Institutional Investors Dump $50,780,000,000 in Stocks in Just One Month Amid US Bond Rating Downgrade and Trump Trade War: S&P Global

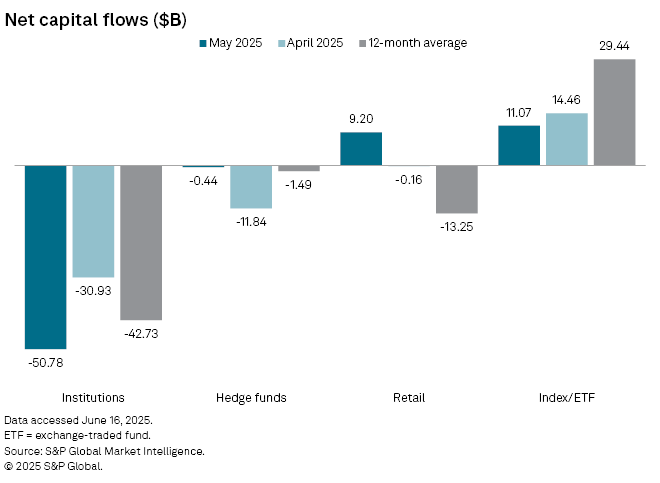

Institutional traders dumped a web $50.78 billion value of shares in Could, in accordance with market intelligence from S&P International.

That quantity surpassed the online $30.93 billion value of shares that have been unloaded by establishments in April and is above the online month-to-month common up to now 12 months of $42.73 billion.

S&P International notes that establishments dumped equities in Could resulting from commerce considerations and Moody’s resolution to downgrade the USA’ credit standing from AAA to AA1.

Explains Thomas McNamara, an S&P International director of market intelligence,

“Establishments nonetheless don’t really feel that we’re out of the woods in relation to tariffs, recession and total world uncertainty.”

Conversely, index and exchange-traded fund traders wolfed up a web $11.07 billion in shares final month and $14.46 billion in April. Each of these numbers are considerably lower than the 12-month common of $29.44 billion, nevertheless.

McNamara says it’s “by no means zero-sum” by way of inventory gross sales.

“There are plenty of elements that go into this on a basic foundation, however this month, a fundamental driver was share buybacks. This may occasionally even be a cause why the market rebounded prefer it did with none long-only conviction.”

The S&P 500 is up 0.25% up to now month, and the Nasdaq Composite is up almost 1.6%, although the Dow Jones Industrial Common is down by almost 1.4%.

Comply with us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Surf The Day by day Hodl Combine

Generated Picture: Midjourney