Why Toncoin’s recovery may not be sustainable – Mixed signals emerge

- Toncoin’s value rose 3.6% to $6.39, however community exercise, together with swaps and lively addresses, declined.

- Analysts linked value traits to decentralized alternate engagement.

Toncoin [TON] is experiencing a notable restoration after hitting a current low of $5.53 on the tenth of December.

The cryptocurrency, which had confronted a downward pattern in current weeks, has surged by 3.6% up to now day, buying and selling at $6.39 on the time of writing.

Regardless of this uptick, TON remained down by 3.3% over the previous week and almost 3.9% within the final two weeks.

This fluctuating efficiency has caught the eye of analysts, who’ve revealed components driving TON’s value actions.

A CryptoQuant analyst not too long ago shared insights into TON’s community exercise, highlighting a decline in decentralized alternate (DEX) engagement.

The analyst famous a lower within the variety of swaps and out there liquidity swimming pools on TON’s DEX platforms, together with Stone.FI and DeDust.

Traditionally, elevated exercise on these DEXs has been straight correlated with rising TON costs, whereas decreased engagement has accompanied value corrections.

This pattern means that TON’s value volatility, significantly the fluctuation between $7.20 and $5.20, has led to lowered curiosity in decentralized buying and selling and liquidity provision.

Blended alerts emerge

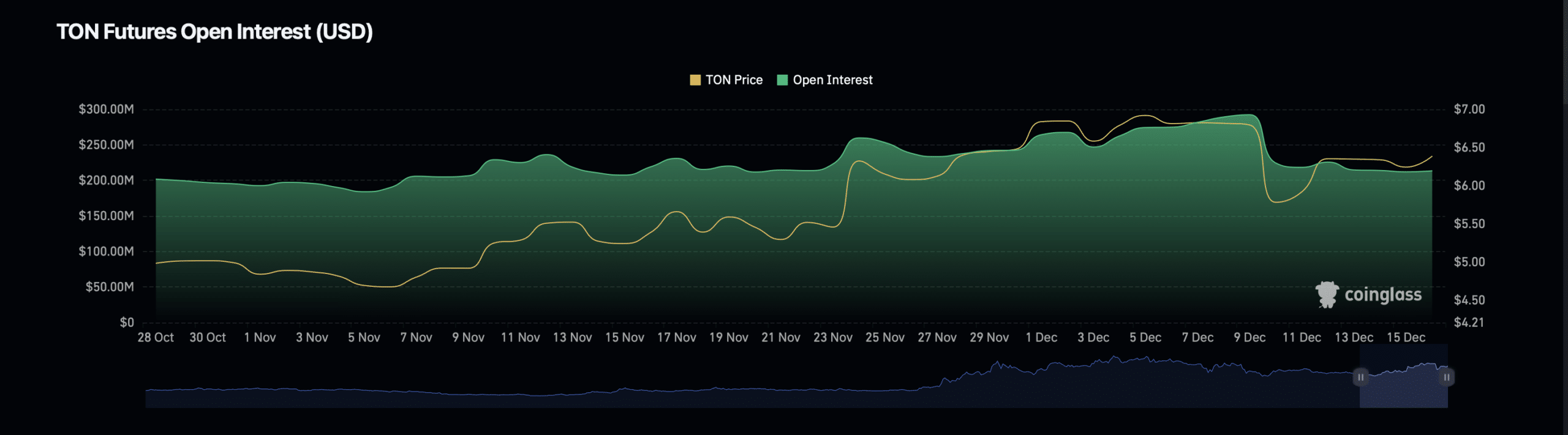

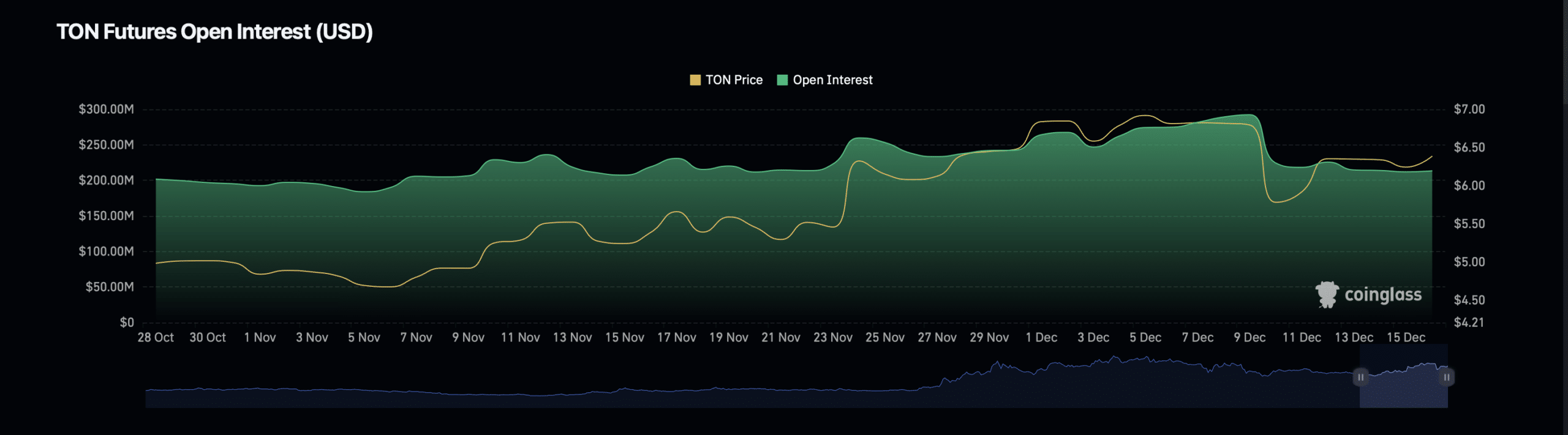

Regardless of the noticed decline in DEX exercise, TON’s Open Curiosity—a measure of the full worth of excellent by-product contracts—has proven optimistic momentum.

Data from Coinglass indicated that TON’s Open Curiosity has elevated by 2.77%, reaching $214.07 million. Equally, the Open Curiosity quantity has risen by 7.10%, now valued at $169.73 million.

Supply: Coinglass

These metrics recommend renewed curiosity from merchants and buyers in TON’s derivatives market, doubtlessly signaling a extra optimistic outlook for the cryptocurrency.

Nonetheless, knowledge from Glassnode painted a much less favorable image. Notably, TON’s lively addresses, which point out the variety of distinctive customers participating with the community, have been on a constant decline.

Supply: Glassnode

Energetic addresses have dropped from 3.8 million in late October to only 1 million as of the fifteenth of December.

Learn Toncoin’s [TON] Value Prediction 2024–2025

This important discount displays waning consumer engagement, which may pose challenges for sustaining value momentum in the long run.

The drop in lively addresses could point out a lower in retail participation or general curiosity within the TON ecosystem, doubtlessly limiting community development and adoption.