Bitcoin Reclaims $27,000, Here Are The Factors Driving The Recovery

Bitcoin started one other restoration development over the weekend and has been on a bullish path since. This follows final week’s unimaginable bearish motion which noticed the digital asset drop beneath the $26,000 mark for the primary time in over a month. Nevertheless, the bulls are starting to select up steam as soon as extra, however what might be driving it?

Bitcoin Accumulation Continues

Now, whereas the decline in costs might have been a deterrent for some, others had taken the chance to refill their baggage. The ‘Wholecoiner’ motion consists of Bitcoin supporters who intention to get their holdings to at the least 1 BTC, making an entire coin.

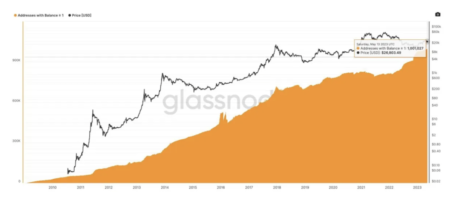

This development has been rising over the previous few years and just lately hit an necessary milestone over the weekend. As of at the moment, there are actually over 1 million addresses which are holding at the least 1 BTC for the primary time in historical past, knowledge from on-chain aggregator Glassnode exhibits.

Addresses holding at the least 1 BTC cross 1 million | Supply: Glassnode

The brand new milestone was reached at a time when cryptocurrencies within the house have been bleeding, presenting a novel alternative for traders to get in at decrease costs. The expectation of higher costs from right here on out, in addition to the uncertainty within the banking business, has additionally been a driver on this accumulation development.

Naturally, when traders are accumulating cash as they’re now, it reduces the provision available in the market. A lowered provide creates shortage and this shortage can result in greater costs. So similar to state of affairs might be what performed out through the weekend.

BTC worth recovers above $27,000 | Supply: BTCUSD on TradingView.com

BTC Investor Sentiment Is On The Rise

As the value of Bitcoin declined during the last week, investor sentiment went down with it, inflicting the Crypto Concern & Greed Index to fall beneath the 50 stage as soon as extra. Whereas the index nonetheless remained in impartial territory, it was bearish on condition that simply a few weeks in the past, the index was sitting at excessive greed.

Nevertheless, as BTC’s worth has bounced again, sentiment has adopted swimsuit. The index is now sitting at a impartial rating of fifty. This places the bears and the bulls at a stalemate, that means both sides must present greater power than the opposite to swing it of their favor.

Regardless of not being again in inexperienced, it’s an enchancment from yesterday’s rating of 48, which was dangerously near plunging the investor sentiment again into the worry territory.

If BTC manages to take care of its present restoration development, then investor sentiment will develop more and more optimistic. Nevertheless, assist at $27,000 remains to be fairly shaky and this implies bears might simply take over the market, particularly if momentum falls.