Mt. Gox moves $1B in Bitcoin—Will it affect BTC’s recovery?

- Mt Gox moved $1B value of BTC to unmarked wallets.

- BTC worth briefly stalled at $92K because the Mt. Gox transfer spooked merchants.

Mt Gox, the defunct Japanese crypto trade, moved $1 billion value of Bitcoin [BTC] throughout the early Asian session on the sixth of March, sparking fears of a brand new FUD that would cap the latest restoration.

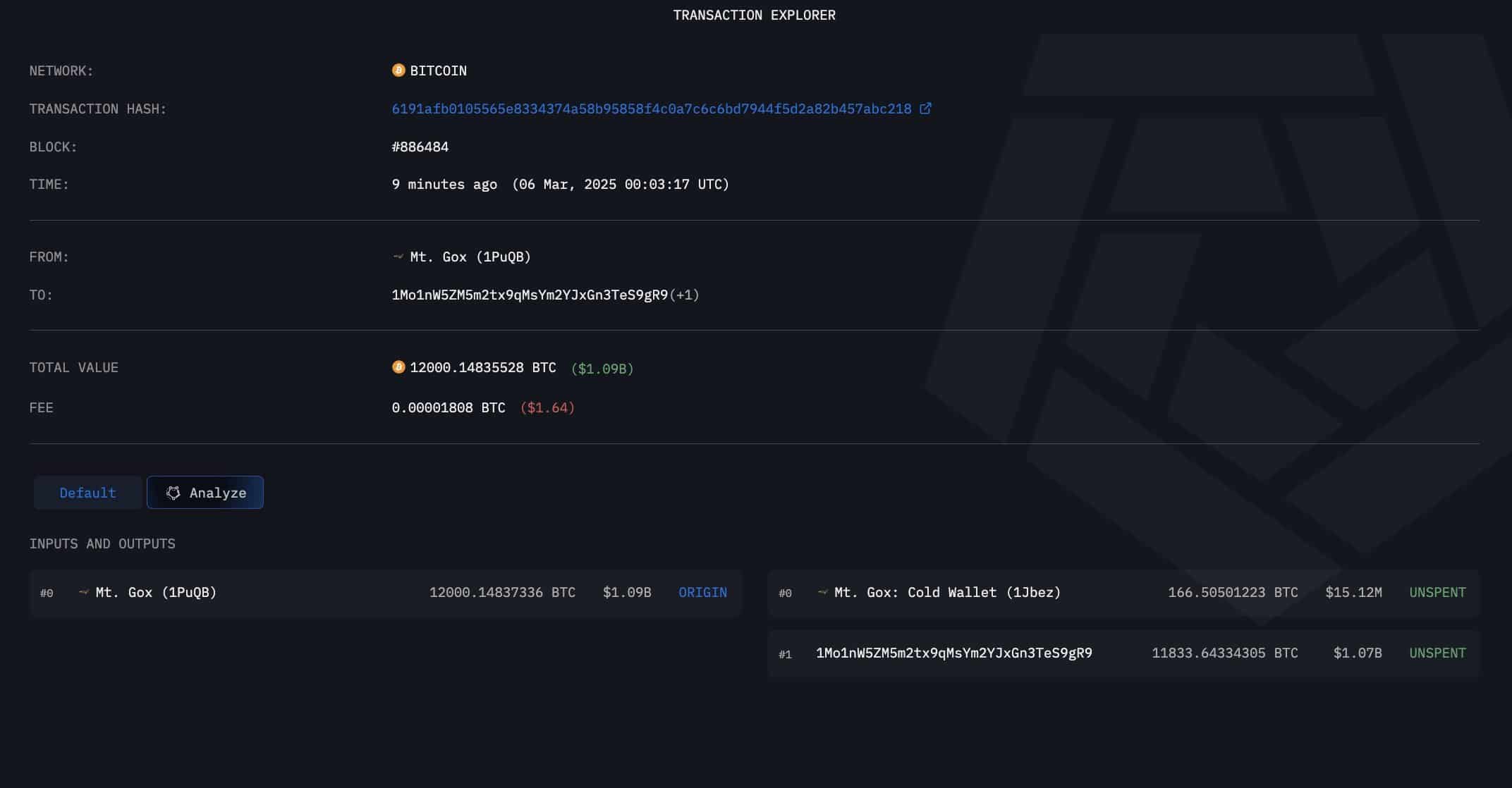

In accordance with Arkham knowledge, the trade transferred 12000 BTC value $1.09 billion, to 2 unmarked wallets. One of many wallets obtained $1.07 billion, whereas $15 million BTC was despatched to a different pockets.

Supply: Arkham

Will it cap BTC restoration?

The switch comes amid weak market sentiment and uncertainty linked to commerce tariffs.

Earlier than the information, BTC tapped $92.8K, a 13% leap from the brand new lows of $81K shaped on the 4th of March. Nonetheless, market watchers doubted the restoration extension on account of Mt Gox’s transfer.

One person stated,

“Bitcoin bounced again to $92K after the latest dip, however bother may be forward… Mt. Gox simply moved $1 BILLION in #BTC! In the event that they promote, a large dump may comply with! Are we about to see a market shake-up?”

For its half, blockchain analytics agency SpotOnChain speculated that the BTC transfers could possibly be inside and never designed for sell-offs.

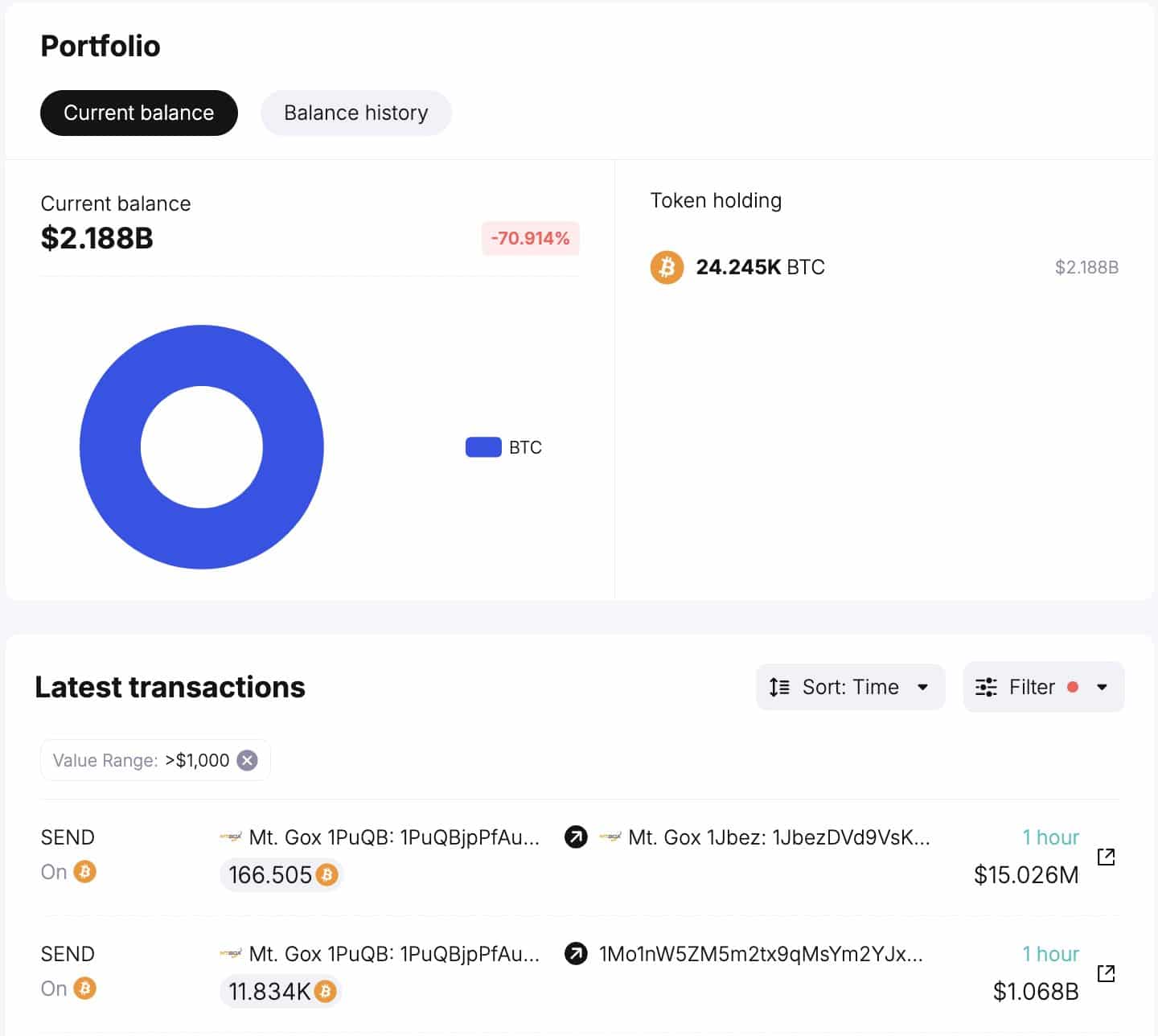

The agency added that the defunct trade nonetheless held +$2B BTC on the identified pockets that made the transfers.

Supply: SpotOnChain

Up to now, such updates from Mt. Gox triggered sell-offs as merchants and buyers anxious a few dumping spree.

At press time, BTC was barely all the way down to $90.9K from $92.8K, suggesting that the Mt. Gox replace could possibly be partly behind the stalling worth.

Nonetheless, in accordance with a earlier statement from the trade, the subsequent compensation stage was scheduled for October 2025. There was no communication for the most recent switch by Mt Gox by the point of going to press.

In the meantime, the market focus will shift to Friday’s inaugural crypto summit amid hypothesis that President Trump may present an replace on Bitcoin’s strategic reserve.

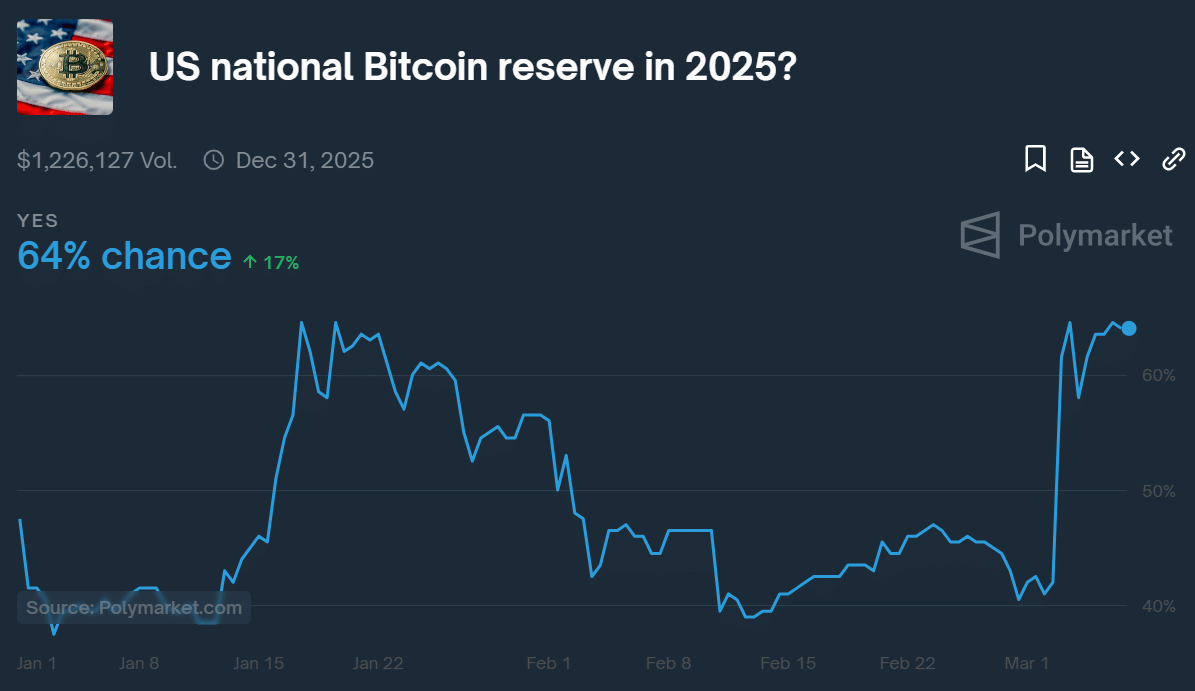

In March, Polymarket odds of a U.S. nationwide BTC reserve jumped from 40% to over 60%. Merely put, the market was optimistic a few optimistic end result. Nonetheless, it stays to be seen whether or not the rumors will likely be validated on the summit.

Supply: Polymarket