AVAX under pressure? Traders, THESE are the key price levels to watch!

- Buying and selling at approx. $36.72, AVAX/USDT confirmed indicators of a prevailing bearish development

- Decline in OI gave the impression to be in keeping with AVAX’s incapability to maintain its upward momentum above $55 in November

Avalanche (AVAX), a blockchain platform famend for its high-speed transactions, is at the moment present process a significant value correction on the charts. With a price of $36.72, AVAX/USDT gave the impression to be displaying indicators of a bearish development at press time.

Actually, the broader market decline, coupled with technical indicators, painted a quite difficult image for the altcoin.

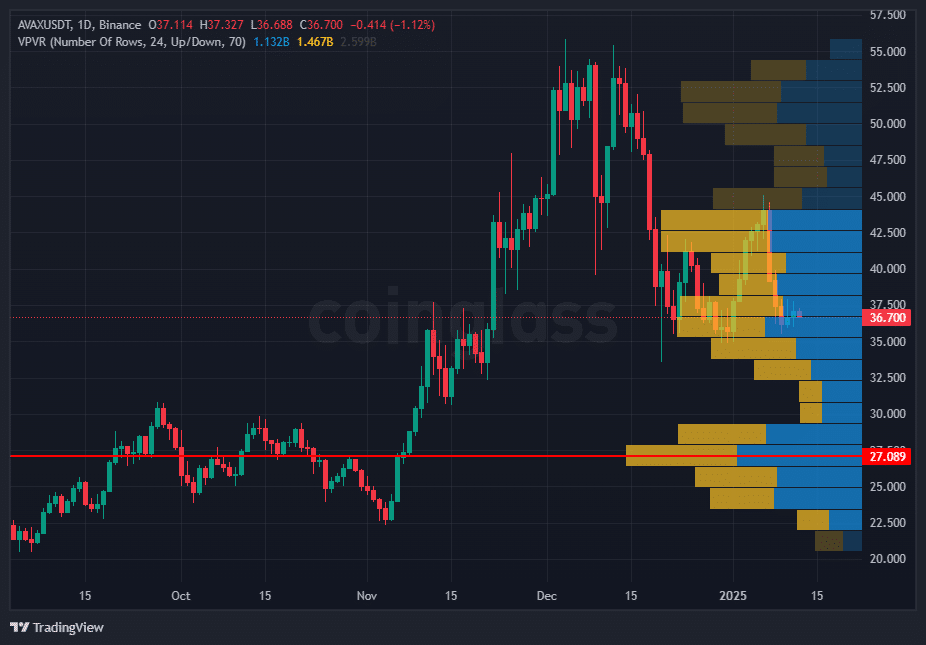

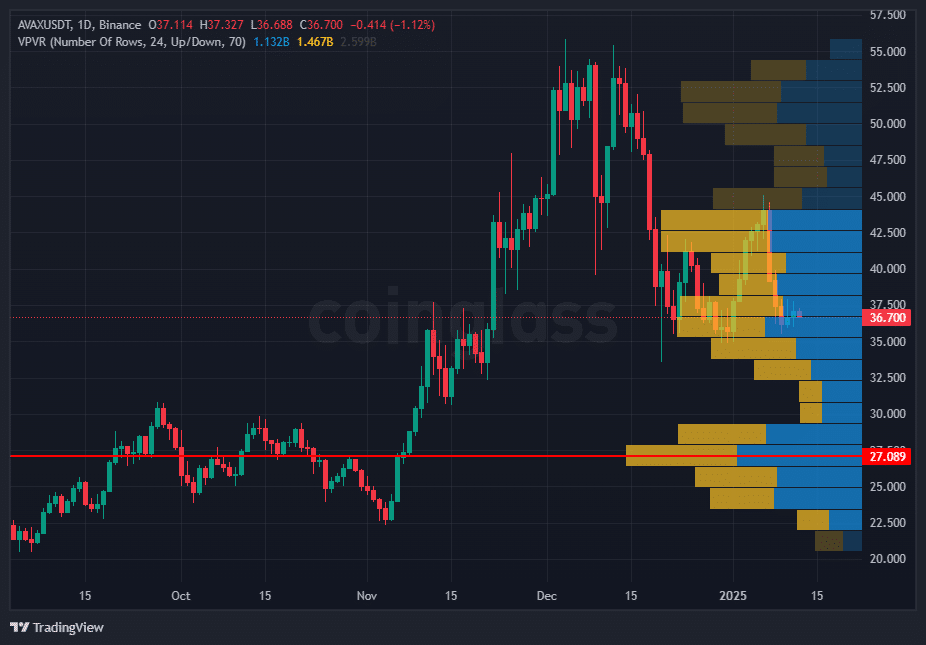

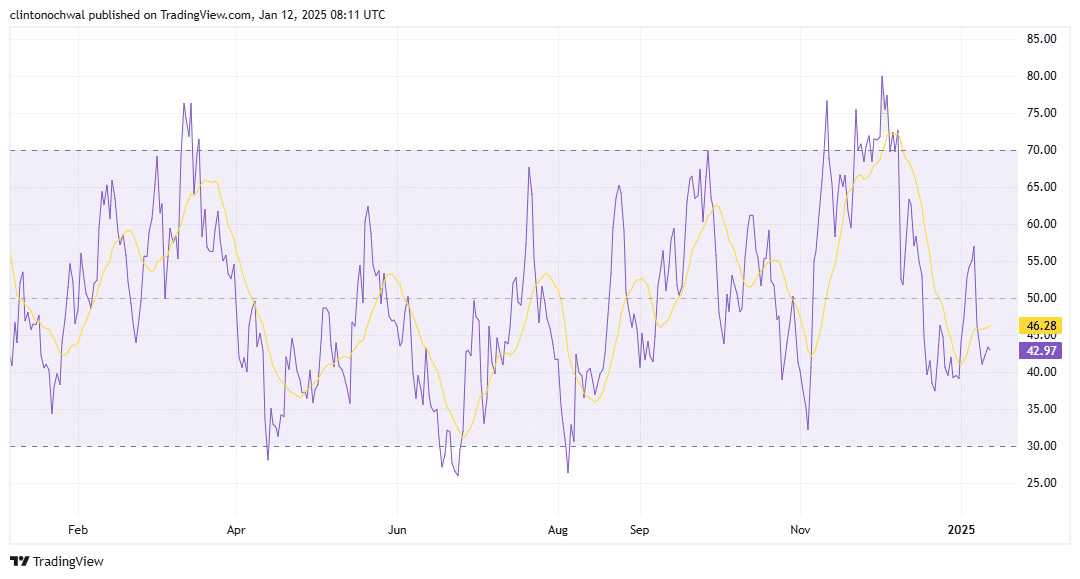

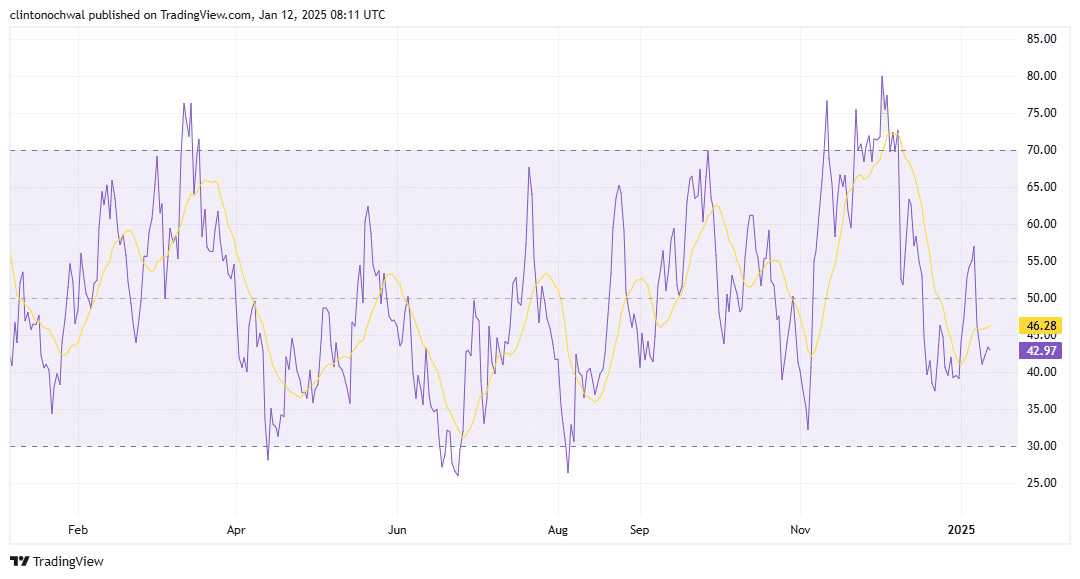

VPVR signifies sturdy resistance

The evaluation revealed a big cluster of buying and selling exercise between the $40 and $42-levels, highlighted by the Quantity Profile Seen Vary (VPVR).

This area mirrored sturdy resistance, the place a big variety of merchants beforehand executed purchase or promote orders. Regardless of makes an attempt to interrupt above this vary throughout December’s rally, AVAX confronted constant rejection, reinforcing bearish sentiment.

Supply: Coinglass

On the draw back, the VPVR highlighted a key help stage round $27. This stage aligned with a earlier accumulation zone marked by excessive historic exercise, indicating potential shopping for curiosity. A breach of this help might result in additional draw back, probably concentrating on the $25 vary.

Given AVAX’s latest failure to maintain momentum close to $55, it additionally fashioned a sample of decrease highs and decrease lows. This basic bearish setup suggests continued downward strain, except a catalyst propels the token above its resistance zone.

Gauging market participation

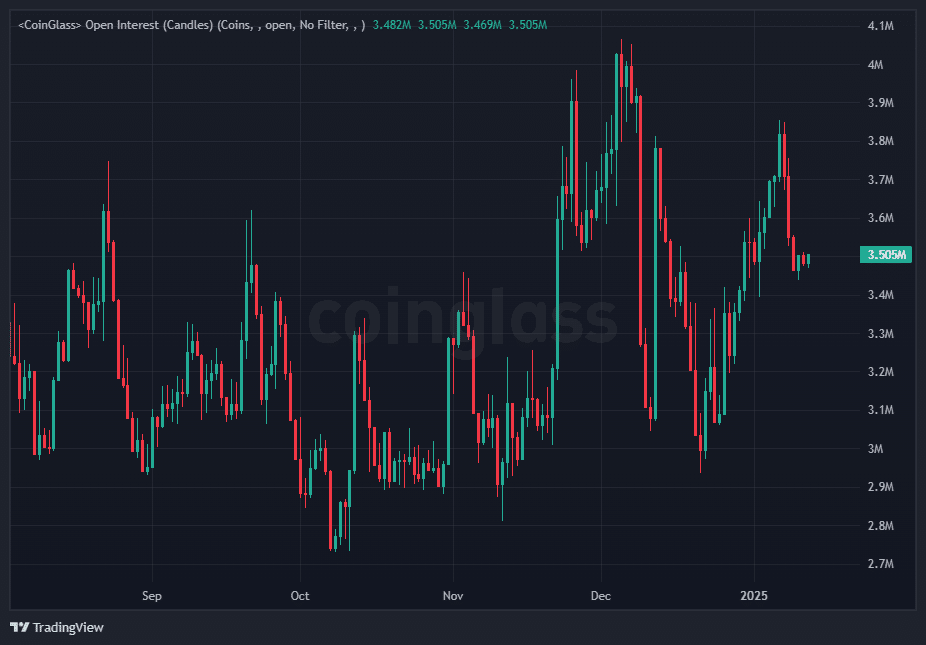

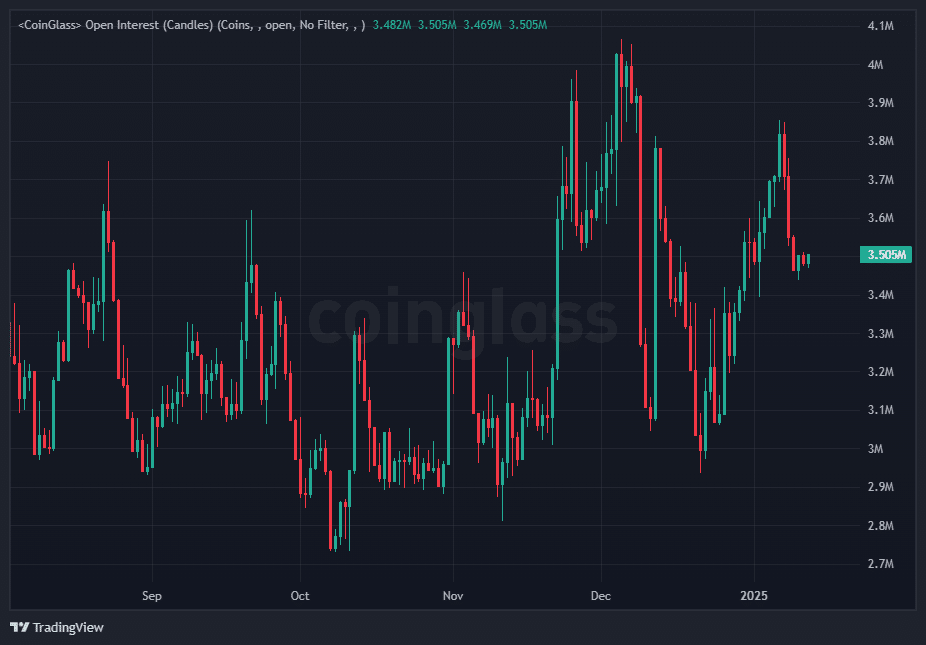

Latest information revealed a decline in OI, alongside the value drop, signaling a discount in speculative curiosity. This development steered that merchants could also be exiting positions, probably as a result of diminished confidence in AVAX’s short-term restoration.

Supply: Coinglass

The decline in OI was in keeping with AVAX’s incapability to maintain its upward momentum above $55 in November.

A falling OI throughout a value correction usually factors to lengthy positions being closed, reflecting uncertainty and bearish sentiment. Moreover, it might point out that merchants are ready for stronger directional cues earlier than re-entering the market.

To reverse this sentiment, AVAX would wish a sustained hike in each value and OI. Rising OI accompanied by a transfer above the $40-$42 resistance zone would recommend renewed confidence amongst market members.

Nevertheless, if the OI continues to drop whereas the value exams decrease help ranges, it might verify the dominance of bearish momentum, with the $27-zone changing into the subsequent focus for merchants.

Oversold or room for additional declines?

On the every day chart, AVAX’s RSI has been trending beneath the impartial 50-level – An indication of ongoing bearish momentum. On the time of writing, the RSI was hovering close to 35 – Inching nearer to the oversold threshold of 30.

Supply: TradingView

This studying highlighted weakening shopping for strain, which aligned with the token’s decrease highs and decrease lows sample. Whereas an oversold RSI can typically set off a short-term bounce, the dearth of sturdy bullish catalysts pointed to restricted upside potential within the quick time period.

If the RSI falls beneath 30, it might point out an oversold situation, attracting discount hunters and doubtlessly resulting in a brief restoration. Nevertheless, a failure to regain power above 45 might reinforce the bearish development, with additional draw back doubtless.

For bulls to regain full management, the RSI would wish to climb decisively above 50, coinciding with a breakout above key resistance zones like $42.

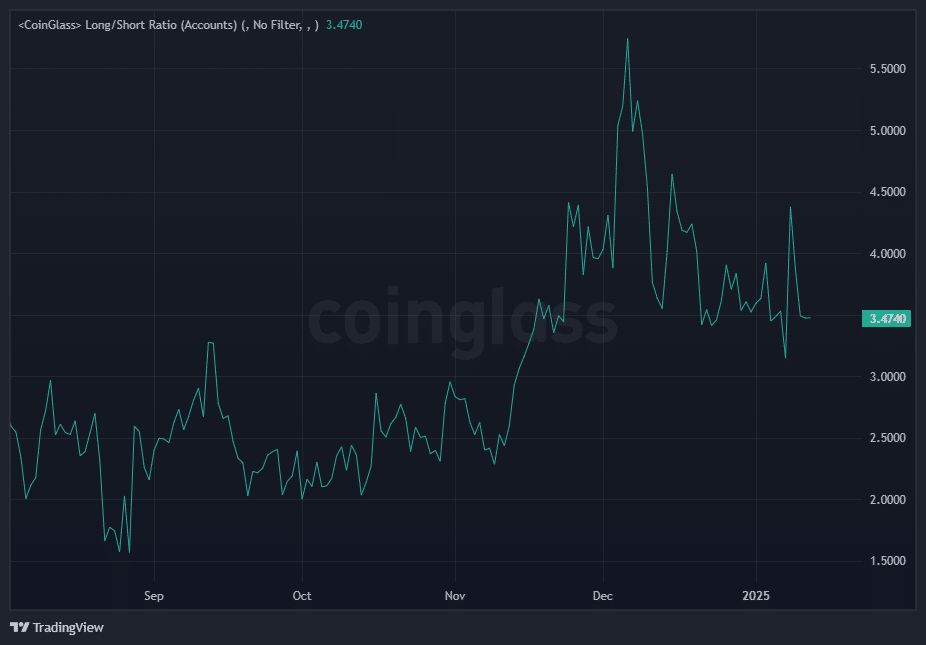

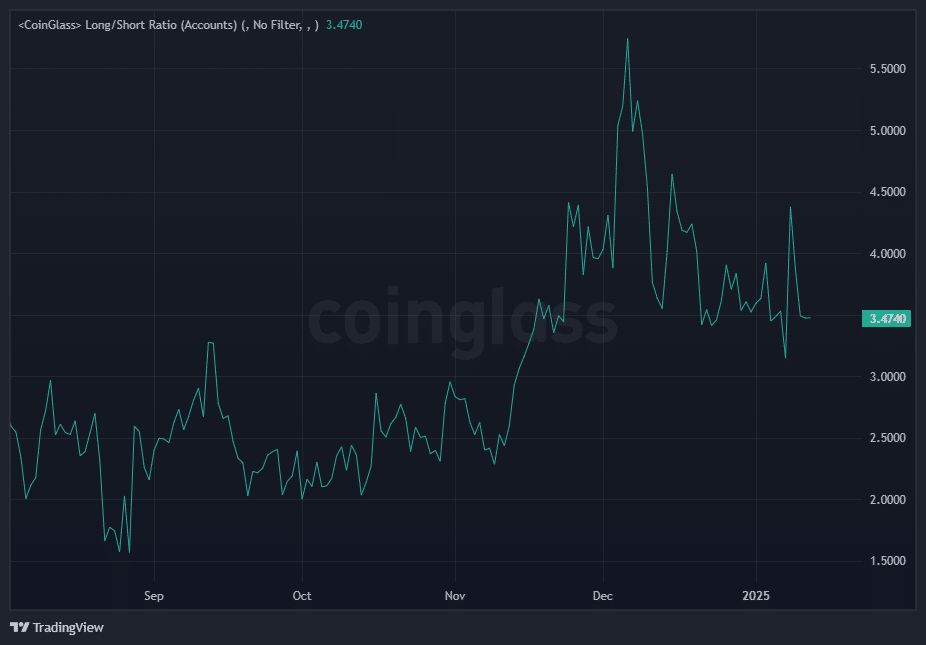

Sentiment and market bias

Lastly, latest information indicated a rising variety of brief positions relative to longs within the AVAX/USDT market – One other signal of bearish sentiment amongst market members.

Supply: Coinglass

On the time of writing, this hike briefly positions was in keeping with the broader downward development and the rejection from the $40-$42 resistance zone.

A rising shorts ratio implies that merchants are positioning themselves for additional draw back, anticipating a possible breakdown beneath the $27-support stage.

Nevertheless, excessive imbalances within the Lengthy/Shorts Ratio can typically act as a contrarian sign. If shorts change into overly dominant, brief squeezes the place the value rises sharply to liquidate extreme brief positions can happen – Resulting in momentary value spikes.

For a bullish shift, the Lengthy/Shorts Ratio would wish to stabilize or present a desire for lengthy positions, indicating renewed confidence amongst merchants. Till then, the rising brief curiosity would help the prevailing bearish outlook, with value motion more likely to stay below strain.