Arbitrum vs Polygon: Is there a shift in L2 dynamics?

- Arbitrum has risen above Polygon to develop into probably the most dominant L2.

- MATIC has dropped under $1 whereas ARB has maintained it.

Polygon [MATIC] was as soon as thought of one of the vital, if not probably the most, well-liked Layer 2 (L2) networks. Nonetheless, in latest occasions, just lately launched L2 community Arbitrum [ARB] has gained important prominence.

How does Arbitrum evaluate to Polygon?

Evaluating the quantity and TVL of Polygon and Arbitrum

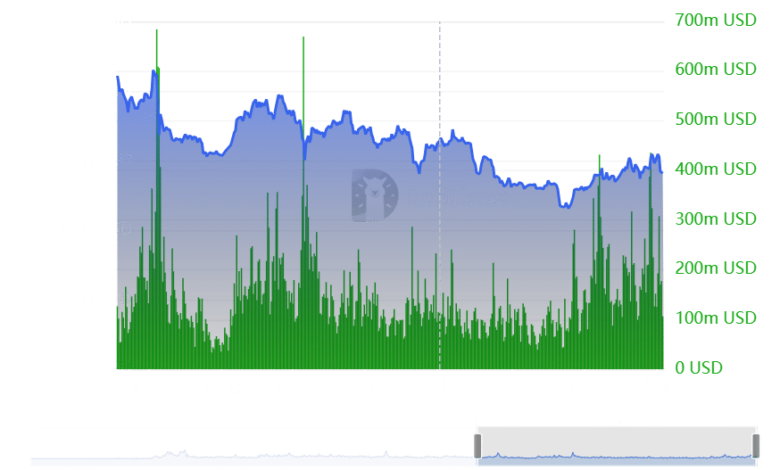

An evaluation of Polygon’s quantity trajectory on DefiLlama indicated an uptrend at press time. In the direction of the top of December, it reached its second-highest quantity of the yr, roughly $435 million.

2023’s peak quantity occurred in March, reaching round $669 million. Notably, Polygon’s quantity surpassed $1 billion solely as soon as in 2021, exceeding $2 billion. As of this writing, its quantity was round $106 million.

Supply: DefiLlama

Analyzing the Whole Worth Locked (TVL), there was an general decline for Polygon in latest weeks, with the TVL at round $845 million at current. Conversely, Arbitrum’s TVL was over $2 billion, displaying an upward development prior to now few weeks.

Within the final 24 hours, Arbitrum’s quantity was over $405 million. Notably, within the new yr, Arbitrum’s quantity has surpassed $1.8 billion twice.

Supply: Defillama

The L2 dialog

In keeping with information analyzed by AMBCrypto by way of L2 Beats, Arbitrum stood as probably the most dominant Layer 2 (L2) community at press time.

Throughout this time, Arbitrum commanded practically 50% of the market share, boasting a complete worth locked (TVL) of over $9.8 billion.

In stark distinction, Polygon ranked twelfth with a relatively modest $111 million, holding lower than 1% of the market share.

This information underscored a major shift within the L2 panorama, signaling that different networks have moved previous Polygon.

Not solely have been these various L2 networks producing larger volumes, however they have been additionally attracting a bigger person base, as indicated by their rising market shares.

MATIC follows market traits as ARB detaches

AMBCrypto’s examination of Polygon’s every day timeframe chart confirmed the impression of the latest market motion on its value.

On the third of January, Polygon skilled a major value crash of round 11.8%, and since then, it has struggled to get well. Earlier than the crash, its buying and selling value was round $1, however as of this writing, it has declined to round $0.8.

Supply: Buying and selling View

Reasonable or not, right here’s ARB’s market cap in MATIC’s phrases

In distinction, Arbitrum demonstrated a distinct development throughout the market crash. Regardless of the broader market downturn, Arbitrum gained over 8%. Nonetheless, it confronted a decline just lately, shedding over 2% and greater than 10% on the fifth of January.

As of this writing, it was displaying a acquire of virtually 5%, with a buying and selling value of round $1.8.

Supply: Buying and selling View