What next for Ethereum’s price after 20.8M outflows on Binance

- Ethereum struggled under $4,000, with Binance outflows suggesting potential long-term accumulation.

- Damaging social sentiment mirrored December 2023 tendencies, probably signaling a bullish restoration for ETH.

How giant withdrawals may affect ETH worth?

Roughly 20.8 million ETH have been withdrawn from centralized exchanges over the previous two months, a pattern harking back to the 2021 bull market. Binance has been central to this motion, accounting for over 7.8 million ETH, or 33-39% of the full outflows.

CryptoQuant analyst Crazzyblockk suggests these withdrawals might sign long-term accumulation or staking, reflecting investor confidence.

These important outflows from Binance point out the platform’s continued affect on the cryptocurrency market, particularly in balancing provide and demand for Ethereum.

With Binance’s affect, backed by its 250 million international customers and $21.6 billion in deposits, these outflows may scale back ETH’s provide on exchanges, probably creating upward worth stress if demand stays robust.

Ethereum market efficiency

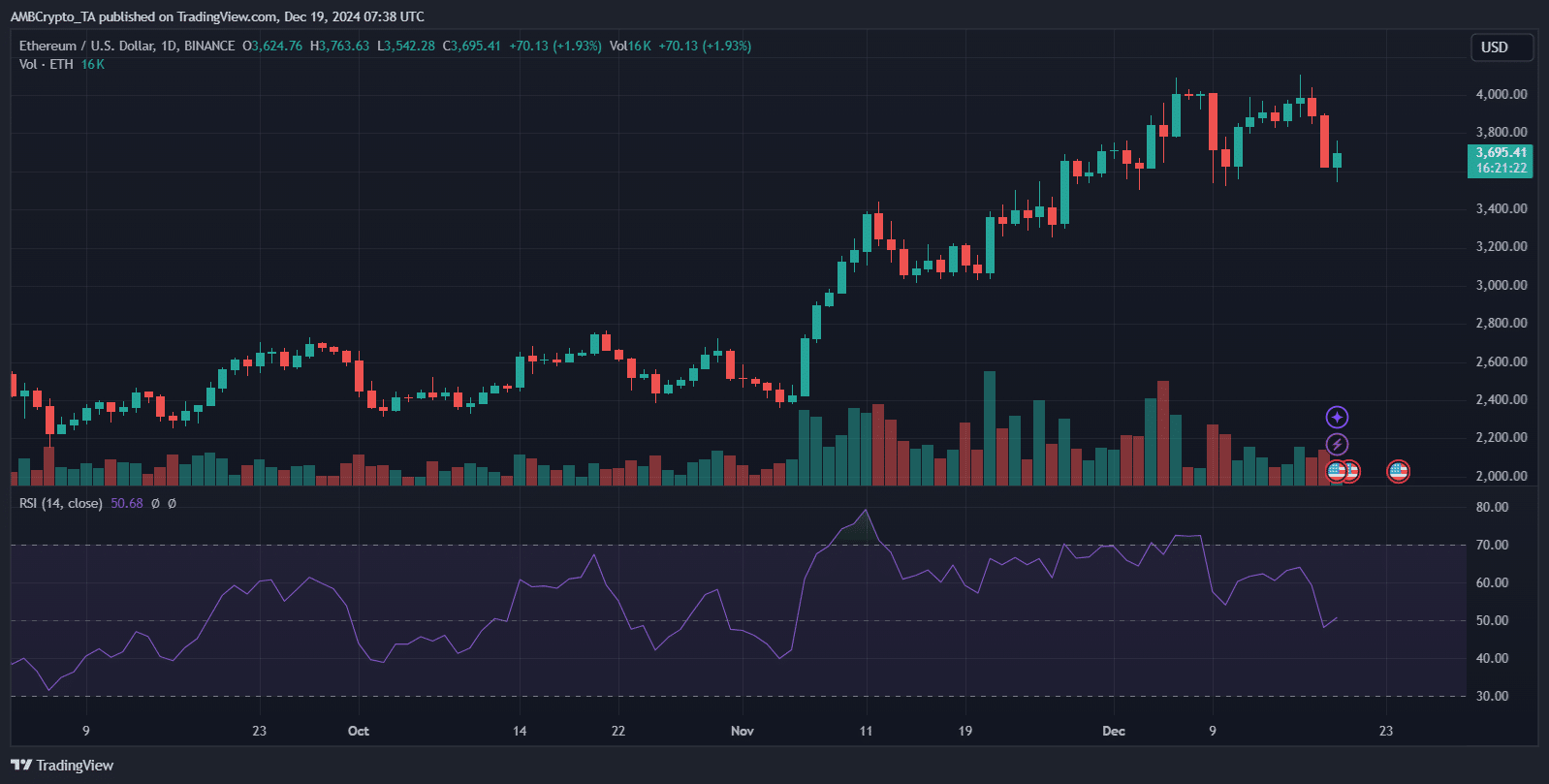

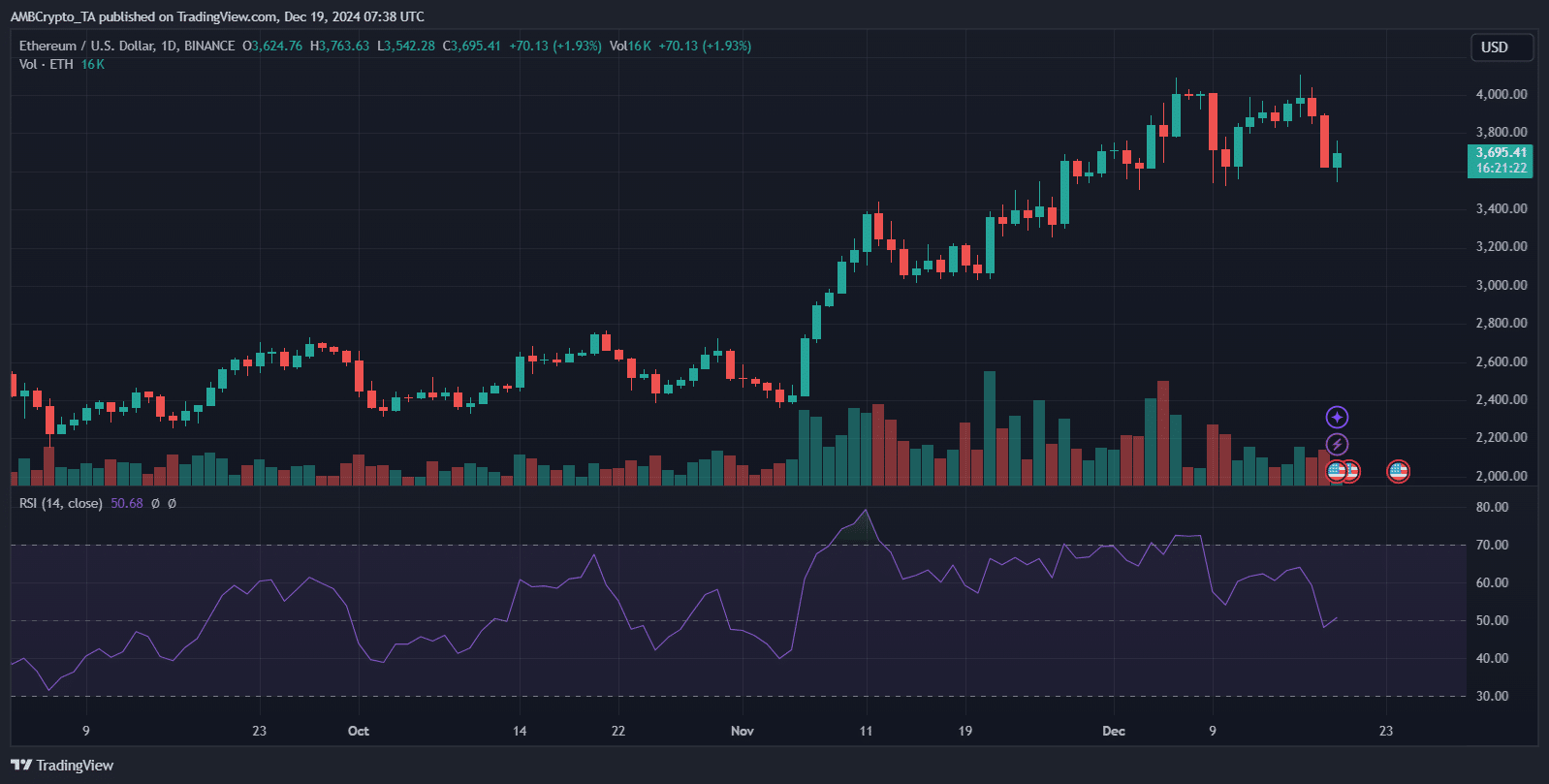

Ethereum has struggled to match Bitcoin’s bullish momentum, failing to breach the $4,000 resistance regardless of the broader crypto market rally.

Whereas Bitcoin has posted new all-time highs nearly month-to-month, Ethereum’s beneficial properties stay modest. Ethereum has seen a 2.3% weekly improve in comparison with Bitcoin’s 5%.

Supply: TradingView

Even constructive information, comparable to Deutsche Bank’s rumored Ethereum-based layer-2 blockchain leveraging ZKsync expertise, has did not inject upward momentum. Technical evaluation suggests bearish alerts, hinting at a possible worth correction to $3,400.

Ethereum’s present lack of breakout potential highlights its challenges in sustaining investor confidence, regardless of current outflows pointing to long-term accumulation tendencies.

Learn Ethereum’s [ETH] Value Prediction 2024-25