Solana mulls slashing inflation to 1.5% – What’s behind the move?

- Solana has proposed to scale back the inflation fee from 5.7% to 1.5%

- Stakers are apprehensive that the proposal would minimize their yields

The Solana [SOL] group has proposed slashing the community annual inflation fee (token emission) to 1.5%, pushed by market circumstances. Tushar Jain, Managing Companion at Multicoin Capital, made the proposal and faulted the present inflation mannequin.

In a latest interview on the Lightspeed podcast, Jain summarized the proposal as,

“Our concept is to make emission fee pushed by market forces. Proper now, we emit the identical quantity of SOL tokens irrespective of the market circumstances. We’re proposing a sensible emission schedule that may dynamically incentivize participation/staking. “

Jain added that the present mannequin emits “greater than essential” SOL tokens to safe the community. He believes this ought to be diminished to a minimal.

Extra causes to deal with SOL inflation

For context, the first inflation stress comes from validator staking or locking up customers’ SOL to safe and run community operations. In return, stakers earn a charge within the type of SOL tokens, which provides to the availability.

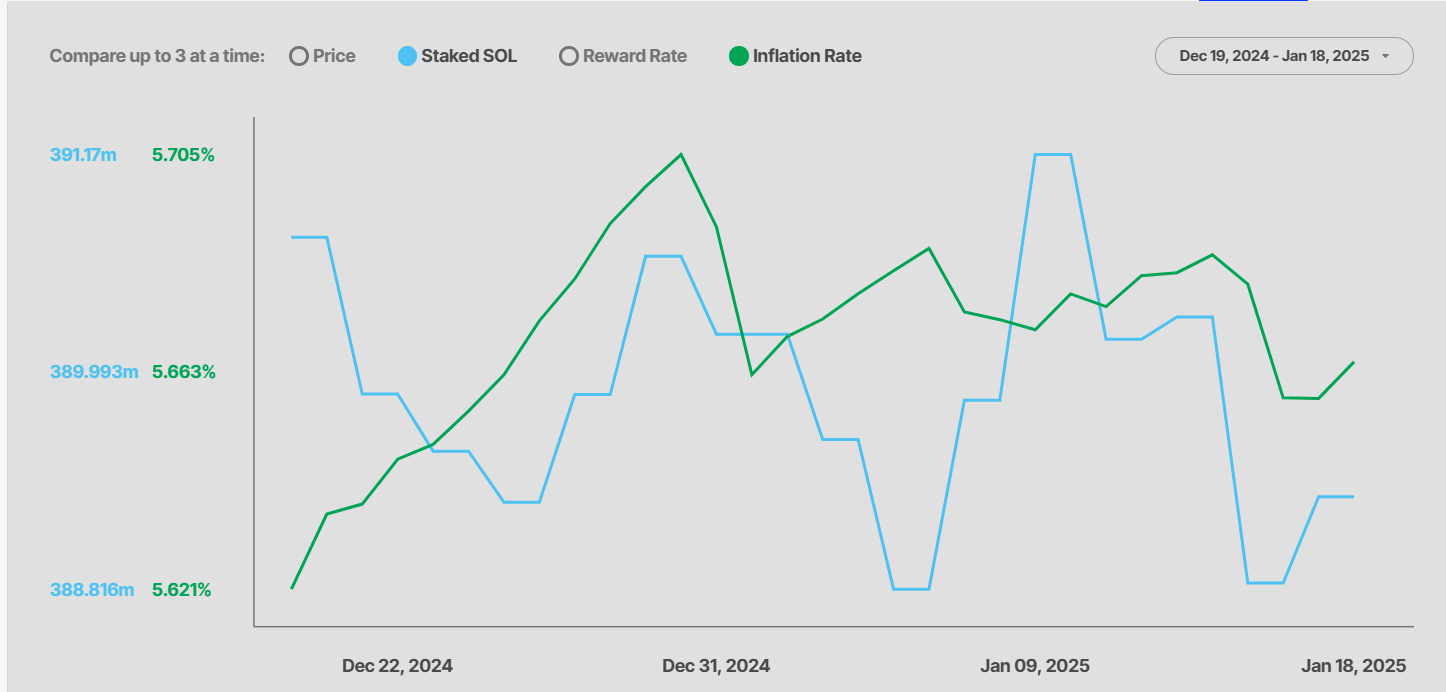

Jain stated that about 100 million SOL has been added to produce since 2021. Out of the entire provide of 592.4 million, 391 million tokens are locked in staking, translating to 66% of the general provide.

The proposal eyes 50%-66% staked SOL, stating any greater than 67% doesn’t assist community safety.

“Past 67% incremental staked SOL doesn’t add any incremental safety ensures as a result of a supermajority of all SOL has voted on any given block and a long-range assault is unimaginable.”

Nonetheless, something beneath 33% might expose the Solana community to safety danger. Value stating although that the proposal’s advantages transcend market effectivity. It might additionally scale back promoting stress as validators could also be compelled to promote their tokens to pay their tax obligations.

Moreover, it will enhance SOL’s optics as excessive inflation would deter others from holding the tokens to devaluation.

Value stating, nevertheless, that not all members appear proud of the proposal. A pseudonymous DeFi analyst, Ignas, famous that the yield from staking SOL would drop if the proposal is adopted. He said,

“To be sincere, I don’t need the $SOL Inflation Discount Act to go. I do know it’ll however I used to be actually proud of my 20% to 30% APY on $SOL multiply swimming pools in Kamino.”

In keeping with MC, the present mannequin solely advantages stakers and diluted non-stakers. If inflation is diminished, even non-stakers may benefit as their stash wouldn’t be devalued. Moreover, Multicoin Capital believes that it might spur DeFi exercise within the ecosystem.