Analysts Warn BTC Could Break Below $80K After Global Market Panic

Each dealer and investor has eyes on BTC $80k help, which has grow to be probably the most important help line as Bitcoin faces relentless promoting strain triggered by world macro shocks, liquidation spikes, and collapsing danger sentiment. Whereas the BTC worth at the moment exhibits very delicate makes an attempt at stabilization,however the market nonetheless broadly stays fragile, and the BTC worth chart continues to sign warning throughout main timeframes.

Why Crypto’s This autumn Wipeout Is Worst In Reminiscence That Sparked Document Market Stress

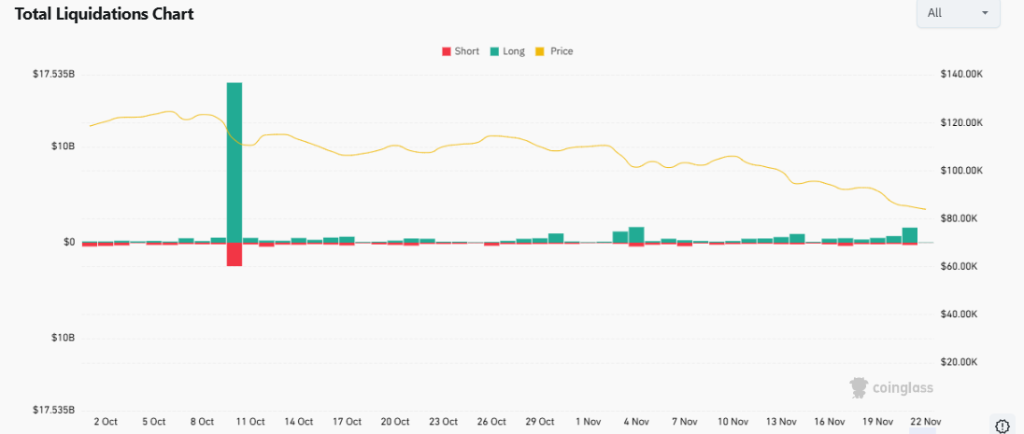

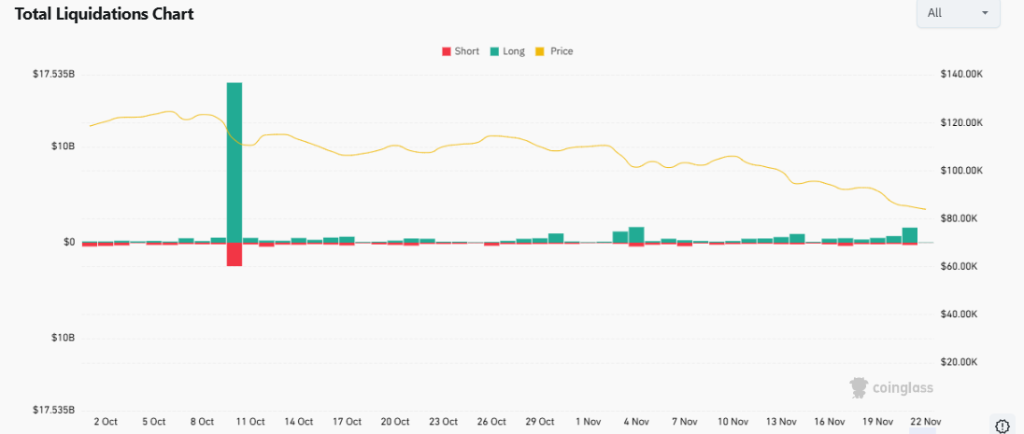

The downturn started on October 10, 2025, when the U.S. administration escalated its commerce warfare with China. The announcement triggered a speedy and extreme market response, wiping out $19.16 billion in crypto liquidations. Rising enterprise prices, provide chain issues, and world instability all contributed to a pointy unwind of leveraged longs.

Though many anticipated late-October price cuts to melt the decline, however the Federal Reserve’s 0.25bps minimize produced the other impact. The unsure ahead price cuts left buyers with little confidence in further easing, pushing them additional into risk-off sentiment territory.

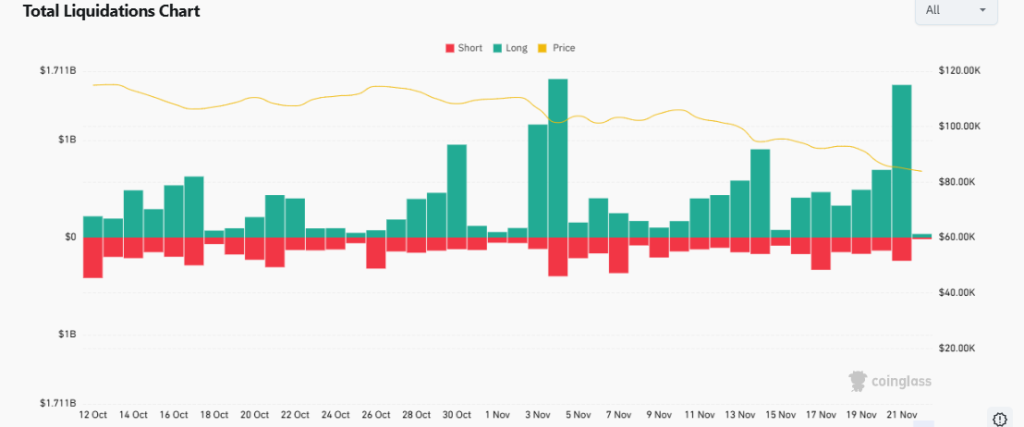

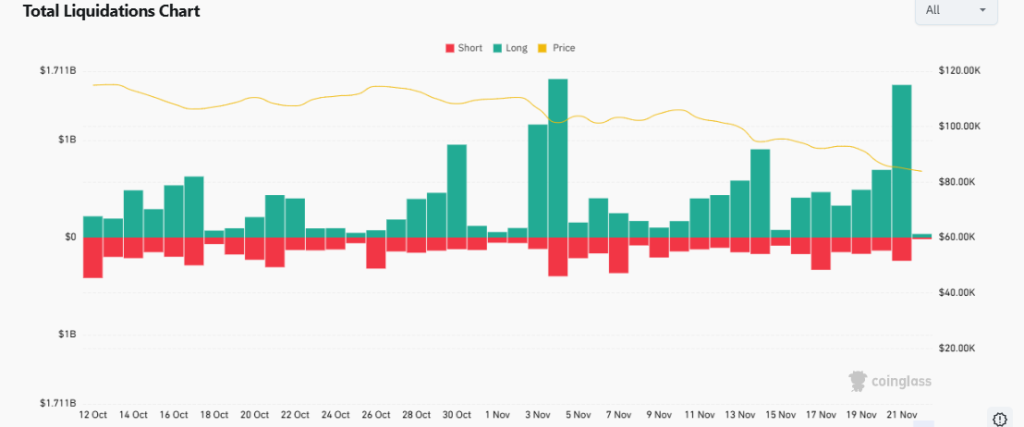

This shift is evident in the Crypto Liquidation charts, the place lengthy positions closely outweighed shorts, confirming the dominance of fear-driven promoting.

Battle Tensions and Institutional Retreat Add Gasoline to the Selloff

SImilarly, geopolitical shocks added additional strain. Not the one trigger however one of many main trigger was the newest missile and drone assaults within the Russia-Ukraine battle triggered one other wave of panic, with $1.87 billion liquidated on November 21 and $1.70 billion on November 22. This sequence of occasions deepened concern that world battle danger was rising and markets responded accordingly.

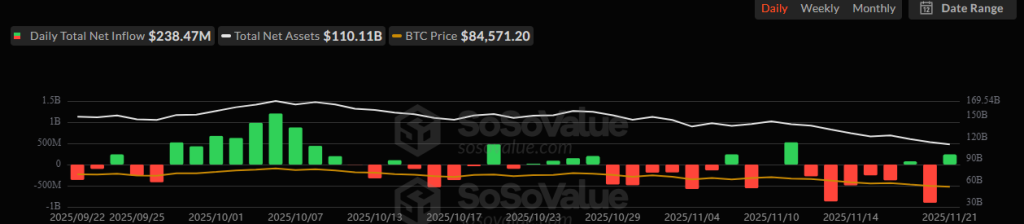

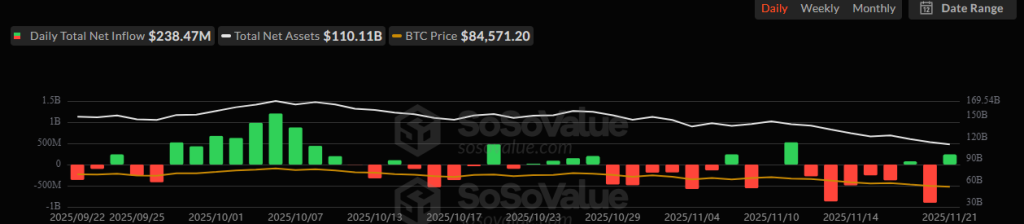

One of many main findings comes from institutional flows which mirrored the identical warning. Billions had been withdrawn from crypto-backed funding merchandise all through November. In consequence, the BTC worth USD dropped sharply.

Despite the fact that Bitcoin reached an ATH of $126,296 earlier in a friendlier local weather, however the macro backdrop has now overshadowed earlier optimism. Expectations for additional price cuts have diminished, dampening hopes for a fast stabilization.

- Additionally Learn :

- Bitcoin More likely to Stay Beneath Strain as Huge ETF Outflows Shake the Market

- ,

BTC $80k Assist Examined as Pattern Weakens Additional

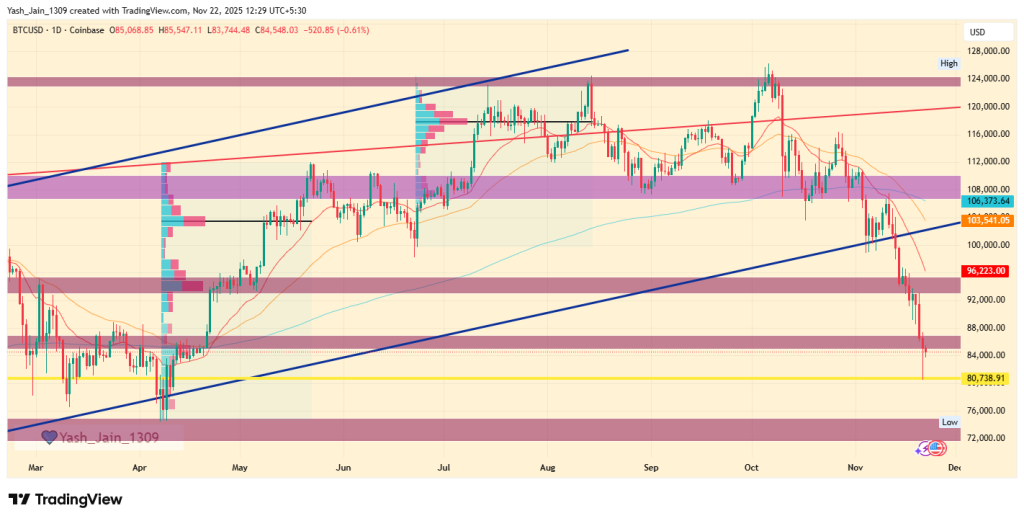

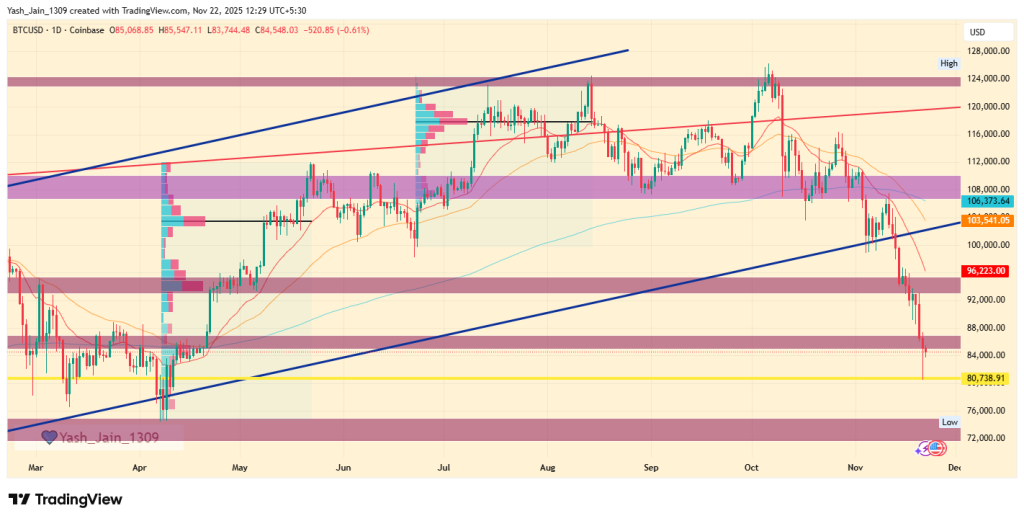

Technically, Bitcoin worth has been in a persistent decline, falling 35% from its peak to achieve $80,524. Whereas BTC worth at the moment exhibits a slight rebound towards $84,244, analysts emphasize that the bounce stays shallow and lacks momentum. The BTC worth chart nonetheless displays a construction that favors decrease ranges except demand strengthens decisively.

The BTC $80k help stage now represents the ultimate near-term zone stopping a deeper slide. Analyst suggest that failure to remain above it might speed up the drop towards $72,000-$73,000, adopted by the broader $66,000 area if promoting strain escalates. Then again, a reclaim above $86,000 can be the earliest signal of stabilization.

Whether or not Bitcoin can defend BTC $80k help will largely form the broader BTC worth prediction and sentiment heading into December.

Bear Market Positioning: Sensible Strikes for the Subsequent 12 Months

Another analyst stated that the whole market cap has shed $1.3T since October, signaling a transparent bearish pattern. however this section is about positioning, not panic, per analyst. Primarily based on financial capacities, stack conviction by regular DCA if liquid, or keep in stables to guard capital, is the most effective technique at occasions like these.

Additionally, analysts recommend avoiding random tokens and give attention to high quality property like BTC, ETH, and ZEC whereas watching high-liquidity chains reminiscent of SOL and BNB.

FAQs

Crypto is dropping because of world commerce tensions, liquidation spikes, and risk-off sentiment as buyers pull again from unstable markets.

No. The latest price minimize created uncertainty as an alternative of aid, pushing buyers towards safer property and increasing the selloff.

Battle dangers and new assaults fueled worry, inflicting heavy liquidations and driving merchants out of leveraged lengthy positions.

Give attention to high quality property, use regular DCA if liquid, or keep in stables to guard capital whereas avoiding dangerous low-liquidity tokens.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict Editorial Tips based mostly on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked in opposition to respected sources to make sure accuracy, transparency, and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We try to supply well timed updates about every thing crypto & blockchain, proper from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market situations. Please do your personal analysis earlier than making funding choices. Neither the author nor the publication assumes duty in your monetary decisions.

Sponsored and Commercials:

Sponsored content material and affiliate hyperlinks could seem on our website. Commercials are marked clearly, and our editorial content material stays completely impartial from our advert companions.