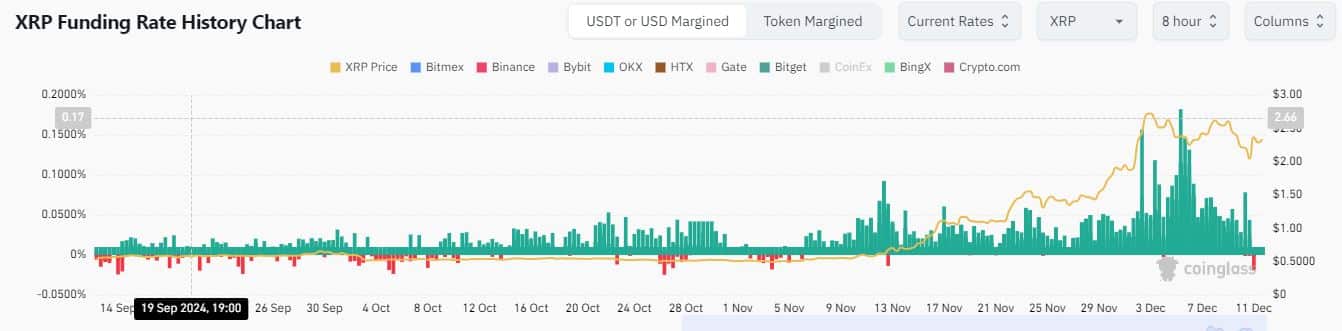

What in regards to the state of affairs within the derivatives section? Effectively, in response to Coinglass, XRP registered a spike in unfavourable funding charges on 11 December. An indication that there was a surge briefly sellers with the rising bearish expectations.

Supply: Coinglass

The unfavourable funding charges emerged after days of declining optimistic funding charges. This was an indication that the earlier strong demand has been cooling down.

Learn Ripple [XRP] Worth Prediction 2024-2025

These observations together with the escalating spot flows point out rising risk that XRP might proceed its descent.

Nonetheless, merchants ought to maintain a watch out for potential adjustments together with demand-inducing occasions that would support XRP bulls. Excessive volatility is anticipated alongside the best way as was the case on Tuesday attributable to liquidations.