As the NFT market continues to bleed, is there a recovery in sight

- The NFT market underwent a pointy decline, with Bored Ape Yacht Membership (BAYC) NFTs going through a historic worth drop.

- ApeCoin will get affected as worth and curiosity from whales begins to wane.

In latest months, the NFT market witnessed a gradual decline in curiosity and engagement. This downturn has been significantly noticeable over the previous few weeks, because the decline in curiosity inside the NFT sector has intensified, impacting varied sides of the NFT house.

Life like or not, right here’s APE’s market cap in BTC’s phrases

Declining well being

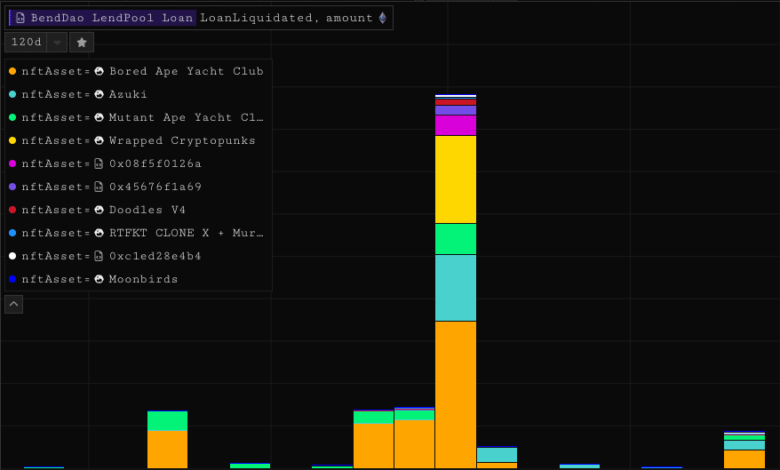

Based on ASXN’s knowledge, one stark instance of this market shift is the ground worth of Bored Ape Yacht Membership (BAYC) NFTs. This ground worth has skilled a pointy decline, hitting a traditionally low worth of 23 ETH. Consequently, a considerable quantity—greater than 108 of BAYC NFTs confronted the chance of liquidation.

Delving deeper, it’s noteworthy that BendDAO, which actively contributes to the BAYC ecosystem, had 32 BAYCs with a well being issue equal to or beneath 1.1. This determine consists of 8 NFTs which have a good decrease well being issue, at 1.05 or much less.

BendDAO adopts a technique that calculates ground costs primarily based on a time-weighted common, which positions the BAYC ground worth at 25.02 ETH.

Supply:ASXN

Compared, considering the opposite platforms, Blur and Opensea, we discover their respective ground costs at 23.1 and 23.49 ETH. In an fascinating parallel, ParaSpace, one more market, was additionally grappling with challenges.

Right here, an extra 76 BAYC NFTs have been going through potential liquidation dangers, with 18 of them sporting a well being issue beneath 1.05. In the meantime, the remaining 58 NFTs exhibited a well being issue beneath 1.1. Additional including to the complexity, 6 BAYCs are presently up for public sale. This marked a turbulent time for this phase of the NFT market.

State of {the marketplace}

Moreover, the ripples of this development have been being felt throughout the complete spectrum of NFT marketplaces. Yuga Labs NFTs, had as soon as drastically contributed to the market quantity. The whole charges paid to OpenSea over time underscored this, with Yuga Labs accounting for 3 of the highest 4 tasks, collectively amounting to over $100 million.

Regardless of this vital contribution, the general share of complete income attributed to Yuga Labs stood at roughly 15%. Yr-to-date figures continued to rank Yuga Labs as a high contributor, albeit with significantly decrease numbers as market volumes have seemingly migrated to different platforms comparable to Blur.

Supply: NFTstats.eth

Apeing round

Contemplating these dynamics, it’s believable to invest in regards to the potential ramifications of the autumn of Yuga Labs on ApeCoin. This token, which is intrinsically linked to Yuga Labs, skilled a substantial decline in worth.

Is your portfolio inexperienced? Take a look at the ApeCoin’s Revenue Calculator

As of press time, ApeCoin was buying and selling at $1.51, reflecting a major lower over the previous week.

Including to the complexity, the sentiment of bigger holders turned bearish this era. Furthermore, a discount within the variety of token holders was noticed. The mix of those components might affect APE’s worth considerably.

Supply: Santiment