Aethir Ethereum launch sends ATH token soaring 100%, details here

- Aethir has launched its decentralized cloud computing community on the Ethereum mainnet.

- The worth of its ATH token could plunge within the quick time period.

Aethir, a decentralized bodily infrastructure community (DePIN) supplier, launched its decentralized cloud computing community on the Ethereum [ETH] mainnet on twelfth June.

The protocol permits customers to hire high-performance computing sources wanted for coaching synthetic intelligence (AI) and rendering digital content material.

This service is essential for organizations that require important computational energy because it provides flexibility and scalability for his or her operations.

Aethir’s mainnet launch comes with a local token, ATH.

ATH is required for governance and safety throughout the Aethir ecosystem, staking on the Ethereum community, and cost to compute suppliers by Arbitrum [ARB].

This mainnet launch comes seven months after its testnet launch on seventh November 2023 on Arbitrum, a layer-2 scaling answer for Ethereum.

In its announcement, Aethir confirmed that its consumer base exceeded 500,000 on its testnet, and it accomplished a $146 million node sale.

ATH pursues new lows

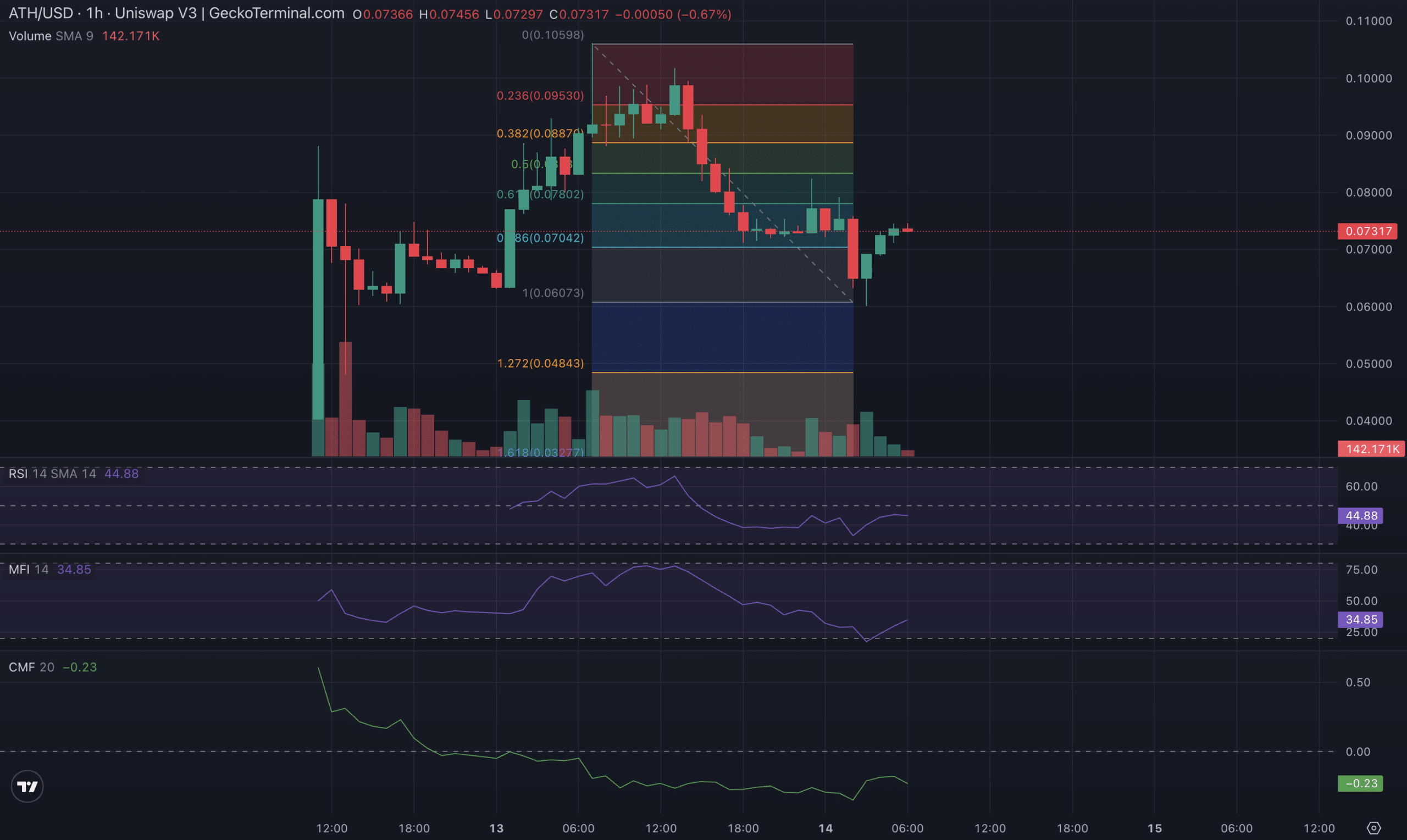

Following ATH’s launch, its value skyrocketed by virtually 100% earlier than correcting. At press time, ATH exchanged palms at $0.073. In line with CoinGecko, its value has declined by 14% previously 24 hours.

Its every day buying and selling quantity totaled $261 million throughout that interval, rising by 38%. The alternative actions of ATH’s value and buying and selling quantity indicated the presence of serious bearish sentiment within the token’s market.

When an asset’s value declines whereas its buying and selling quantity surges throughout the identical interval, it alerts a spike in promoting stress. Which means that most token holders need to promote their positions, therefore the downtrend within the asset’s worth.

An evaluation of ATH’s key technical indicators on an hourly chart confirmed the regular decline within the demand for the altcoin.

For instance, its Relative Power Index (RSI) and Cash Circulation Index (MFI) had been 44.88 and 34.85 at press time.

These indicators measure an asset’s overbought and oversold situations by monitoring its value momentum and adjustments. At these values, ATH’s RSI and MFI counsel that market members want to promote their holdings somewhat than accumulate new tokens.

This pattern was confirmed by ATH’s Chaikin Cash Circulation (CMF), which measures the move of cash into and out of its market. As of this writing, this indicator’s worth was -0.23.

A unfavourable CMF worth is an indication of market weak spot. It alerts liquidity exit from the market, a precursor to additional value decline.

If ATH’s promoting stress continues to extend, its value would possibly decline towards $0.048.

Supply: TradingView

Nevertheless, if the bulls re-emerge and token accumulation begins to climb, ATH’s worth would possibly rally towards $0.078.